Disney Flexes Brand Muscle and Investment Capabilities in Unveiling Disney Plus

Disney has thrown down the content gauntlet.

The company capped a three and a half hour investor presentation on its plans to move aggressively into the direct-to-consumer arena Thursday with news that produced gasps from the roughly 250 Wall Street analysts and reporters in the room.

Related stories

Disney+ Lineup: Shows and Movies Confirmed for Streaming Service So Far

'Star Wars: Episode IX': Watch the First Trailer for 'The Rise of Skywalker'

The $6.99 monthly price of its cornerstone Disney Plus streaming service was seen as a major shot across the bow at Netflix. Disney is planning to serve up gold-plated brands, a deep vault of movie and TV shows and high-wattage original production at a price point that is highly attractive even to cost-conscious consumers. Netflix’s streaming plans range from $9-$13 a month.

“We’re designing a product that we want to be as accessible to as many consumers as possible,” Disney chairman-CEO Bob Iger said during the concluding Q&A session.

Iger told the crowd that assembled on a soundstage on Disney’s Burbank lot that the company was prepared to absorb some significant losses during the formative stages of the Disney Plus launch, set for Nov. 12. The rollout in Europe, Latin America and Asia is planned over the next three years.

“Obviously the strategy is extremely important to us,” Iger said. “We’ve got to be very serious and be all in on it. We believe that is the best way to succeed.”

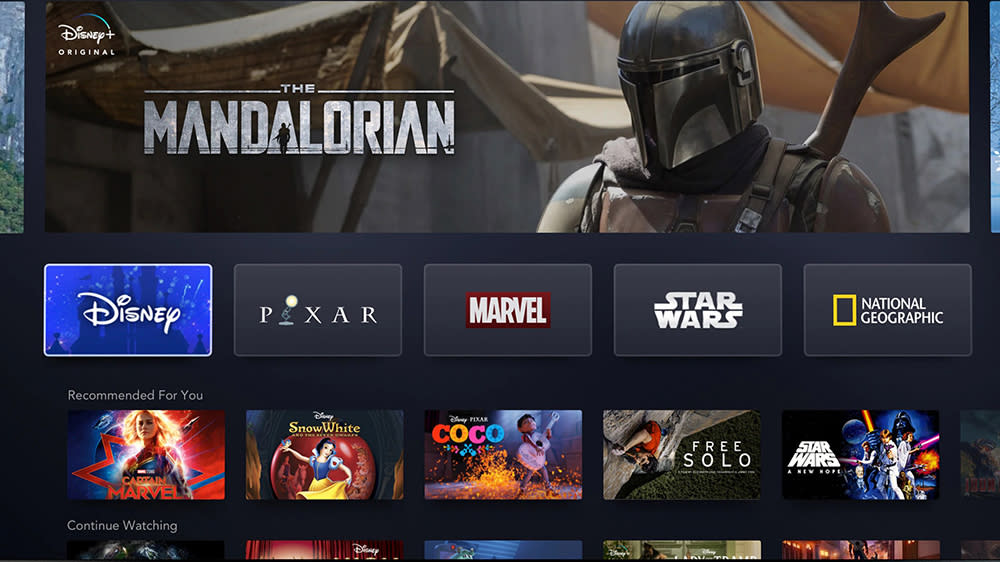

The lengthy presentation could not have been more focused on underscoring the point that Disney has a seemingly invincible roster of brands — Disney, Pixar, Marvel, Star Wars and National Geographic — to drive a robust offering that will blend original fare and vintage titles.

“The fact that we have the brands that matter is the single biggest differentiator of our service,” said Kevin Mayer, chairman of Disney’s direct-to-consumer and international division.

Iger asserted that while Disney is taking a big swing in transitioning so much of its film and TV production into the direct-to-consumer arena “we’re starting from a position of strength, confidence and unbridled optimism.”

Disney also emphasized that all Disney Plus content will be downloadable for offline viewing so long as the user remains an active subscriber. That’s a major plus for the Disney Plus target audience of families with young children.

Disney projected that Disney Plus will have 60 million to 90 million subscribers worldwide by 2024, with one-third of those coming from the U.S. Disney said it expects to spend a little over $1 billion on original content for Disney Plus in its fiscal 2020, ramping up to the $2.5 billion range by 2024.

Disney will commit another $1.5 billion in fiscal 2020 to license content that debuts on other platforms from its studio and networks units.

Disney chief financial officer Christine McCarthy said operating losses for Disney Plus are projected to peak between 2020 and 2022, with profitability coming in 2024.

“From a financial perspective, the operating results during the first couple of years will reflect the aggressive early investments we’re making,” she said. “We want to set the business up for long-term success.”

The presentation featured a parade of executives and a handful of creative talent including Jon Favreau, the veteran director who is shepherding the studio’s highly anticipated live-action take on “The Lion King.” From original Marvel- and Star Wars-branded series to a host of remakes and spinoffs from characters in the vast Disney vault, the presentation made it clear that Disney has the arsenal to lead traditional Hollywood into a new era of film and TV viewing.

“Each of these series will be equal to the movies in quality and storytelling,” said Marvel Studios president Kevin Feige, who showed off a clip of the upcoming “Avengers: Endgame,” which will eventually be available to Disney Plus subscribers.

Feige emphasized the creative potential of having such a broad canvas to work on with original series. “They will change and evolve existing characters and introduce new ones.” He said the storylines of Disney Plus originals and Marvel films will converge and be part of the all-important “canon” for characters and franchises in way that will “significantly impact the Marvel Cinematic Universe.”

The presentation also offered the first glimpse of the Disney Plus interface across multiple devices. The look and feel was colorful and intuitive, with the promise of offering users many ways to search for content and for personalizing the service to their own tastes.

“We will have a full array of device platform partnerships,” said Michael Paull, president of Disney Streaming Service.

The presentation underscored the importance to Disney of its 21st Century Fox acquisition as it looks to build Disney Plus. Disney Plus will become the exclusive streaming home of “The Simpsons,” for one, a shift from the previous Fox strategy of making the venerable toon available through the FXX linear cabler and FXNow streaming app. That announcement came in a cheeky “Simpsons” animated clip that featured Homer Simpson and family trying on Mickey Mouse ears as they stood next to two statues — one of Darth Vader, the other of Disney chief Iger — while a framed photograph of Fox baron Rupert Murdoch could be seen in a trash can.

The presentation opened with a nearly 15-minute video that traced Disney’s origins — including the famous Walt Disney quote “It all started with a mouse” — through the present day, incorporating Fox brands ranging from “The X-Files” and “American Horror Story” to “The Sound of Music” and “Bohemian Rhapsody.” The reel also demonstrated Disney’s breadth of content through its linear channels, ABC News operations and the international assets such as Star India and Hotstar.

Iger noted that Disney’s advantages include the “evergreen” nature of the classic titles in its vault. “My grandparents took me to see ‘Cinderella’ when I was a young boy,” Iger said. “This past Christmas I watched that movie with my grandson.” He called that “a perfect illustration of what ‘evergreen’ means to us and how much value it generates for our shareholders.”

As expected, Iger and his lieutenants laid out a direct-to-consumer strategy revolving around three main pillars: ESPN Plus, which launched last year; Hulu, in which Disney now has a majority stake; and Disney Plus.

One of the big shifts for Disney in going “all in,” as Iger put it, on Disney Plus was the decision to make all of the classic Disney animated feature titles, starting with 1937’s “Snow White and the Seven Dwarfs,” available on a permanent basis. In the past, Disney kept a certain number of titles on the shelf at any given time to build demand.

Disney will also mine the vault of Disney Channel to make all of its made-for-TV movies and original series available in one fell swoop. A new spin on the “High School Musical” franchise is planned as one of the original series for Disney Plus.

“Never before has our content been so broadly, conveniently or permanently available as it will be on Disney Plus,” Mayer said.

Mayer said the company’s thinking was driven by “a fundamental shift in the marketplace and growing consumer demand for streaming services.”

Agnes Chu, senior VP of content for Disney Plus, said the plan is to have nine original series plus movies and documentary programs available at launch. By the first year, they expect to have more than 25 original series and 10 original movies and documentaries. She called it “an unrivaled living, breathing eco-system of content.”

Disney expects to roll out Disney Plus in Western Europe and parts of Asia starting the first quarter of next year. Latin America will launch in 2021.

Disney brass vowed to use every “touchpoint” possible across the company’s content and theme park resources to promote the availability of Disney Plus.

Ricky Strauss, president of content and marketing for Disney Plus, said the promo blitz would represent “a synergy campaign of a magnitude that is unprecedented in the history of the Walt Disney Company.”

The curtain-raising for Disney Plus was the focal point of Thursday’s presentation. But McCarthy offered growth and financial projections for ESPN Plus and Hulu as well.

ESPN Plus is expected to have 8 million to 12 million domestic subscribers by 2024. Operating losses for this year and next are expected to hit around $650 million in both years, with profitability expected by 2023.

Hulu is expected to draw 40 million to 60 million domestic subscribers by 2024, up from 25 million at present. Hulu’s operating losses will peak this year at $1.5 billion, with profitability pegged at 2023 or 2024, according to McCarthy.

Disney will likely take steps to offer the three services at a bundled discount. But Iger said they decided against marketing them only as a package because that seems out of step with what consumers want in the streaming arena. Hulu’s menu of offerings includes the $45 a month Hulu Live service that includes a cable-style bundle of linear cable channels.

“We feel consumers should have more flexibility,” Iger said. “Giving them a fat bundle of something that looks more like traditional media would not be the right thing to do in this space.”

Inevitably, Iger was also asked about the long-term leadership plan for the company and whether he will step down as CEO in 2021 as previously stated. Iger said there was no change to his timetable and that Disney’s board of directors was “engaged” in the search for his successor.

“I’ve been CEO since October 2005,” he said. “There’s a time for everything. 2021 will be the time for me to finally step down.”

Sign up for Variety’s Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.