Disney, Reliance Industries to Merge India Businesses in $8.5 Billion Deal

- Oops!Something went wrong.Please try again later.

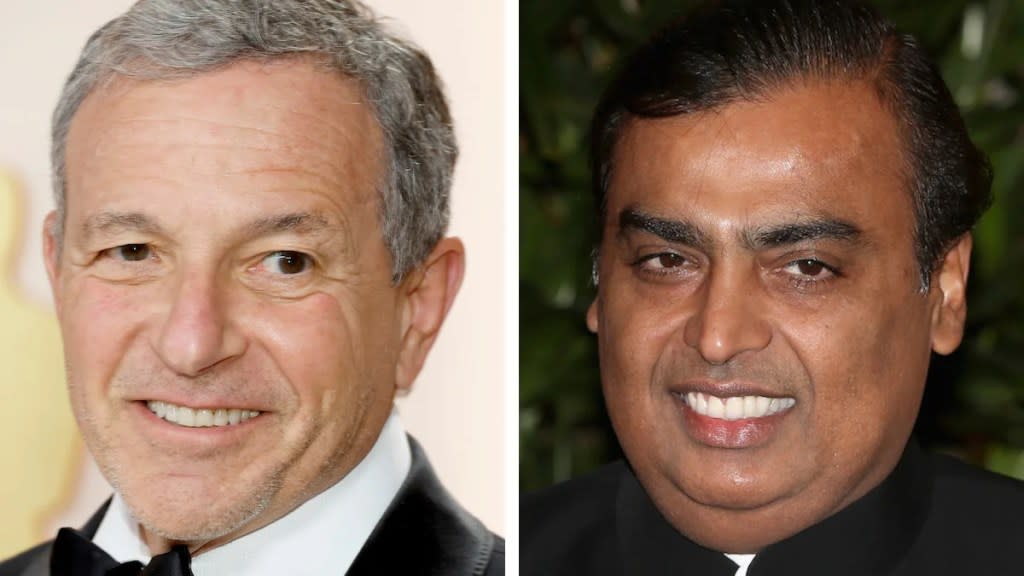

Disney and Mukesh Ambani’s Reliance Industries have inked an $8.5 billion deal for a joint venture that will combine Viacom18 and Star India.

The combined entity will be a leading TV and digital streaming platform in India, bringing together assets across entertainment and sports, including Colors, StarPlus, StarGOLD, Star Sports and Sports 18. It will also offer access to highly anticipated events through JioCinema and Hotstar, catering to over 750 million viewers across India and the Indian diaspora across the world.

Additionally, the joint venture will have exclusive rights to distribute Disney films and productions in India, with a license to more than 30,000 content assets.

The deal, which is is expected to close in late 2024 or early 2025, will give Reliance and its affiliates a 63% ownership stake in the joint venture, while Disney will have a 37% stake.

Reliance will invest $1.4 billion into the joint venture for its growth strategy. Disney may also contribute certain additional media assets to the partnership, subject to regulatory and third-party approvals.

As part of the transaction, the media undertaking of Viacom18 will be merged into Star India Private. Nita Ambani and Bodhi Tree Systems co-founder Uday Shankar will provide strategic guidance to the venture, serving as chair and vice chair respectively.

Mukesh Ambani called the deal a “landmark agreement that heralds a new era in the Indian entertainment industry.”

“We have always respected Disney as the best media group globally and are very excited at forming this strategic joint venture that will help us pool our extensive resources, creative prowess, and market insights to deliver unparalleled content at affordable prices to audiences across the nation,” he added. “We welcome Disney as a key partner of Reliance group.”

Disney CEO Bob Iger praised Reliance for its “deep understanding of the Indian market and consumer.”

“Together we will create one of the country’s leading media companies, allowing us to better serve consumers with a broad portfolio of digital services and entertainment and sports content,” he added.

The deal comes after Disney began exploring options for Star India in July.The House of Mouse acquired the asset in the $71.3 billion acquisition of 21st Century Fox’s entertainment assets in 2019.

The Star India unit ended 2023 with an operating loss of $315 million, driven by higher rights costs from airing of the ICC Cricket World Cup. Revenue for the segment increased 71% year over year to $399 million. Disney+ Hotstar has a total of 38.3 million subscribers and reported average revenue per user of $1.28 during the company’s first quarter of 2024.

Disney expects to incur up to $2.4 billion in non-cash pre-tax impairment charges during the second quarter of 2024, approximately half of which reflects a write-down of the net assets of Star India, in order to adjust them to fair value as part of its “held-for-sale” accounting purposes. The company may recognize incremental gains or losses as a result of any changes to the value of Star India until the transaction has closed.

Reliance Industries, which reported revenue of $118.6 billion, cash profit of 15.3 billion and net profit of $9 billion for the year ending March 31, is India’s largest private sector company. Its business spans hydrocarbon exploration and production, petroleum refining and marketing, petrochemicals, advanced materials and composites, renewables (solar and hydrogen), retail and digital services.

The post Disney, Reliance Industries to Merge India Businesses in $8.5 Billion Deal appeared first on TheWrap.