Demand for Nickelodeon’s ‘Avatar’ Series Is Still High – a Good Sign for Upcoming Projects | Charts

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

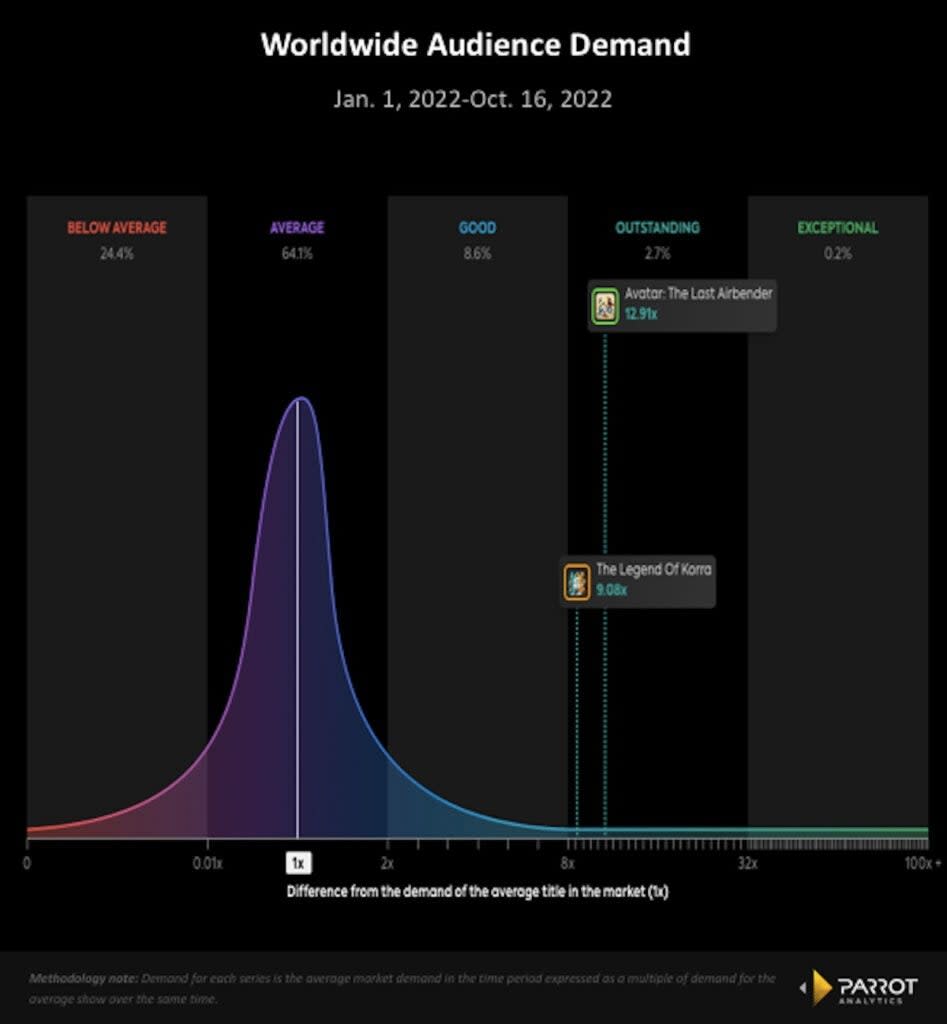

Nickelodeon’s animated series “Avatar: The Last Airbender” and “Avatar: The Legend of Korra” are among the top 2.7% of all TV shows in worldwide audience demand year-to-date (through October 16, 2022), according to Parrot Analytics’ data, which takes into account consumer research, streaming, downloads and social media, among other engagement. And that bodes well for new projects in the pipeline from the franchise.

What’s particularly impressive is that both shows maintain outstanding levels of demand despite the fact that they haven’t aired new episodes since 2008 and 2014, respectively. “Avatar: The Last Airbender” even managed to figure as the most in-demand Nickelodeon show of that period besides the immensely popular hit “SpongeBob SquarePants.”

Normally, revisiting linear series that premiered long before audiences had ever heard of streaming originals wouldn’t be a top priority. But there are big plans in store for the future of this franchise that will yield ripple effects across two of Hollywood’s major players.

Netflix is expected to debut its long-gestating live-action adaptation of “Avatar: The Last Airbender” in 2023. Meanwhile, original series creators Michael Dante DiMartino and Bryan Konietzko are developing new animated projects set within the “Avatar” universe at Nickelodeon parent company Paramount Global under the new production banner Avatar Studios. The latter will include original movies, series and shorts that will debut across theatrical, linear and streaming.

Based on how well “The Last Airbender” and “Korra” continue to perform, there’s reason to believe these franchise extensions will be successful.

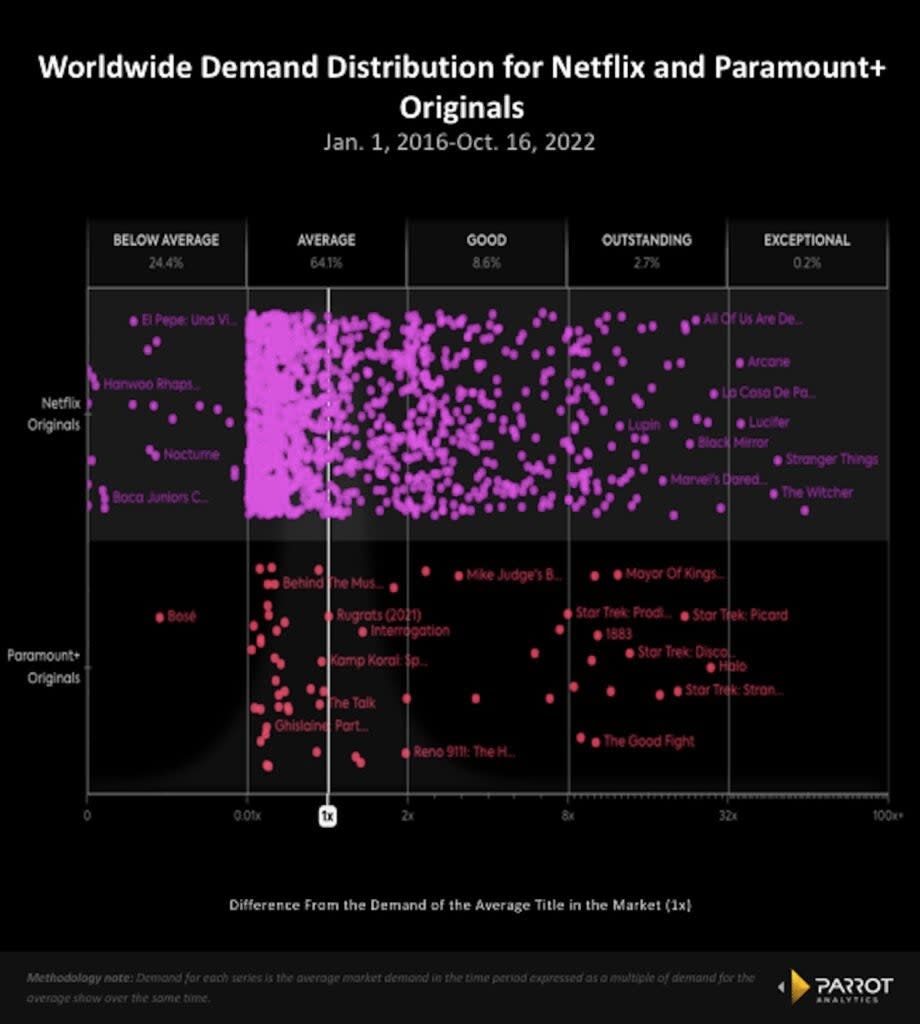

Both original series have enjoyed second lives on streaming over the last decade with boosts from access via Netflix and Paramount+ (née CBS All Access). In fact, both shows have maintained outstanding worldwide audience demand levels (top 2.7%) dating all the way back to 2016 as a result. In that same span, the majority of Netflix and Paramount+ originals have garnered just average demand (top 64.1%).

DiMartino and Konietzko are currently developing an animated theatrical film for Paramount as their first new project. Since the start of 2020, five of the 30 most in-demand films in the U.S. have been animation titles while at least one animated title has ranked among the top 10 highest grossing worldwide films every year since 2015. Past audience behavior suggests the movie will enter a friendly enough marketplace. The demand share for animations in the U.S. grew from 8.9% in September 2021 to 10.7% in September 2022.

Netflix users may be wary of getting their hopes up for another live-action adaptation of a popular animated title after “Cowboy Bebop” was canceled after one season. At the end of the day, artistic quality is one of the most important factors of all and can’t be algorithmically reverse engineered. But it’s the way in which these “Avatar” series have stayed popular that bodes particularly well for the commercial success of future installments.

A show’s reach indicates the breadth of a title’s popularity as it represents the total number of unique users expressing demand for a title. “The Last Airbender” boasts exceptional reach at 46.56 times the average title, putting it in the top 0.41% percent of all shows. Global Travelability indicates the popularity of a show outside of its home market, a category in which “The Last Airbender” is in the top 1.36% of all shows worldwide. “Korra” ranks similarly well, with a reach score of 23.9 times (top 1.33% of all shows) and global travelability of 6.72 times (top 2.77% of all shows).

What’s also interesting is that despite initially premiering in 2005 and 2012, respectively, the shows are now resonating most with Gen Z (ages 13-22). This implies that new generations have discovered the “Avatar” franchise since its conclusion. To continue stoking fan interest, the company has released 11 console games, 50 online games, six tabletop games and one mobile game since 2006. This is often an effective tool in building franchise affinity among fandoms while creating a funnel of engagement.

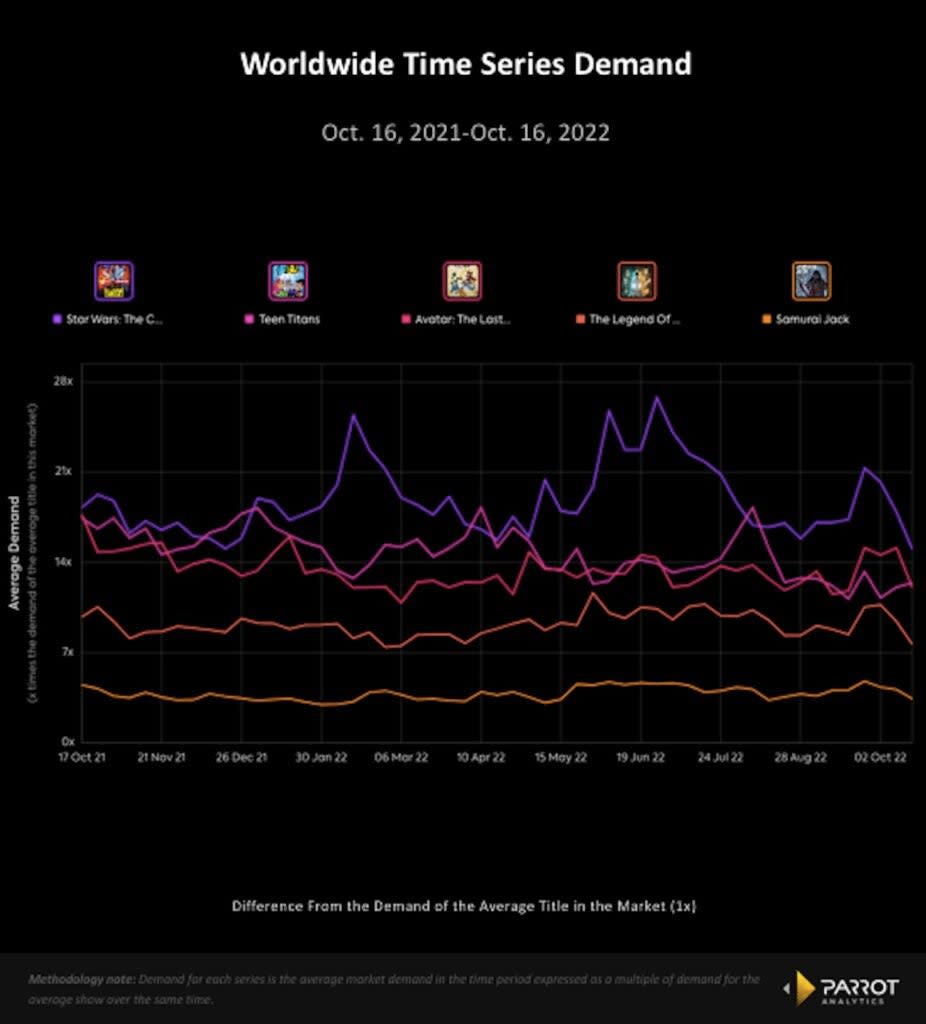

Overall, U.S. demand for both series has remained above average over the last 12 months. They compare favorably in that time to other enduring animated titles from the same era such as “Star Wars: The Clone Wars,” “Teen Titans” and “Samurai Jack” — all of which have been revisited or revived in some form in recent years.

All of this means that both original titles are deeply penetrating the market and appealing to a diverse array of regional audiences while continuing to find new fans. That, combined with their impressive longevity, suggest a passionately and consistently engaged audience. That is a strong foundation from which to launch new material and, with a built-in fan base, should help these upcoming additions attract audiences early on in their runs.

Brandon Katz is an industry strategist at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

Why Paramount Global Hasn’t Been Snatched Up in Media Consolidation Feeding Frenzy | Analysis