Disney Activist Investor Trian Unveils 130-Page Memo Taking Aim at Bob Iger’s Strategy

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

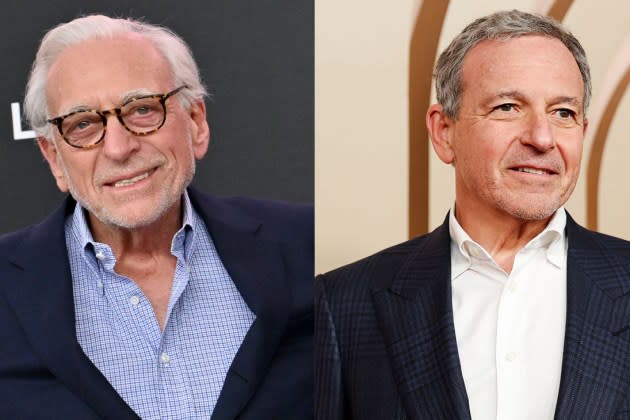

Trian Partners is revealing more detail on its plans to shake up Disney, should founder Nelson Peltz and fellow nominee Jay Rasulo be elected to Disney’s corporate board next month.

As part of its ongoing proxy fight with Disney, Trian published a 130-page whitepaper, accusing Disney’s current board of directors of being “the root cause of Disney’s underperformance” in recent years.

More from The Hollywood Reporter

Disney Grandchildren Back Bob Iger in Board Seat Fight With Nelson Peltz

Disney Inks $8.5B Deal to Merge India Business With Reliance Industries

But while much of the paper assigns blame to the board and reiterates many of the claims made by Trian previously, it also offers suggestions for what the company should do, and what Peltz and Rasulo would push for, should they win board seats at Disney’s April 3 annual meeting.

Among the suggestions are to “right-size” both Disney’s studio business and its linear TV networks.

“We believe that it is unlikely that Disney can realize its full potential if it refuses to sufficiently right-size expenses in legacy businesses that are growth challenged,” Trian writes. That includes spinning out or finding strategic partners for Disney’s legacy linear TV networks, arguing that it would improve the corporate balance sheet and would “improve morale” at the linear networks “by giving management and employees more control over their destiny.”

Trian also argued that Disney+ and Hulu should be fully consolidated (and that Hulu should not be relegated into a tile within Disney+), that the company should explore expanded opportunities to bundle alongside other media companies, and that it should evaluate the viability of Hulu With Live TV.

Trian says that it is “skeptical” of ESPN’s viability as a stand-alone streaming service and that he company should “scale back ESPN’s DTC plans and focus on maximizing the value of ESPN+ and the existing linear business.”

Disney’s other activist, Jason Aintabi’s Blackwells, has offered suggestions of its own, including spinning out Disney’s real estate holdings into a Real Estate Investment Trust (a REIT), and using AI to create characters and expand the company’s parks business.

Disney has responded by leaning on Professor Ludwig Von Drake (he’s Donald Duck’s uncle) to try and educate shareholders about the vote, with CEO Bob Iger also using the February earnings call to announce a slew of new projects, including an animated Moana sequel, and a $1.5 billion deal with Epic Games. The grandchildren of Walt Disney and Roy O. Disney also wrote letters in support of Iger in his board seat battle.

Best of The Hollywood Reporter