What downturn? The total cloud market reached $126B in Q1 2022

Imagine for a second that you could roll up the entire cloud market, everything from SaaS to infrastructure to platform, CDNs (content delivery networks), managed private clouds, data center rentals -- everything. What would that be worth in a quarter?

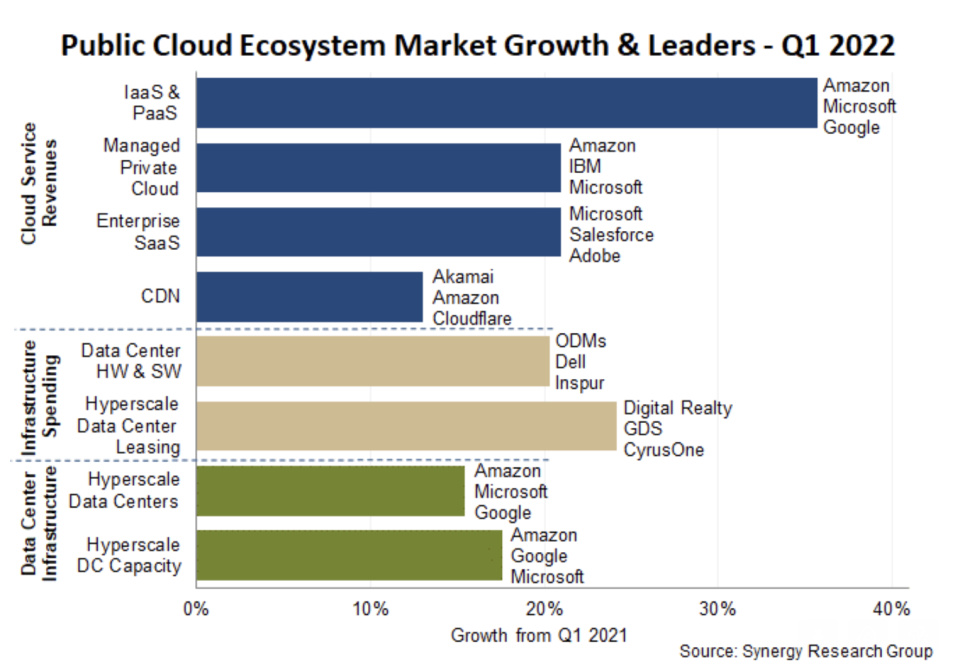

Well, the folks at Synergy Research were kind enough to do the work for us and the figure the firm came up with was $126 billion for Q1 2022, up 26% over the prior year. That’s a lot of money, but consider that a significant portion of that, $44 billion, came from the infrastructure and platform segment, which was itself up 36% year over year.

Another major tranche of $54 billion came from three major categories that Synergy follows encompassing managed private cloud services, enterprise SaaS and CDN, leaving $28 billion divided up among the remaining categories -- still nothing to sneeze at, mind you.

The astonishing part of all this is that John Dinsdale, who is research director at Synergy, is predicting that the cloud services portion (at the top of the chart) will double in three years, with the other parts of the market continuing to grow at a brisk pace.

Image Credits: Synergy Research

Dinsdale believes that cloud is likely to remain an attractive option even if there is an economic downturn. “The economy always impacts things in a variety of ways, both good and bad. But the thing about cloud services is that the fundamental benefit they bring is all about agility, flexibility and responsiveness,” he said.

“When the going gets tough financially, that can actually provide added impetus to shifting to the cloud. We will see continued strong growth in cloud services whatever the economic situation.”

The numbers at the top of the chart represent the different aspects of cloud services. The middle numbers are hardware sales to cloud data center providers, along with data center leasing, excluding hardware being sold to enterprises for private data centers. While the last third is looking at hyperscale data center growth, another key data point that shows that the world’s largest cloud providers need increasing amounts of data center real estate to support the growth of their businesses.

Dinsdale admitted that some of these categories can be confusing. “Managed private cloud can sometimes be a slightly confusing label, but these are services that are offered by public cloud providers as an alternative to more traditional on-premise solutions. The public cloud provider is hosting the services within their infrastructure,” he said.

He says the major difference between these offerings and more general public cloud is the customer gets dedicated resources. “There are various different flavors of managed private cloud, but the key is that the cloud provider infrastructure used to support a specific client is dedicated to that client and not shared; or in virtual private services workloads for an enterprise customer are clearly isolated from other enterprise customers. Bottom line is these are managed or hosted services that are provided by public cloud providers. The enterprise customers are not buying or owning their own cloud infrastructure,” he explained.

No matter how you define it, the cloud market is lucrative, it’s growing and it’s only going to do more so over time. Consider that a recent report issued by Snowflake found that just 25% of workloads were in the public cloud. That means there’s plenty of room for the cloud infrastructure players, especially the Big Three -- Amazon, Microsoft and Google -- to continue growing at a brisk pace for some time to come.

Further, the SaaS business model is also not going anywhere and continues to expand. The market leaders are Salesforce, Microsoft and Adobe in this category, but we are seeing this as the default business model for most startups.

Synergy puts together a variety of public reports throughout the year that are represented by each section of the graphic above. This is the first time they have rolled all of the data into a single report.

Savvy readers may note that we published a report in April citing $53 billion in total first-quarter cloud infrastructure revenue based on Synergy data. Dinsdale said that included the $44 billion cited in the roll up report, plus an additional $8 billion in hosted private cloud revenue.