Disney Investor Day Preview: Unanswered Questions About Disney+

As much as we already know about Disney+, there’s a lot we still don’t know.

That’s about to change at an investor presentation on April 11, when Disney will give a demonstration of its yet-to-be-launched streaming service, as well as showcase some original content that’s being developed for it. Additionally, Disney will discuss its overall direct-to-consumer (DTC) business — which includes its majority ownership of Hulu and streaming technology company BAMTech, ESPN+, and Disney+ — in greater detail.

Related stories

U.K. Film and TV Firms Show Improvement in Gender Pay Gap but Little Equality

CinemaCon Big Takeaways: Diversity, Disney and the Threat of Netflix

Much of what consumers know about Disney+ centers around the content it will offer, but the market is poised to know more about how the video streaming platform itself works.

Currently, it’s known that Disney+ will be anchored by Disney’s entire classic film library and act as the exclusive U.S. streaming home for movies that the company releases theatrically moving forward. Disney+ will also offer content from Disney’s Pixar, Marvel, Star Wars, and National Geographic brands.

But details on Disney+ aside from the content it will offer are less clear. The service is expected to be “substantially cheaper” than Netflix and release in late 2019, but no concrete price or launch date has been announced. Disney CEO Bob Iger has previously signaled interest in bundling Disney+, ESPN+, and Hulu, but it’s still unclear exactly how Disney+ will coexist with those two other services.

Price, launch date, and the interplay between its streaming businesses are key areas investors are expecting to hear about at Disney’s event. Consumers are also likely keen to figuring out how they will be able to navigate through and access the various content from Disney’s different brands on Disney+.

Disney video streaming push is a costly venture, and the event will allow the company to provide a clearer picture of how Disney+ will be beneficial to its bottom line in the future. BTIG estimates Disney will lose out on $500 million per year by no longer licensing content to Netflix, for example. And RBC Capital Markets earlier this year estimated that Disney will spend $500 million on Disney + original programming in 2019.

Moreover, Disney has already has over $1 billion in losses tied to streaming, without Disney+ being launched yet. In a January 2019 filing, Disney reported a loss of $469 million in its DTC segment for its fiscal year 2018, mainly spurred by BAMTech; Disney also said Hulu was the main driver of a separate $580 million equity investment loss for its fiscal year 2018.

However, in order to quell investor concerns, Disney could use the event to provide more color on how it plans to minimize losses moving forward, as well as how it will recover from lost licensing revenue. Providing Disney+ subscriber projections would also be helpful, although it seems unlikely that Disney would publicly disclose this information and add fuel to the fire of chatter surrounding its position in the streaming wars. BTIG estimates that Disney needs about 7 million subscribers to make up for its licensing revenue loss.

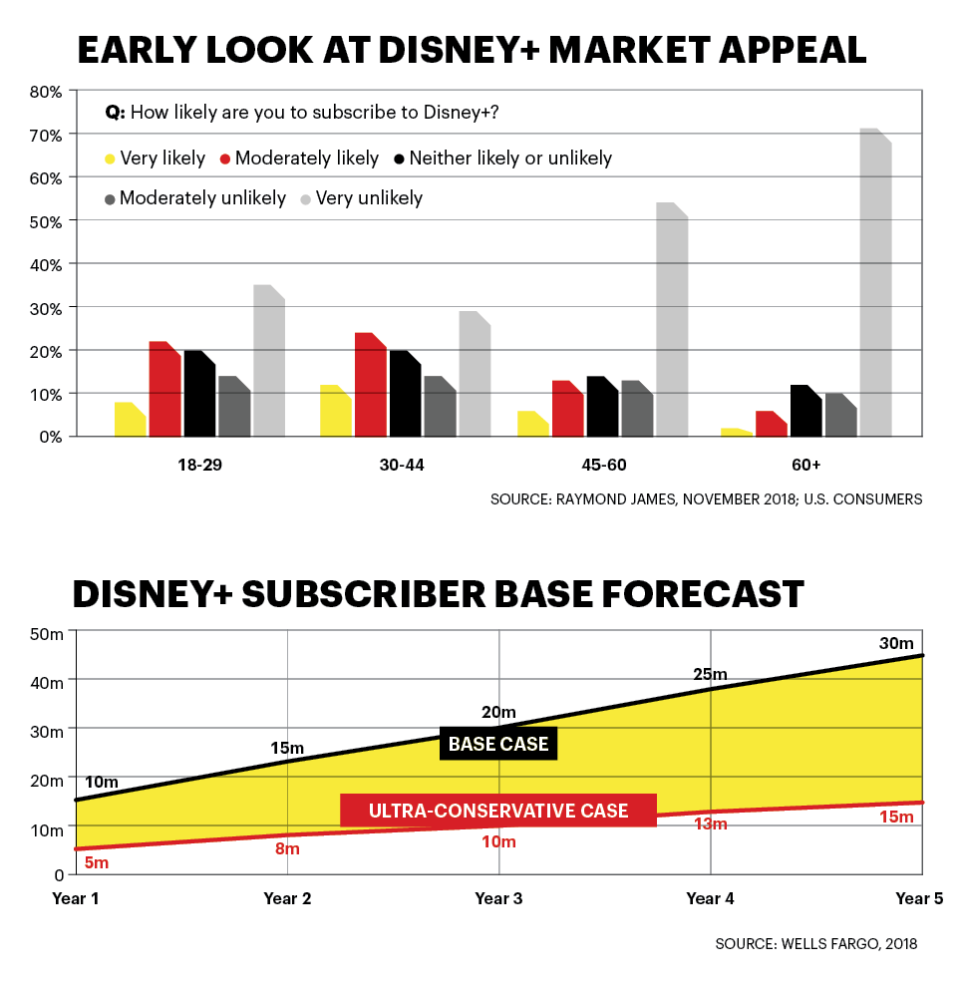

This likely won’t be a difficult hurdle for Disney to clear as Wells Fargo has estimated that Disney+ will attract 10 million subscribers after one year on the market in a base case scenario.

User experience may not be a make-or-break factor for Disney+, but being able to demonstrate that its upcoming streaming service is easy to use could be fruitful for Disney’s aim of further enticing SVOD subs. Consumers indicated that an interface that’s easy to navigate is one of the most important attributes of the video streaming services they choose to buy, according to a Nielsen report published in March 2019.

There’s already some preliminary interest in Disney+, but original content that’s showcased at the event could embolden more consumers to gravitate toward the service. Twenty-four percent of U.S. consumers with a Netflix subscription expect to tack on a Disney+ subscription, while 8% expect to replace their Netflix subscription with Disney+, according to a recent survey by Wall Street brokerage firm SunTrust Robinson Humphrey.

Even if consumers are left with many unanswered questions after its streaming service-unveiling event (similar to how some felt after Apple’s splashy Apple TV+ reveal event), the company still has several tricks up its sleeve it could reveal at the event that would accelerate Disney+ uptake after its launch.

For example, Disney could give Disneyland and Disney World attendees free access to Disney+ for an extended period of time, like six months. The company could simply require a user’s credit card information to access the 6-month trial and then begin charging on a monthly basis after that period. Some trial users would likely forget they signed up for Disney+ after six months, helping Disney inflate its Disney+ subscriber count.

Meanwhile, Disney could also begin to offer Disney+ subscribers discounts on annual passes to its Disneyland or Disney World theme parks or cruises. This isn’t a deal that current SVOD incumbents or up-and-coming streaming players like Apple or WarnerMedia could match, and it could help lower churn rates among Disney+ subscribers.

Bundling of video and non-video services will likely become a bigger trend moving forward as new streaming service entrants look to differentiate their offerings in a crowded market over the next several years. Apple, Disney, WarnerMedia, and NBCUniversal alone could grow the US SVOD market by 53 million paid subscriptions by 2023, according to IHS Markit. Disney is likely to be one of the main drivers of this subscription growth largely due to the combination of its hard-to-rival content offering and potentially relatively low price point.

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.