The Demand for Amazon’s Original Series Is Second Only to Netflix | Charts

Amazon Prime Video is becoming more popular with American audiences. In the third quarter of 2022, Prime Video accrued the second-highest U.S. demand share among SVOD (streaming video on demand) platforms for original series at 9.3%, behind just Netflix, according to Parrot Analytics‘ data, which takes into account consumer research, streaming, downloads and social media, among other engagement.

Importantly, Prime Video has seen that number rise by 0.4 percentage points since the third quarter of 2021. Among the the top SVOD platforms, only HBO Max enjoyed higher demand growth in that period.

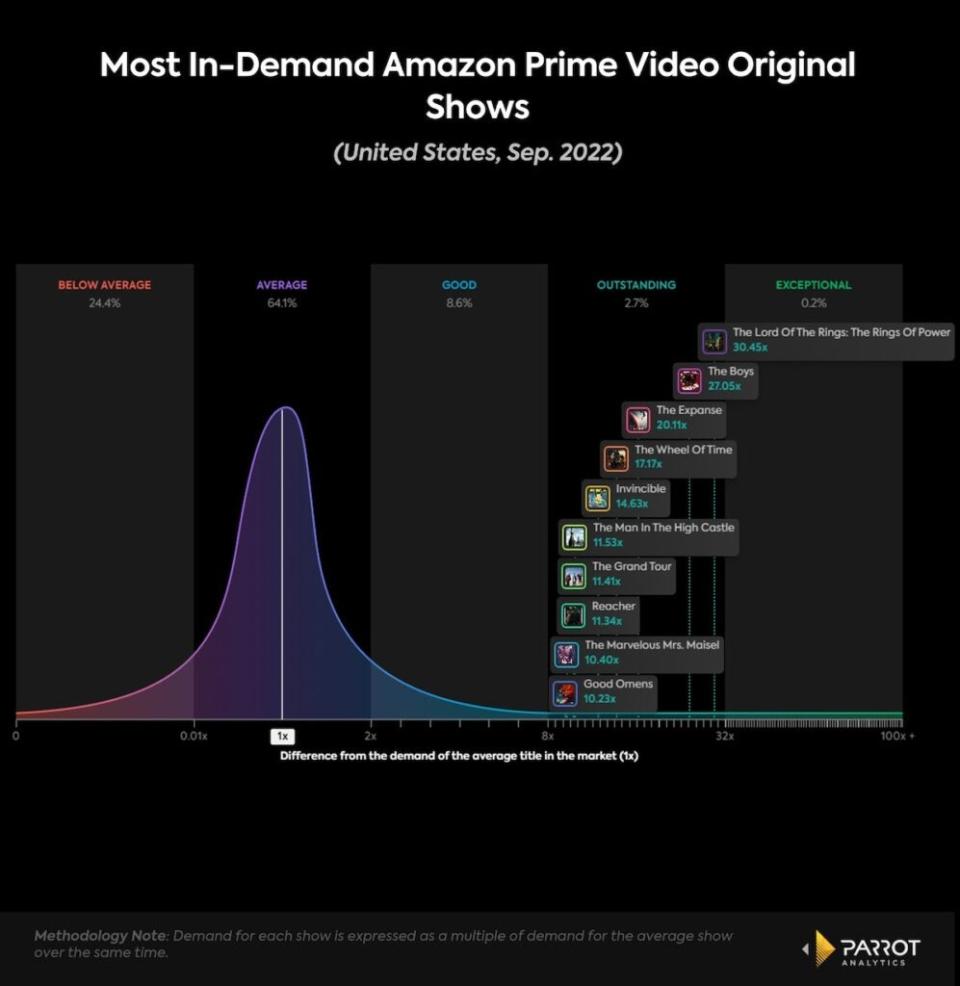

Prime Video’s biggest hope for the second half of 2022 is “The Lord of the Rings: The Rings of Power,” allegedly the most expensive TV show ever produced. Released on Sept. 1, the series was the most in-demand Prime Video original in its release month as well as one of the 10 most in-demand digital originals, with more than 30 times more demand than the average show in the U.S. market. Despite its outstanding demand, the “Rings of Power” performance is arguably not meeting lofty expectations considering the massive financial investment. The show has been a hit, but it’s far from being an unrivaled success among U.S. audiences. In fact, “The Rings of Power” was less in-demand than less costly shows like Netflix’s “Monster: The Jeffrey Dahmer Story” and Apple TV+’s “Ted Lasso” in September.

“The Rings of Power” is closely followed by ”The Boys,” Prime Video’s second most in-demand production in September. That show is also the most successful superhero series in the U.S. that is not part of either the Marvel or DC franchise.

Another aspect in the top 10 Prime Video originals that stands out is the longevity of “The Expanse.” Almost seven years after the release of its first season and nearly a year after the release of the last one, the show is still one of Prime Video’s top streaming originals (the show’s first three seasons aired on Syfy before moving to Prime Video).

Prime Video operates with a different business model than its main streaming competitors. The SVOD platform, as well as Amazon Studios — the production arm of Amazon — are housed in a much larger holding company where streaming is not the core business (unlike Netflix). In the U.S., Prime Video subscriptions are part of Amazon Prime memberships, which provide benefits unrelated to streaming services, such free shipping or same-day grocery delivery. In that sense, Prime Video subscribers are considered Amazon customers and production decisions are made considering how they help reduce Prime churn (the rate in which customer end their subscriptions) and increase the number of Prime subscriptions.

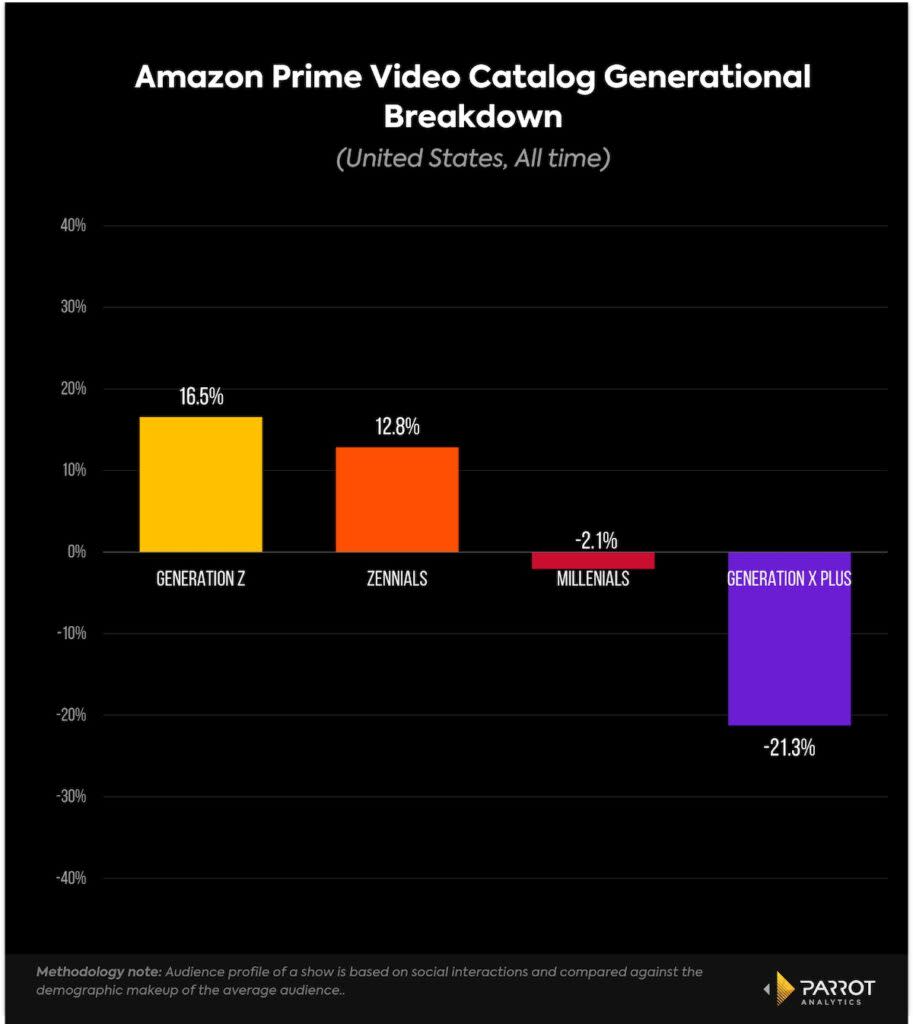

This raises an important question: Who is Prime Video attracting to Amazon Prime? Using Parrot Analytics’ generational index, which shows how much content on a platform over or under indexes with each generation, we can see that Prime Video’s catalog over indexes more with younger audiences (Generation Z and Zennials) and under indexes with the older ones (Millenials and Generation X Plus). This means that Prime Video is more capable of attracting younger audiences to the whole Amazon ecosystem, which may be complementary to the other benefits given to Amazon Prime members. These numbers are in line with data recently released by Amazon. The company reported that the average age of the audience for Thursday Night Football on Prime Video is six years younger than the typical NFL audience (47 years old on Prime Video vs. 53 years old on linear).

Daniel Quinaud is a senior data analyst at Parrot Analytics, a WrapPRO partner. For more from Parrot Analytics, visit the Data and Analysis Hub.

Also Read:

Demand for Nickelodeon’s ‘Avatar’ Series Is Still High – a Good Sign for Upcoming Projects | Charts