Congress returns — What you need to know for the week ahead

The markets went into the long holiday weekend on a positive note after the jobs report missed expectations Friday but didn’t force a full re-think of the health of the U.S. labor market.

In August, the U.S. economy added 156,000 nonfarm payrolls while the unemployment rate ticked up slightly to 4.4%. Expectations were for job gains to total 180,000 and the unemployment rate was expected to hold at 4.3%.

Economists, however, noted ahead of this report that August has traditionally been a weak month for payrolls due to a seasonal adjustment issue with the report, and this appears to have held true on Friday.

In response, stocks kicked off the first trading day of September on a positive note, with the Dow rising above 22,000 before settling just below that milestone, while the S&P 500 and tech-heavy Nasdaq also closed in the green. The small-cap Russell 2000 led the markets on Friday, rising about 0.6%.

Gold, meanwhile, continued its recent rally closing the week at $1,329 an ounce, while the 10-year yield backed up just a touch to 2.16% after hitting 2.12% earlier in the week.

In the coming week, markets will contend with U.S. lawmakers returning to Washington, D.C. after the August recess with tax reform and passing a budget bill to raise the debt ceiling at top of mind.

On Friday, Bloomberg reported that the Trump administration was considering tying a debt ceiling bill to an initial relief package for Hurricane Harvey aid in an effort to quell concerns over a government shutdown. A later report suggested House Republicans may be against this plan.

On the economic side of things, this week will be a slower one after we got a rush of month-end data on July and August ahead of the holiday, and the corporate calendar is also expected to be light.

Notable earnings this coming week are expected to include Kroger (KR) and HP Enterprise (HPE).

Economic calendar

Monday: Markets closed in observation of the Labor Day holiday.

Tuesday: Factory orders, July (-3.2% expected; +3% previously)

Wednesday: Trade balance, July (-$44.6 billion expected; -$43.6 billion previously); Markit services PMI, August (56.9 expected; 56.9 previously); ISM non-manufacturing PMI, August (55.4 expected; 53.9 previously); Federal Reserve Beige Book

Thursday: Initial jobless claims (242,000 expected; 236,000 previously); Nonfarm productivity, second quarter (+1.2% expected; +0.9% previously)

Friday: Wholesale inventories, July (+0.4% expected; +0.4% previously); Consumer credit, July ($15 billion expected; $12.4 billion previously)

Labor markets and consumer confidence

When a jobs report misses expectations, some might be inclined to call it a bad report.

And while Friday’s August jobs report missed what economists had forecast — with lackluster wage gains certainly remaining a point of weakness for the economy overall — the report still points to a labor market that remains solid, in-line with other data we got this week.

On Tuesday, data from The Conference Board indicated that at least among consumers, jobs are seen as plentiful by the highest percentage of folks since 2001.

And on Wednesday, private payroll figures from data processing firm ADP showed that hiring remains robust in the economy with 237,000 jobs added in August. Following this report, Mark Zandi, chief economist of Moody’s Analytics, said that in the U.S. economy, “mounting labor shortages are set to get much worse.”

Inside Friday’s jobs report, we also saw encouraging signs when it comes to labor force flows.

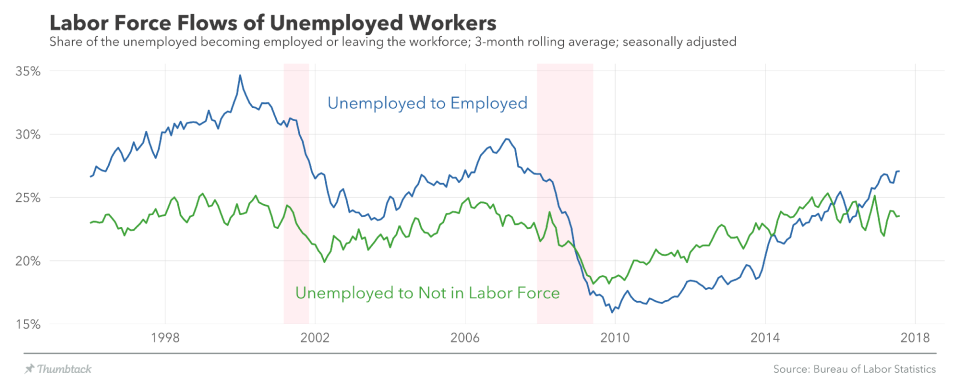

As highlighted by Lucas Puente of consultancy Thumbtack, the share of unemployed workers who got jobs in August was the highest since October 2008. And over the last several months, unemployed workers have become more likely to get a job than leave the workforce, flipping a trend that persisted from 2009 through 2015.

This kind of improvement beyond the headline readings on job gains and unemployment levels shows the strength of the labor market. It also shows why, despite the economic recovery being in its eighth year, there are no clear signs of a slowdown on the horizon.

And as we highlighted on Thursday, strategists at Bespoke Investment Group noted that secondary indicators of labor market strength — for example, commentary from regional Fed surveys or consumer confidence data — were “overwhelmingly positive” in August.

Additionally, there are statistical quirks in play that impacted Friday’s numbers. Namely, seasonal adjustments.

“August has historically been a noisy month for employment data,” said Michael Gapen, an economist at Barclays, “with as-reported data generally underperforming expectations and subsequent revisions removing that underperformance.

“This year seems to be no different and we suggest investors look to three-month averages to smooth through any volatility and assess underlying trends.” We noted Thursday that August payrolls have tended to underperform relative to expectations at as high a rate as any other month of the year. This trend played out again in 2017.

Ian Shepherdson, an economist at Pantheon Macroeconomics, noted that August reports also tend to be revised up in subsequent reports, meaning this will be a theme to keep an eye on in September and October.

And overall, Friday’s report does not rewrite the narrative for the U.S. economy, the U.S. labor market, or the Federal Reserve as we head into the fall.

“We continue to be taken aback by the persistent growth data depicted in the U.S. and globally, and continue to hold to the view that the economy is in much better shape than most give credit to,” said Rick Rieder, chief investment officer of global fixed income at BlackRock (BLK).

Jim O’Sullivan, chief U.S. economist at High Frequency Economics, said Friday’s report is more than strong enough for the Fed to begin the process of paring its balance sheet in September, adding that an additional rate hike in December is still on the table.

“As a standalone event, the August jobs report was a disappointment,” writes Neil Dutta, an economist with Renaissance Macro. “But taken with the other data over the month of August and the general tone of the labor market over the summer, it does little to change the baseline outlook for the economy or the Fed.”

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: