Disney Goes All-in on Streaming – But Is It Too Late to Catch Netflix? | Analysis

- Oops!Something went wrong.Please try again later.

Bob Iger says Disney is going all-in on streaming.

The Disney CEO laid out a new course on Wednesday for the company’s streaming business, saying the company would launch a beta version of a combined Disney+ and Hulu app offering in December and make achieving “significant and sustained profitability” for its streaming business a top priority.

The company’s confidence was supported by strong streaming results in Q4, adding 7 million subscribers to Disney+, mostly international.

With the company set to purchase Comcast’s remaining 33% minority stake of Hulu for at least $8.61 billion in 2024 and a fully direct-to-consumer version of ESPN targeting a 2025 launch, Disney has laid the groundwork to execute a more focused assault on its competitors.

“If you think about the portfolio of streaming assets that we will have — Hulu, Disney+, and ESPN — that’s a very, very strong hand,” Iger said on the company’s Q4 call with analysts.

But will fresh packaging and price increases be enough to solve Disney’s struggles with streaming, which have had just as much to do with overspending and a lack of content diversity as with the confusion of offering three different platforms to consumers?

Disney+ has struggled to catch market leader Netflix, despite buzz four years ago when it launched — with about 10 million sign-ups in the first 24 hours — that it could be formidable enough to overtake the ubiquitous platform. After all, Disney had a library of tentpole franchises, including the Marvel Cinematic Universe, “Star Wars” and its legacy animation classics and other family content.

In the years since then, most of its new viewers have come from MCU shows, “Star Wars” episodic content and theatrical-focused or animated films. Disney+ has had few hits among its slate of original movies (“Hocus Pocus 2” was one exception) or television shows. Even high-profile IP bets like “Willow” were both canceled and pulled from the platform.

“Simpsons” reruns remain among the platform’s most-watched titles, with the slew of revamped or revisited 20th Century properties (“Night at the Museum,” “Ice Age,” “Diary of a Wimpy Kid” and “Home Alone”) failing to generate comparatively strong viewership.

In creating one single app for Hulu and Disney+, the company hopes to eliminate consumer confusion. But it will also have to navigate the dicey waters of creating an app for adults as well as families that could easily switch from an episode of “Mickey Mouse’s Clubhouse” to one of “American Horror Story.” Iger cited this challenge as a reason for launching the beta in December, so parents and the company can work out the nuances before fully launching the new app in March.

The new concept stands in stark contrast to the initial promise of Disney+, which the company intended as a one-stop shop for family-friendly entertainment. Disney has been dipping their toes into more adult fare over the last two years, adding the first R-rated films (“Deadpool” and “Logan”) to Disney+ in June 2022 with increased parental controls. The company is also launching the first TV-MA-rated Marvel Studios show, “Echo,” in January simultaneously on Hulu and Disney+.

Iger declared to analysts on Wednesday that the company was on track to reach profitability in its streaming division by the end of fiscal year 2024, though he noted that progress “may not look linear from quarter to quarter.”

In its fourth quarter of 2023, Disney’s direct-to-consumer division saw revenue grow 12% year over year to $5.03 billion, while its operating loss narrowed 70% year over year to $420 million.

Looking ahead, Disney anticipates that core Disney+ subscribers will decline slightly in its first quarter of 2024 due to the expected temporary uptick in churn from its recent price increase in the U.S. as well as from the end of a summer promotion. Then it expects subscriber growth to rebound later in the fiscal year.

Is Netflix Still Out of Reach for Disney?

Disney+ added 6.9 million subscribers during the quarter for a total of 150.2 million, including 112.6 million core subscribers and 37.6 million Hotstar subscribers. Nearly all of that growth came from international subscribers, which grew by 11% to 66.1 million, while subscribers in North America only edged up 1% to 46.5 million. Disney+ has launched in more than 50 new countries since the end of 2021, including across Europe and the Middle East.

(Last quarter, Disney+ lost 11.7 million total subscribers, or a 7% decrease, from the previous quarter, including 300,000 core subscribers in the U.S. and Canada.)

Hulu’s growth was also flat in Q4, with the platform adding 200,000 subscribers during the quarter, or 0.4%, for a total of 48.5 million, including 43.9 million SVOD-only subscribers and 4.6 million Live TV and SVOD subscribers.

Domestic average revenue per user for Disney+ grew 3% quarter over quarter to $7.50, while international (excluding Hotstar) grew 1% quarter over quarter to $6.10. Disney+ Hotstar ARPU grew 19% quarter over quarter to 70 cents.

By comparison, Netflix — which Iger referred to on Wednesday as the “gold standard” — has more than twice as many subscribers as Disney+, with 247.15 million subscribers, after adding 8.76 million during its latest quarter. Netflix’s average revenue per user sits at $16.29 in the U.S. and Canada, $10.98 in the Europe, Middle East and Africa region, $8.85 in Latin America and $7.62 in the Asia Pacific region, the company has reported.

“Netflix is out of reach” for Disney to catch in total subscribers with Disney+, a former executive told TheWrap. The strategy shift is “all about churn reduction, it’s not about going after Netflix,” he said.

In addition, Disney’s current streaming growth “is not sustainable,” the executive said. “They are going to hit a level in each [new] country where it becomes mature. They can’t keep adding subs.”

Lately, Netflix has been proving that its platform has a significant competitive advantage in its ability to make other companies’ content more popular once it lands on Netflix. Iger said Wednesday that Disney has also been licensing content to Netflix and is in discussions with the company about additional opportunities. But he said the House of Mouse has no plans to license content from its core brands.

“Those are real, obviously, competitive advantages for us and differentiators. Disney, Pixar, Marvel, Star Wars, for instance, all doing very, very well on our platform,” Iger said. “And I don’t see why just to basically chase bucks we should do that when they are really, really important building blocks to the current and future of our streaming business.”

Warner Bros. Discovery, which reported mixed third-quarter results on Wednesday, has been even more aggressive in licensing core content to Netflix, including its DC movies like “Man of Steel” and “Wonder Woman,” and sending high-profile HBO shows like “Westworld” to Tubi and Roku.

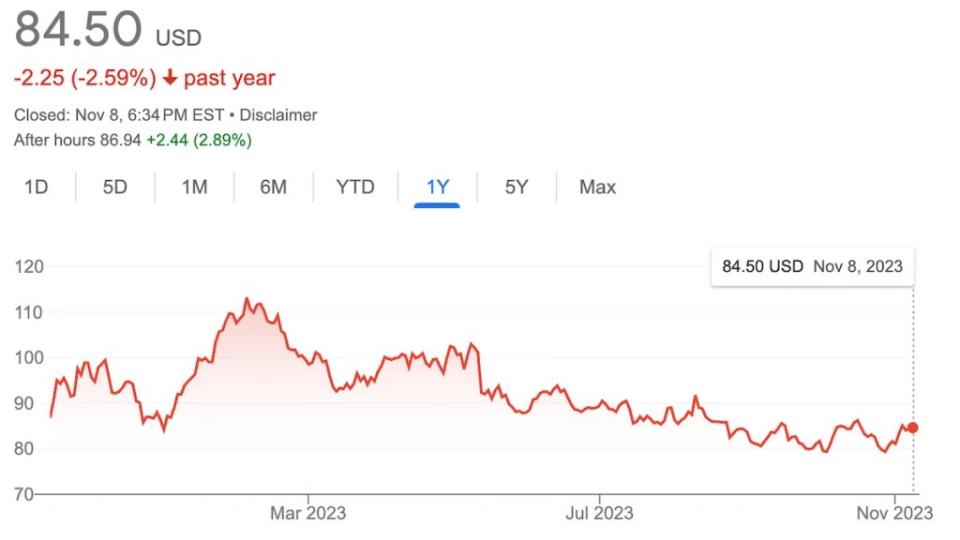

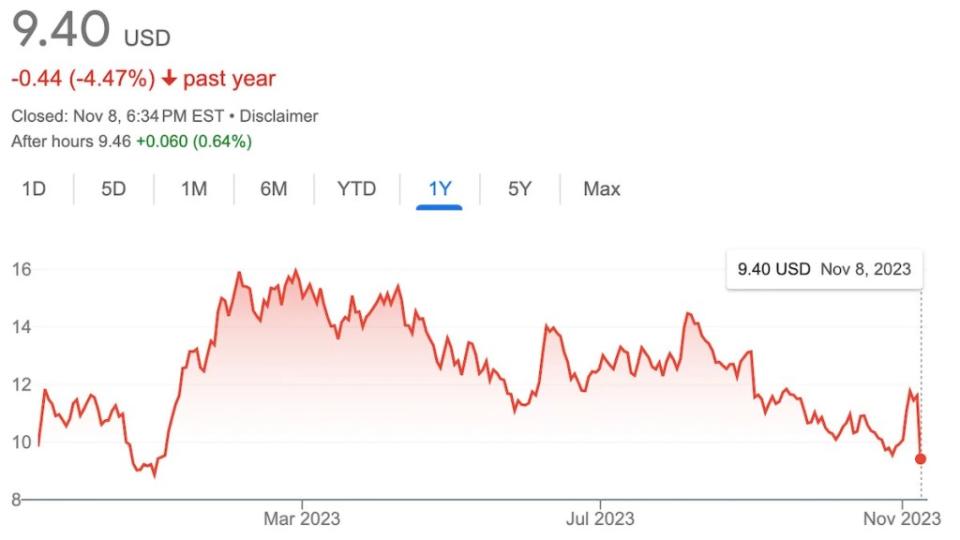

In the quarter, WBD shed 700,000 direct-to-consumer subscribers for a total of 95.1 million globally, including 53.6 million domestic subscribers and 41.4 million international subscribers. However, the segment reported its second consecutive profitable quarter with adjusted EBITDA of $111 million, a $745 million year-over-year improvement. Domestic average revenue per user came in at $10.66, while international ARPU was $3.37 and global ARPU was $7.38. Warner Bros. Discovery’s stock took a hit after its earnings call, falling over 18% as a weak advertising market clouds the company’s 2024 outlook.

“Disney made progress in turning its streaming business profitable but still has a ways to go,” Jamie Lumley, an analyst with research firm Third Bridge said in a note Wednesday. With WBD reporting a profitable quarter for streaming, “the pressure for results continues to rise for Disney’s leadership.”

Scott Mendelson contributed to this story.

The post Disney Goes All-in on Streaming – But Is It Too Late to Catch Netflix? | Analysis appeared first on TheWrap.