The Disney-Nelson Peltz Proxy Battle, Explained

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Disney’s proxy fight with activist investor Nelson Peltz is heating up as Trian Fund Management co-founder and the House of Mouse’s former chief financial officer Jay Rasulo will stand election at the company’s annual meeting on April 3.

Shareholders of record as of the close of business on Feb. 5 will be entitled to vote at the meeting. Disney has approximately 1.8 billion outstanding shares, according to its latest proxy filing.

Expect a feisty one. TheWrap broke down the corporate intrigue and its major players.

What’s a proxy fight?

A proxy fight is when shareholders join forces to try to pressure a company’s management or board of directors to make changes using rules of corporate governance. That pressure is normally applied by gathering enough shareholder proxy votes to win a vote for corporate level change. A proxy fight strategy is also common in hostile corporate takeovers.

Prior to going the route of a proxy fight, shareholders could appeal to a company’s board directly to express their dissatisfaction with a specific decision by management.

Disney extended an offer for Trian to meet with its board but informed the firm that it was turning down its request for board representation, including for Peltz.

What does Trian want?

Trian, which dropped a previous proxy fight in February 2023, is back pushing for changes at Disney, including a plan for future leadership.

Peltz wants Disney’s board to develop a succession plan for CEO Bob Iger, who returned to the company as chief executive in 2022 after previously serving in the post for 15 years, with plans to retire in 2026.

It also has released a 130-page white paper proposing various initiatives to “restore the magic,” including introducing a new “streaming margin” incentive for executives to target a Netflix-like 15-20% margin by 2027, reviewing the viability and potentially limit investment in Hulu + Live TV, phasing out the Hulu tile in Disney+ and fully consolidating the two streaming services, exploring more bundling opportunities and allocating more of its budget to lower-cost, easier-to-produce projects.

Additionally, it expressed skepticism about ESPN’s viability as a standalone streaming service and said that the company should either scale back its DTC plans and focus on “maximizing the value of ESPN+ and the existing linear business” or move forward with a bundle partner like Netflix or Amazon.

Peltz and Trian argue that Disney has “woefully underperformed its peers and its potential” and that its turnaround “does not appear to be materializing.” They cite tens of billions of dollars in lost shareholder value, a meaningful drop in consensus earnings-per-share estimates for fiscal years 2024 and 2025 and studio content that “continues to disappoint consumers, slowing the speed of the flywheel and threatening future earnings growth.” More generally, Trian said that Disney “appears no closer to adequately addressing the compensation misalignment, governance, and succession issues that have plagued the Company for decades.”

The root cause of Disney’s underperformance, Trian added, “is a Board that is too closely connected to a long-tenured CEO and too disconnected from shareholders’ interests,” and that “lacks objectivity as well as focus, alignment, and accountability.”

Disney stock, which hit a 52-week low of $78.73 per share in October, has rebounded to $120.77 per share as of Wednesday. The company’s market capitalization currently sits at $222.6 billion, compared to its $328.02 billion market cap at the end of 2020.

How is Nelson Peltz trying to gain more influence?

Trian and Peltz have an approximately $3 billion ownership stake in Disney, with 78% of that total coming in the form of shares from former Marvel Entertainment chairman Ike Perlmutter.

According to a filing with the U.S. Securities and Exchange Commission, the firm raised its Disney stake to 7.3 million shares during the third quarter of 2023, from 6.42 million shares during the second quarter. The filing also disclosed another 25.57 million Disney shares listed as an “other investment discretion.”

In October, Perlmutter, who aided Peltz in his first proxy fight and was let go by Disney as part of cost cuts in March, granted sole voting power over his shares in the company to Trian and Peltz, calling them a “constructive voice for Disney’s shareholders” that can help leadership “better navigate the company’s challenges and opportunities.” He cited their “strong operating and strategic capabilities.”

In a statement to TheWrap at the time, Perlmutter said that “as someone with a large economic interest in Disney’s success, I can no longer watch the business underachieve its great potential.”

Perlmutter, who acquired Disney stock in 2009 following the Marvel acquisition, said he has not sold any shares and has added to his holdings over the years.

“Increasing the value of my Disney holdings will also result in increasing the amount that my wife and I will be able to provide to the leading hospitals, medical research institutions and other charities to which we plan to leave the vast majority of our wealth,” he added.

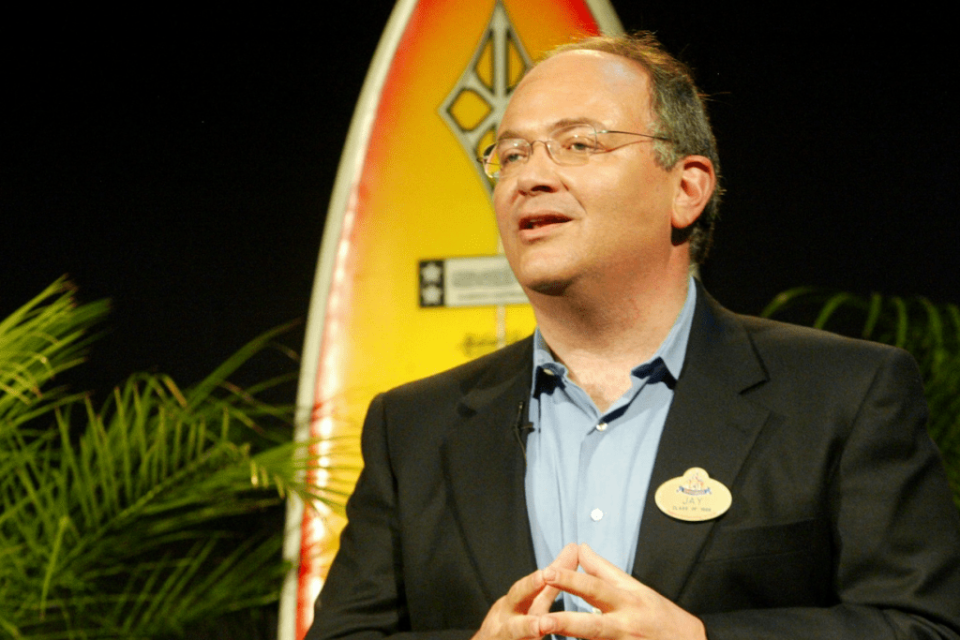

Trian has also enlisted the help of former Disney chief financial officer Jay Rasulo, who along with Peltz has been nominated for a seat on the company’s board.

Rasulo, who was once seen as a potential heir apparent to Iger and was ultimately passed over for the chief operating officer role, spent three decades at Disney, serving as president of Walt Disney Parks and Resorts from 2002 to 2005, chairman of Walt Disney Parks and Resorts Worldwide from 2005 to 2009 and senior executive vice president and CFO from 2010 to 2015.

“The Disney I know and love has lost its way,” Rasulo said in a statement. “As independent voices in the boardroom, Nelson and I are confident that the combination of my decades of experience at Disney, Nelson’s significant boardroom skills and history of driving positive strategic change, and our combined consumer brands expertise and financial acumen, will be additive to the Disney Board.”

In addition to Perlmutter, Peltz and Rasulo’s proxy campaign has received backing from activist investor Ancora Holdings, over a dozen current and former public company directors who worked with Trian and Peltz on their boards and proxy advisory firms Egan Jones and the influential Institutional Shareholder Services. ISS notably threw its recommendation behind Peltz, but not Rasulo.

Who is Blackwells Capital?

Blackwells Capital is another activist investor making their own push for change at Disney, though it has previously thrown its support behind the company’s turnaround efforts.

The firm has nominated former Warner Bros. and NBCUniversal executive Jessica Schell, Tribeca Film Festival co-founder Craig Hatkoff and TaskRabbit founder Leah Solivan to stand election for board seats. It also proposed increasing the size of Disney’s board to reinstate any incumbent director outvoted by its nominees. Additionally, it has urged Disney to prioritize artificial intelligence and spatial computing and proposed a real estate and strategic asset review, including a potential split of the company.

Blackwells, which has previously called on Peltz to end his “ego-driven” proxy battle, has said its own campaign “provides shareholders a necessary alternative to what would otherwise be a solipsistic sideshow.”

What is Disney doing to respond?

Disney has told shareholders that it is “laser-focused on a strategy that will drive shareholder value.”

That strategy has included restoring the company’s cash dividend, increasing that payment by 50%, announcing a $3 billion share buyback program for fiscal year 2024, and investing $60 billion in its theme parks over the next decade. Disney is also on track to meet or exceed $7.5 billion in cost savings, reach streaming profitability and deliver $8 billion in free cash flow by the end of fiscal year 2024.

Additionally, Disney is buying out Comcast’s minority stake in Hulu for at least $8.61 billion, officially launched a Hulu and Disney+ combined app offering, inked an $8.5 billion deal with Mukesh Ambani’s Reliance Industries for a joint venture that will combine Viacom18 and Star India, took a $1.5 billion stake in “Fortnite” creator Epic Games, obtained the streaming rights to Taylor Swift’s Eras Tour concert film, and announced sequels to “Moana” and “Zootopia,” plans to launch a fully direct to consumer version of ESPN in fall 2025 and a sports streaming joint venture with Fox and Warner Bros. Discovery this fall.

Disney has also been making changes related to its corporate governance. In November, the board of directors appointed two new members: Morgan Stanley chairman and CEO James Gorman and Sir Jeremy Darroch, a veteran media executive and former group chief executive of Sky.

Iger, who has extended his contract through the end of 2026, has also said he will “definitely step down” at the end of that term, with a “robust” process currently underway to find a successor.

The company also tapped former PepsiCo chief financial officer Hugh Johnston as its new CFO, replacing Christine McCarthy who stepped down to take family medical leave in June. Johnston, who had served as Pepsi’s CFO since 2010, was a key player in the snack and beverage maker avoiding a potential proxy fight with Peltz and Trian, when the activist investor called on the company in 2013 to either merge with its rival Mondelez or split into two businesses. In 2015, Pepsi added former Heinz CEO and Trian adviser Bill Johnson to its board. Trian sold its position in Pepsi the following year.

Supporters backing Disney in the proxy fight include activist investor ValueAct Capital, which entered into a confidentiality agreement with the company that allows it to consult on strategic matters through meetings with the board and management, proxy advisory firm Glass Lewis, “Star Wars” creator George Lucas, Laurene Powell Jobs, J.P. Morgan CEO Jamie Dimon, former Walt Disney Imagineering president Bob Weis, “Frozen” star Josh Gad, former Disney CEO Michael Eisner and Walt Disney and Roy O. Disney’s grandchildren.

Could Peltz and Trian win?

Peltz and Trian will likely have an uphill battle to winning board seats given that the majority of proxy fights are unsuccessful. However, Charles Elson, founding director of University of Delaware’s Weinberg Center for Corporate Governance, believes there’s a “compelling case” when it comes to Disney’s recent performance and corporate governance challenges – especially as it pertains to succession planning.

“The fact that it took the threat of a proxy fight to force changes is certainly not helpful to Disney,” he told TheWrap in January.

Jeffrey Sonnenfeld, CEO of the Chief Executive Leadership Institute at the Yale School of Management, slammed Peltz’s track record in an interview with TheWrap in November, arguing that he “adds distraction like a dripping faucet.”

A January 2023 analysis conducted by Sonnenfeld and CELI research director Steven Tian previously found that more than half of the companies Peltz and his firm targeted underperformed the S&P 500, in both share price and total shareholder returns, while he was on their boards. Sonnenfeld and Tian also pointed out that Peltz has been downsizing after shuttering a fund in the United Kingdom following a campaign from activist investors.

Peltz, 81, currently serves as the non-executive chairman of The Wendy’s Company and a director of Unilever PLC and Madison Square Garden Sports Corp. Other companies where he has previously served as a board member include Janus Henderson Group plc, Invesco Ltd., Procter & Gamble, Sysco Corporation, Legg Mason, Inc. and Mondelez International.

Sonnenfeld touted Iger’s “very good progress” in restructuring, removing inefficiencies and working on streaming profitability.

“Iger is right on track and I think he’d be able to explain to the board that when you benchmark him against any other returning general like he is, he’s doing quite well,” he said.

In the end, the outcome will ultimately rest in the hands of Disney’s bigger institutional investors like BlackRock, Vanguard Group and State Street and index funds. But Elson points out that Peltz was previously able to win in uphill proxy battles at Procter & Gamble and Heinz and that he may not even need a board seat for Disney to make positive change.

“Sometimes you win by losing and a good board will understand that and react appropriately,” he added. “We’ll have to wait and see.”

The post The Disney-Nelson Peltz Proxy Battle, Explained appeared first on TheWrap.