Elder fraud results in far more than nearly $191 million reported in Ohio, study says

There were nearly 15,000 cases of elder fraud reported in Ohio in 2020 — defined as scams or abuse of financial authority, such as a power of attorney — that resulted in more than $190.8 million in losses, according to a study by Comparitech.com.

But tens of thousands of more cases were likely unreported by seniors who, out of embarrassment or for other reasons, didn't report their losses. Using government and other data, Comparitech's methodology estimates that more than 350,100 seniors age 60 or older in Ohio have been victims with losses estimated at more than $4.48 billion, according to the firm's study published earlier this month.

Online scams can involve emailed requests for money or personal account information, such as passwords, account numbers or personal information. Fraud attempts can also be made over the phone, said Comparitech, which identifies itself as a pro-consumer website providing information to help people improve their cyber security and privacy online.

Detective Patrick Durant, a member of Columbus police's economic crime unit, said it is important to have conversations with senior family members and loved ones about potential scams and how to handle them.

"You want to stress that there are situations out there where scams are occurring and you want to make them aware, but not scared," Durant said. "We’re hoping something like this never happens, but we want you to know there are people, there are bad actors out there, whether they live on the same street as you in Columbus, in the state or somewhere else in the world, they are out there to commit some type of theft and they have bad intentions."

AARP's website lists dozens of examples of scams in the Columbus area, ranging from websites that promised services that were never delivered to being told to buy gift cards or money orders to send to someone to prevent assets from being frozen. Most of the locally reported scams involved pitches made over the phone or through email.

Police say to avoid being a victim of a scam, do not give account or personal information over the phone unless you have verified with the company or bank that they have called. One way this can be done is to call the financial institution yourself, before giving any information over the phone, and asking if they had called.

While speaking with The Dispatch on Friday, Durant said the economic crime unit received a call from an elderly person whose spouse had received a phone call that the couple's bank accounts were compromised. To regain control of the accounts, the couple was told they needed to provide money, gift cards and cryptocurrency.

"It’s sad because in our cases, no one gets hurt physically, but people’s lives get dramatically effected," Durant said.

In another case, Durant said an elderly person responded to a pop-up ad on their computer that said his computer had been compromised. When the victim contacted a number provided to him, he was given numbers that were for the fraud departments at his banks, however, those numbers were false. The victim spoke with the people on the phone, who then took money from his accounts and changed it into cryptocurrency before the situation had been discovered.

Durant said setting up alerts for banks and credit cards for withdrawals or purchases over a set amount of money can help identify potential victimization early and stop money transfers or lock accounts.

AARP also suggests family members of those who may be vulnerable to falling victim to scams, particularly involving credit cards, use prepaid cards from banks that allow for caps on spending. The agency also recommends monitoring billing statements for charges that are unusual or out of character for family members and loved ones.

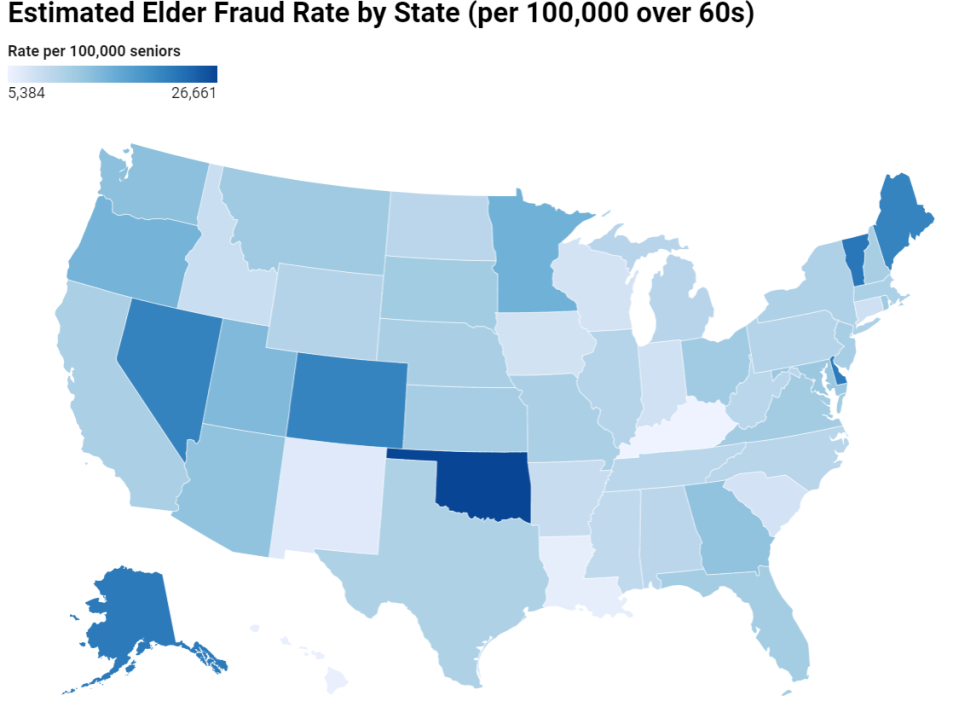

Not surprisingly, California, the most populous state in the nation, had the highest estimate money loss to elder fraud, with more than 928,000 estimated total cases and total losses of nearly $10.8 billion. Others in the top five in losses were Vermont, Alaska, Delaware and Nevada.

Oklahoma has the highest estimated rate of elder fraud with 26,661 cases per 100,000 seniors. Comparitech estimates more than 234,000 Oklahoma seniors are affected by elder fraud each year, losing an estimated $4.17 billion. Others in the top five for highest estimated rates were Florida, Texas, New York and Virginia, Comparitech reported.

Having a plan in place for how any suspicious calls or emails will be handled also helps for when the situation arises. But even if someone falls victim, Detective Durant said the important thing is to make sure it gets reported.

"Don’t be embarrassed," Durant said. "A lot of people are and then they don’t report it and don’t tell anyone."

In some instances, a delay in reporting by weeks could result in money being gone and little to no way of tracing it or getting it returned.

"If something seems suspicious, don’t be afraid to run it past someone you trust," Durant said. "If it sounds too good to be true, it is too good to be true."

bbruner@dispatch.com

@bethany_bruner

This article originally appeared on The Columbus Dispatch: Don't be a victim: Tips for how to avoid phone, email scams