Disney Plus Loses 300K U.S. Subscribers For Second Consecutive Quarter Following December Price Hike ... And They Just Announced Another Increase!

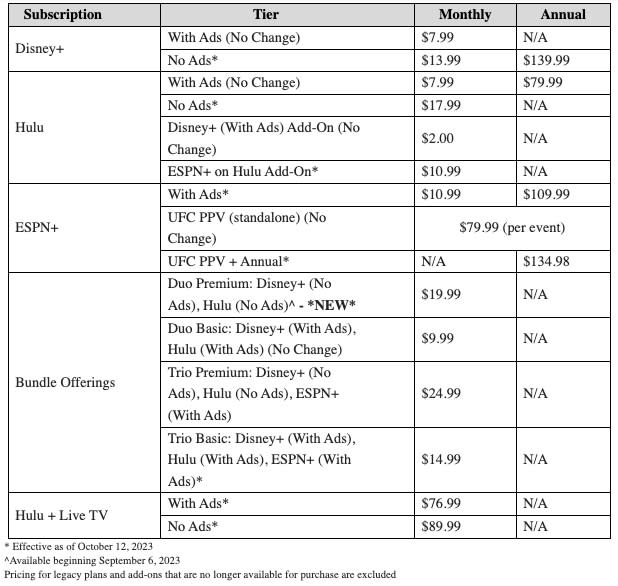

In December, Disney Plus launched a $7.99-a-month basic tier with commercials, bumping up the standalone price of its ad-free tier significantly to $10.99 a month in the U.S.

That was $4 a month more expensive than the Disney Plus launch price in November 2019.

Disney Plus hasn't posted domestic subscriber growth since that price hike. In fact, on Wednesday, Disney reported its second consecutive fiscal quarter during which the platform has lost around 300,000 U.S. subscribers.

But get ready for another one -- Disney said the price of its ad-free Plus tier will rise again to $13.99 a month starting in October. (That's still $2 cheaper than Netflix's most popular $15.49-a-month standard tier, but we're a long way away from that little $6.99 streaming service with the cute baby Yoda.)

Disney also plans to up the price of the sans-commercials Hulu tier to $17.99 a month. Both the $7.99-a-month Disney Plus ad-supported tier and the $6.99 base Hulu plan with ads will stay as is.

“The strong momentum of our ad-supported plans in the U.S. demonstrates the importance of providing consumers with choice, flexibility and value,” said Joe Earley, president of direct-to-consumer for Disney Entertainment.

Here's the updated list of pricing that Disney released for its subscription services on Wednesday.

Also as part of its pricing/plan revision announcement, Disney said it would start rolling out its partially ad-supported tier in November to Canada and parts of Europe.

Disney Plus, which reported 46.6 million U.S. subscribers as of the end of 2022, had 46 million as of the end of June, the finish line for Disney's fiscal third quarter.

Internationally, excluding Disney Plus Hotstar, the platform expanded by 1.1 million users in fiscal Q3 to 59.7 million.

For his part, Disney CEO Bob Iger told equity analysts in May that losing only 300,000 U.S. Disney Plus customers in fiscal Q2 was actually a good thing.

“We were pleasantly surprised that the loss of subs, due to what was a substantial increase in pricing for the non-ad-supported Disney Plus product, was de minimis,” Iger said at the time. “It was some loss, but it was relatively small. That leads us to believe that we, in fact, have pricing elasticity.”

Meanwhile, Hulu continued to grow in fiscal Q3, adding another 100,000 customers to finish the period at 48.3 million. This growth came despite continued erosion of the vMVPD product, Hulu + Live TV, which lost another 100,000 subscribers in the quarter to finish with 4.3 million.

Unlike most pay TV operations, Hulu + Live TV is still technically growing, its user base up 300,000 since Disney's fiscal Q3 for 2022.

(Here's Broadcasting+Cable's main Disney earnings event coverage from Wednesday: Disney Cuts Streaming Red Ink But Posts $460 Million 3Q Loss.

And here's Disney's fiscal Q3 letter to shareholders.)

As for those once ubiquitous -- and in hindsight, rather ridiculous -- streaming-scale comparisons between Disney and Netflix that pubs like ours used to do too often, well, we don't do those anymore.

Like Warner Bros. Discovery, which is also losing customers in subscription streaming as it trims direct-to-consumer EBITDA losses, Disney is offering less content for more money these days, embarking on an active campaign to remove shows from Disney Plus in order to save on things like taxes and royalties.

Disney cut losses related to its DTC business by more than half to $512 million in fiscal Q3.

Great.

But global revenue from linear channels, once Disney's best earner, was down another 7% in the quarter, and Disney reported a $460 million loss for the period.

Meanwhile, the streaming company Disney had been trying to chase down, Netflix, finished June with nearly 239 million subscribers worldwide and free cash flow of $1.339 billion.