The CNN Max Dilemma: Streaming Launch Could Leave CNN Cable Business Behind

- Oops!Something went wrong.Please try again later.

As CNN races to catch up with the streaming world, its strategy in launching CNN Max — more than a year after the failure of CNN+ — will be a hat trick: offer news on its main subscription platform while preserving as much of its fast-declining linear audience as possible.

The pressing need to get CNN into the streaming space is obvious. Competitors like Fox News have already begun building an audience on their own streaming services. And adding news to the Max platform gives Warner Bros. Discovery a significant leg up over competitors like Netflix and Disney+, which currently do not carry live news at all.

“There is only one CNN and a significant number of U.S. homes have cut the cord. So if you don’t have a robust streaming solution, you can’t reach them,” Dave Morgan, CEO of cross-channel TV advertising firm Simulmedia, told TheWrap.

“Adding CNN to the Max offering will add important audience viewership volume to the service, which is critical in driving more advertising impressions and revenue,” he continued. “The future of streaming services is no longer just about subscriptions, it’s also about driving more ‘tune-in’ and viewership.”

But bringing the cable network’s live shows to streaming creates tension with the huge cable companies, who agree to pay top dollar for some degree of exclusivity in what they carry. The risk there is how to preserve the existing linear viewership and legacy brand while expanding the online audience, and driving engagement on Max.

A CNN spokesperson told TheWrap the linear and streaming audience demographics are very different and “serve two different sets of people.”

“If they were to decide that they didn’t want to renew with the operators and just go straight direct to consumer, I think it would be pretty much a bad business decision at this point in time, because the amount of subscribers that they would need to supplement the loss from the traditional operators would be massive,” S&P Global research analyst Scott Robson, who covers U.S. cable networks, told TheWrap of CNN’s cable/streaming juggling act.

The firm estimates that CNN will generate $1.05 billion in licensing revenue in 2023 and that its contracts with cable providers account for about 62% of the network’s total revenue. Deals with carriers are renegotiated about every three to five years and over the past decade have become more complicated with the rise of streaming.

“The network owners certainly don’t want to kill the linear business as it’s still generating the bulk of revenues and pretty much all the profits as most of the streaming services are still underwater,” Robson said. “So it’s a tough balancing act right now.”

CNN live-streamed content “will make Max more valuable,” Rosenblatt Securities analyst Barton Crockett told TheWrap. But it will come at a cost, potentially diluting the value of the linear network even further. It’s a “difficult trade,” but according to Crockett, it’s “one WBD has to make to stay in front of obvious trends.”

The CNN Max beta, which launches on Sept. 27 in the U.S. and will be included at no extra charge in all the streamer’s subscription tiers, is intended to be an extension of the programming already provided by CNN, giving Max an opportunity to feature real-time breaking news content while catering to cord-cutters.

While an official schedule hasn’t been set, CNN Max is set to include original programming specifically built for the platform, including “CNN Newsroom with Jim Sciutto” and “CNN Newsroom with Jim Acosta, Rahel Solomon, Amara Walker and Fredricka Whitfield.” Sciutto will also be tasked with leading breaking news coverage in the afternoons.

Additionally, some CNN programs that already air on cable will simultaneously stream on Max through a live feed. These programs include “Anderson Cooper 360,” “The Lead With Jake Tapper,” “The Situation Room With Wolf Blitzer” and “Amanpour.”

The strategy is in many ways the polar opposite of the scotched CNN+ service, which launched in March of 2022 after $300 million in spending and great fanfare — and was summarily canceled as David Zaslav took over Warner Bros. Discovery as CEO.

“CNN Max might not be the luxurious streaming lifeboat that CNN+ might have been,” CNN media reporter Oliver Darcy wrote in an edition of the Reliable Sources newsletter last week. “It is a lifeboat — and some form of a vessel is better than none at all.”

A former CNN executive involved in the building of CNN+ acknowledged the scrapped streaming service’s grand designs were modeled after The New York Times. “It was never just about a streaming platform, it was about building the world’s largest global Direct to Consumer news service,” the individual said.

CNN+ included live daily and weekly programs which ranged from hard-hitting straight news coverage to lifestyle content with CNN anchors. CNN Max will apparently not include the lifestyle-based offerings from well-known anchors that were intended to populate CNN+ and make it distinct in the marketplace (remember “Jake Tapper’s Book Club?”).

The arrival of a new CEO at CNN — New York Times and BBC veteran Mark Thompson announced on Wednesday — adds a new level of uncertainty to the planned strategy.

A former CNN executive told TheWrap that the network’s integration into Max could “rub up against” what Thompson “might see as the future of CNN,” and said he’s sure to come in and put his own stamp on the new streaming endeavor.

But the move to streaming seems critical, if not existential to the network.

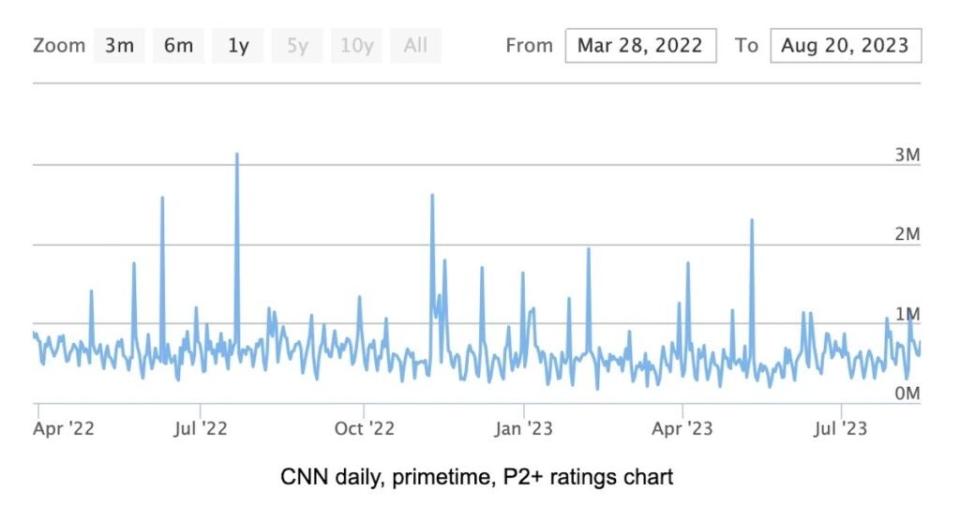

CNN’s linear ratings have taken a massive hit with the network garnering only 470,000 total daily viewers on average for the month of July, according to Nielsen. In the key demographic for July, CNN averaged 86,000 viewers between the ages of 25 and 54, the lowest viewership in 23 years. August has seen some more promising viewership gains as CNN finally set an official primetime lineup and Trump’s indictment coverage floods the news cycle, but there is still a lot of ground for the network to make up.

To make matters worse, overall viewership for linear television fell below 50% in July for the first time ever, according to Nielsen, as cable providers bleed subscribers at an alarming rate. The largest pay-TV providers — which represent about 96% of the market — now account for about 71.9 million subscribers, with the top seven cable companies having 35.9 million video subscribers, other traditional pay-TV services having about 22.7 million subscribers, and the top Internet-delivered (vMVPD) pay-TV services having about 13.4 million subscribers, according to Leichtman Research Group.

They collectively lost around 1.73 million subscribers in the second quarter of 2023, compared to a net loss of about 1.725 million during the same period a year ago, the firm estimates. Over the past year, that net loss was about 5.36 million subscribers, compared to about 4.235 million over the prior year, according to the firm.

Gerber Kawasaki Management CEO Ross Gerber told TheWrap that CNN Max’s change in approach from the failed CNN+ standalone service signals a lesson learned.

“CNN+ was basically saying, ‘Anderson Cooper, make us new shows that are outside of the scope of your real job, so that people will pay us again for more of your content,’” he said. “And I think what they found out really quickly is nobody wants that.”

Warner Bros. Discovery views CNN Max as a product that can help their streaming business “reduce churn and drive deeper engagement as part of a broader streaming platform,” the former CNN executive told TheWrap.

In its latest quarter, Warner Bros. Discovery shed 1.8 million direct-to-consumer subscribers for a total of 95.8 million globally and reported an adjusted EBITDA loss of $3 million, a $555 million year-over-year improvement. Executives have promised Wall Street its streaming business in the U.S. remains on track to reach profitability by the end of the year.

Max’s pricing ranges between $9.99 to $19.99 per month, while a standalone version of Discovery+ — which won’t have the new CNN service — remains available with ads for $4.99 per month and without ads for $6.99 per month.

While the nature of adding CNN to a pre-existing streaming service with the audience of Max is unique, the network’s competitors are not necessarily new to live-streaming their content. Fox Nation, a companion platform to Fox News, provides subscribers with exclusive coverage but the offering doesn’t include well-known Fox News Channel anchors. NBC, ABC and CBS also offer live streaming services through FAST channels and individual apps.

Some worry CNN Max could signal a death knell for the linear network. Gerber cautioned that bringing CNN to Max sends a statement that “CNN is worthless,” acknowledging that individuals aren’t willing to shell out more for the service separately. “Essentially, they’re making cable irrelevant,” said Gerber.

“It doesn’t help CNN,” said the former CNN executive. “I think the challenge in this is where’s the benefit for CNN? I think there’s a benefit for Warner Bros. Discovery, but the incremental ad dollars is not going to be enough to build a future for CNN.”

The same executive added that CNN Max is “a great opportunity for CNN to start over.”

Whether the integration of CNN drives more engagement with news content on a platform like Max, whose subscriber base skews younger, remains to be seen.

“If WBD has success, others will follow suit,” said Crockett. “News will be less of a reason to subscribe to pay TV,” further eroding the linear network consumer base.

The post The CNN Max Dilemma: Streaming Launch Could Leave CNN Cable Business Behind appeared first on TheWrap.