The crypto boom may have made criminals richer

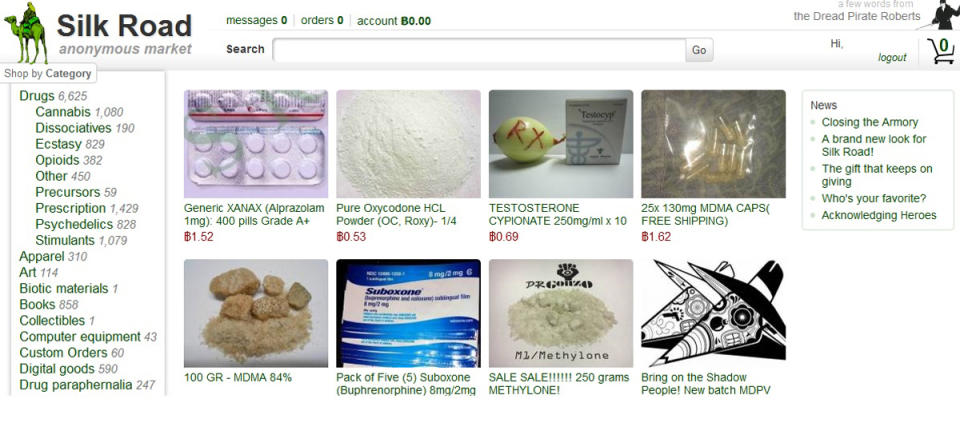

When the FBI seized Silk Road founder Ross Ulbricht’s assets a few years back, the bureau confiscated 144,336 bitcoins, or around $28.5 million.

That was 2013, when a single bitcoin went for around $200. As both institutional and retail investors have taken a hold of the cryptocurrency looking to make it big, bitcoin’s value has exploded from around $1,000 per coin at the beginning of 2017 to over $15,000 at the end of 2017.

Today, if Ulbricht hadn’t lost his bitcoin, he’d have an amount equal to around $2.2 billion.

For years, bitcoin has been the de facto currency of black markets on the so-called dark web. Near anonymous (when used properly), easy to store, and able to be transferred without an in-person interaction, bitcoin was a natural fit for the “Amazon for drugs,” other illicit online black market trading, and terrorism. And if these actors store significant amounts of assets in bitcoin like Ulbricht, then it’s very possible the bitcoin boom has made criminals assets balloon.

“Mainstream America is sending billions to cash out some really smart guys on computers, some drug dealers, some arms dealers — nefarious people,” said Lee Munson, Chief Investment Officer of Portfolio Wealth Advisors. “It’s crazy. All of us who put in $5 or $1,000, we’re providing liquidity, one bag of fentanyl at a time.”

It’s not just bitcoin. In September 2016, cryptocurrency Monero was heralded as the new preferred dark web alternative when AlphaBay, a Silk Road successor, added it to the platform. Unlike bitcoin, Monero uses a different address for each transaction and has a few other security features that enhance anonymity.

Since then — and since the 2017 crypto boom began — Monero has exploded, up 344% since November and 3,400% since AlphaBay began accepting it. Someone has gotten rich, though the anonymity makes it impossible to know who.

Bitcoin and terrorism

Terror groups’ crypto interest has also increased of late, perhaps tied to the boom. A recent report from the Meir Amit Intelligence and Terrorism Information Center in Israel detailed a drive on an ISIS-affiliated website for donations in bitcoin in December, and noted that the organization makes “extensive use” of cryptocurrencies like bitcoin. A few days later, a Long Island woman was caught sending around $62,000 of bitcoin to fund terror.

ISIS’s crypto interest is not recent, though the group has traditionally relied more on less technological means, according to the Financial Crimes Enforcement Network. In 2013, Ghost Security Group, a collective that tracks terrorist cryptocurrency wallets, noted that it had tracked ISIS accounts that had $3 million in bitcoin. Back then, a single bitcoin was worth around $330, giving that $3 million a value of over $136 million today.

This doesn’t mean that ISIS still has these bitcoins and benefited from the boom, however. Roger Rice of Ghost Security Group declined to comment on specific tracking of wallets, but told Yahoo Finance that anyone who was currently holding funds during the bull market profited immensely from it, be they criminals, civilians, or nation-states.

“We have certainly seen an increase in general cryptocurrency discussion groups on the Telegram platform — not necessarily related to terrorism specifically,” he said. “Those who have benefited from the increase in valuation of their holdings have surely seen the light by now.”

Bitcoin’s anonymity hides the truth

Bitcoin transactions are more or less anonymous when done properly, making it hard to know exactly how much bitcoin bad guys hold.

According to Mark Testoni, CEO of SAP’s National Security Service (NS2), which helps the U.S. government track the digital trails of terrorists, there’s only anecdotal evidence at the moment about who is using bitcoin.

“Obviously it’s a platform that lends itself to these kinds of [actors] because of its ability to be anonymous,” he said. “This is a modern-day version of Swiss bank accounts. It’s very hard to say criminals control 30% or ISIS controls x-percent.”

Stephan Simon, a security researcher with Binary Defense Systems, a company that deals with the dark web and cyber-crime and tracks some bitcoin wallets, explained how hard it is, even when they manage to infiltrate or find addresses bad actors use.

“Once you find an address, without the use of some kind of tool — and I’m not aware of them — it gets very hard to track. Coins move from wallet to wallet and eat up fees and you have to follow that through the blockchain transaction,” he said. “Then you have two addresses to track. Then four, then eight, then 16. It could spread like crazy. And then you can’t tell when someone cashes out.”

Anecdotes and bad actors

Though global data seems impossible to get, anecdotes do paint somewhat of a picture. While dark web forums indicate that many people do quickly cash out via “web consulting” businesses and other money-laundering fronts — to avoid bitcoin’s historic volatility — the Ulbricht case and the barriers to convenient money laundering suggests that it’s at least likely a solid portion of illicit wealth has stayed in bitcoin.

Other anecdotal holders of bitcoin include ransomware operators. Binary’s Simon noted that “99.999%” of ransomware attacks he’s seen use bitcoin as the means of payment. North Korea has made a habit of stealing bitcoin — or participating in bitcoin ransomware — which has enabled it to get around sanctions. In December, North Korea was suspected in a heist of $81 million worth of bitcoin. In recent months, the regime’s cyber army has turned to focus on cryptocurrencies, according to the Wall Street Journal.

The piecemeal picture painted by anecdotes doesn’t necessarily prove broad, systematic usage or massive gains by bad actors during the boom. Or at least, not ones that can cast a shadow over bitcoin to give speculators too much pause. But as the Center of New American Security noted in a recent report, the anecdotal evidence does highlight bitcoin’s relationship to criminal entities as something for law enforcement and intelligence to pay close attention to in the future.

Ethan Wolff-Mann is a writer at Yahoo Finance. Follow him on Twitter @ewolffmann. Confidential tip line: FinanceTips[at]oath[.com].

Read More:

American Airlines just resolved its 15,000 flight fiasco

The phone industry’s clever plan to stop robocalls

Jack Dorsey on bitcoin and cryptocurrency

How cutting the 401(k) limit would affect people’s saving

Former ambassador: Mexico has ‘moved on’ from NAFTA

Big bitcoin-friendly companies like Microsoft and Expedia hedge their bet

The real reason Mexico will never pay for the Trump’s wall: It’d be ‘treason’

How Waffle House’s hurricane response team prepares for disaster

Trump weighs slashing one of the most popular tax deductions