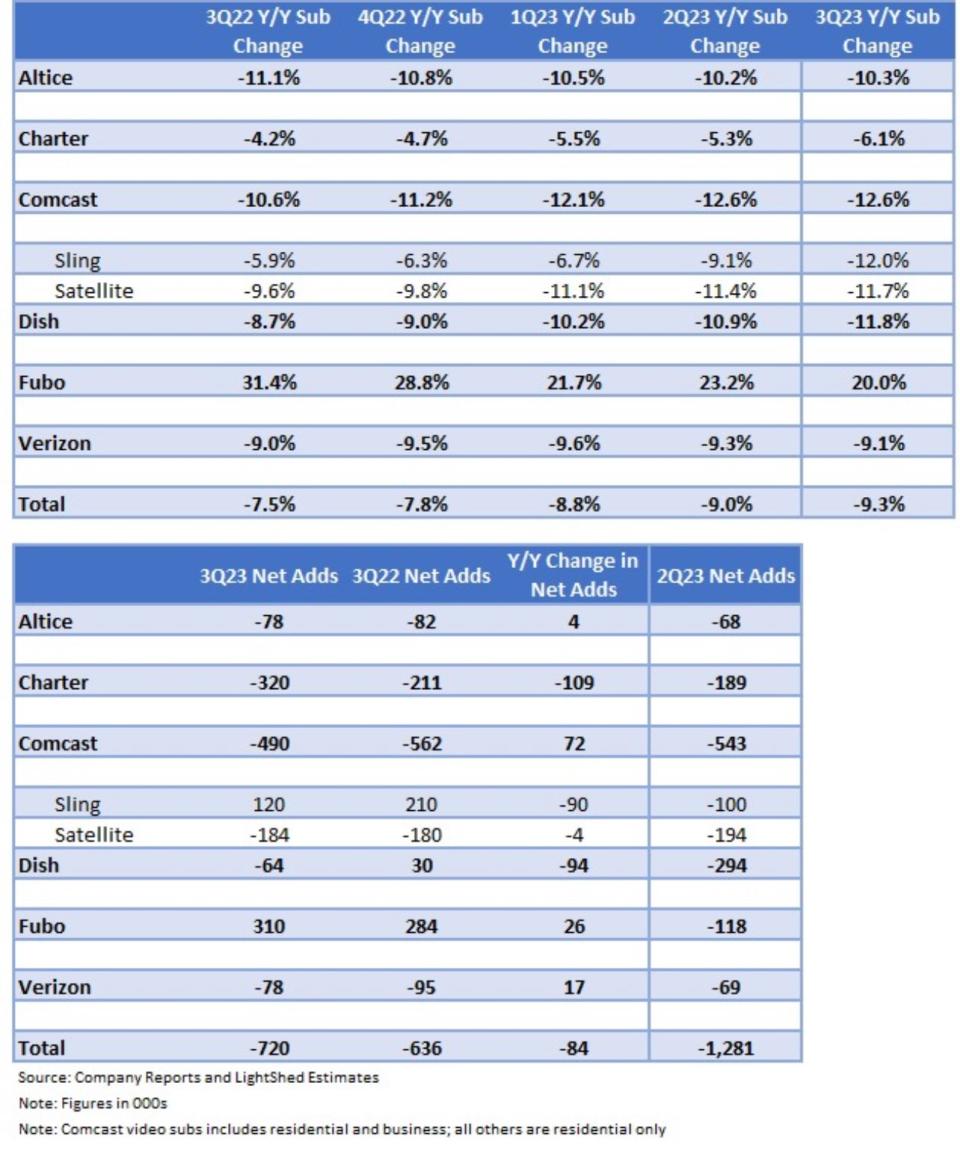

Cord-Cutting Quickened Again in Q3 For the Top 6 Publicly Transparent Pay TV Platforms (Chart)

Despite decreased third-quarter linear video customer attrition by the No. 1 U.S. pay TV operator, Comcast, cord-cutting once again accelerated from July - September among the top six U.S. operators who publicly report their customer metrics.

LightShed Partners this week published a useful snapshot, which we included below.

The overall rate of attrition for these pay TV companies was 7.5% in the third quarter of 2022, but accelerated to 9.3% in the most recent quarter.

The main backward driver was Charter Communications, which saw Spectrum TV customers bolt in early September as it fought a carriage war with Disney for over a week at the start of the college and pro football seasons. And Dish Network lost 64,000 customers across its satellite TV and Sling TV virtual platforms after gaining 30,000 customers in Q3 2023.

But there's some big caveats here: We can probably assume that the fastest growing pay TV platform at this point, YouTube TV, grew more in Q3, given Google's aggressive promotion of the platform ... and the fact that Charter directed angry customers to the vMVPD during its Disney blackout. As usual, Google/Alphabet didn't break out numbers for the platform during its Q3 report.

Also, Disney will report metrics for Hulu + Live TV on Wednesday.