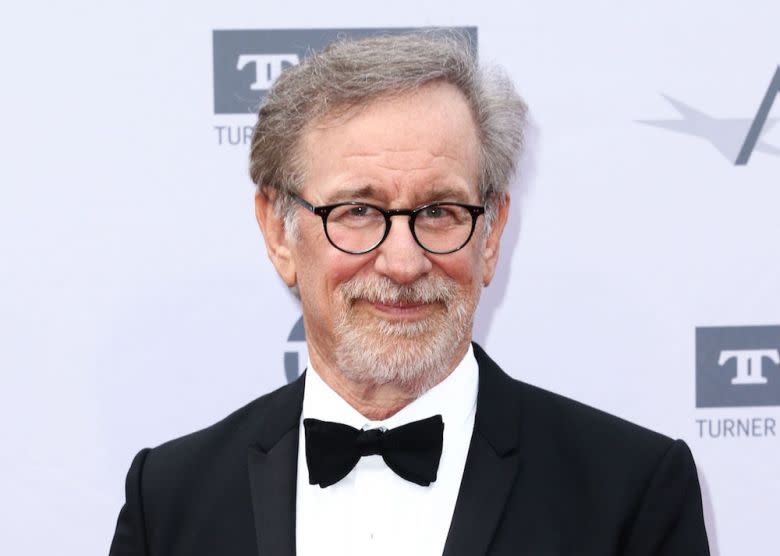

At CinemaCon, Exhibitors Side With Spielberg Over Netflix — No Matter What

Day one of the Las Vegas exhibitors convention CinemaCon and, on panel after panel, Netflix (which commands 68 percent of the SVOD business) is the Borg. It doesn’t matter if Jeffey Katzenberg tells reporters at SXSW that Steven Spielberg has no beef with Netflix; at a packed international day panel, exhibitors broke into spontaneous applause at the mere mention of the ballyhooed battle. ‘Nuff said.

While several exhibitors expressed cockeyed optimism that Netflix, Apple, Amazon and other new streamers could maintain the current theatrical windows, there’s little evidence to support that. Additional competition for eyeballs is more likely to drive companies to do what’s best for their bottom line, whatever that is — and for many distributors, that could mean building the streaming business.

Related stories

'One Day at a Time' Gets Pickup Offer from CBS All Access, But Netflix Can Kill the Deal -- Report

DOJ Warns the Academy That Rule Changes Targeting Netflix Could Violate Antitrust Laws

'The Gentlemen' First Look: Guy Ritchie Will Return to His 'Vintage' Roots After 'Aladdin'

Here is what exhibitors hope, if not believe, it will take to survive the streaming future.

Hope that disruptors are a good thing.

Pathé co-chairman and CEO Jérôme Seydoux, who received the CinemaCon 2019 Career Achievement in Exhibition Award at the International Day Luncheon, had words of encouragement. “I am hopeful that one day Netflix will understand that if they really they want to produce movies they have to go out first in theaters so that on [streaming] they will happen,” he said. “You can’t produce movies of a certain caliber with great directors without showing those movies to the public. Our exhibitors should resist — if they are not going to theaters then they are not movies, as Spielberg is saying, they are TV products.” (Rousing applause.)

Middle Eastern Vox Cinemas CEO Cameron Mitchell thinks consolidation helps. “We now have five massive international exhibitors,” he said. “We have studio consolidation and multiple streaming platforms. It feels like equilibrium has been restored to some extent. We have to work closely with the studios to give each other what we need to grow this industry.”

According to the panel’s moderator, Cineplex Odeon’s legal executive Anne Fitzgerald, data shows that the more customers stream content at home, the more they come to theaters, and that the longer a film stays in theaters, the better it does in streaming.

“The studios are in a huge disruption in a rapidly changing ecosystem,” said Alejandro Ramirez Mangana, CEO of burgeoning luxury chain Cinepolis. “We have to have very strong and continuous communication with studios to see how it unfolds with new players in the streaming ecosystem and the entrance of Disney to streaming and Apple and Hulu growing. We’ll see what Warner does. It’s all positive. There’s not going to be one dominant player in that sense, but actually several, which is good for theatrical. Many new participants in streaming have supported theatrical windows and will continue to do so.”

“No industry can be complacent,” said Tim Richards, CEO of European exhibitor VUE International. “We saw what happened to the industry in the ’60s, ’70s and ’80s.” While he complained to BAFTA that eventual Best Film winner “Roma” should not be considered eligible for awards, Richards insisted that he doesn’t see Netflix as the enemy.

“Our hope is to bring them into the tent,” he said. “They are massive content producers, committing north of $12 billion this year. A lot of that is feature film as well. What we’re hoping to see is Netflix releasing them on screens and respecting the release window, which does not affect their subscription base. It’s incremental and hopeful, these new entrants coming in. [Amazon chief Jeff] Bezos supports theatrical windows. Apple is coming in. We are hoping they will release via the theatrical release window.”

IMAX theater

Films that aren’t blockbusters are essential.

With the North American box office at $12 billion and the global total at $40 billion, said Mitchell, clearly “people love to go to cinemas. But where there is no content, box office will suffer.”

“It’s ironic that with more content than ever, theaters will receive less content, in an age when content is more abundant than ever,” said Ramirez Mangana. “As there is more, I hope we get more … and Netflix will little by little warm up to the fact that releasing movies in theaters will help product, not hurt it.”

“If there is not enough content, there’s not much you can do,” he said. “We are programming local movies to help to overcome down cycles. Everywhere in the world, domestic production is picking up; it’s critical to help us with the downside of our over-dependency on Hollywood. Also alternative content, while it is still a small percentage of overall box office, these things help.”

“Local productions can turn a good year into a great year,” said Richards. “In our ten markets, massive local film production is 10-30 percent of box office.”

Joe Pesci and Martin Scorsese on the set of “The Irishman”

Netflix should come around to the windows.

Again, exhibitors seem to defy logic in believing this. The public mantra at CinemaCon is all about holding firm, at all costs, against distributor pressure to shorten windows. Privately, many folks outside major theater circuits admit that working with Netflix is a good idea — that theater chains are leaving money on the table, and that premium Netflix content like Martin Scorsese’s “The Irishman” could score big for theaters. For the past few months, Netflix Original Movie Content chief Scott Stuber has been quietly meeting with theater owners behind the scenes. But a four-to six-week window is on the table — not 88 days.

Streamers are “just a new form of competition, it continues to raise the bar,” said Lionsgate’s Pantelion Film CEO Paul Presburger at one morning panel. “I think working together is the key … Those streamers are really important to our business model.” Presburger and FilmNation’s Glenn Basner agreed that Netflix and other streamers have done much to help bolster interest in international projects.

Cinepolis

There’s nowhere to go but up.

Exhibitors believe that spending money on making the theater experience better will yield more customers. “You can only be bullish if you believe the business goes upscale,” said Seydoux. “The local business is TV. You have to go upscale to improve screens and theaters. We believe we have better-designed theaters, better decorations and seating, better everything. I don’t think business in Europe should stay as they were 20 years ago in the era of multiplexes. We have to do better and do new things to innovate. If you are an innovator, you will be successful.”

Richard said his company is reconsidering “the basics: seats, sight and sound … Our recliner seats are all leather and will be rolled out over half the circuit in the next 24 months. Sound systems are improving, like Dolby Atmos, laser projector prices are coming down. The tech side is our main focus.”

Of all the International Day speakers, “Bar Rescue” host and bonafide hospitality expert Jon Taffer came prepared with actionable ways to pump up the theatrical experience. In his solo panel “Better Business Through Reaction Management,” he tossed out ideas for exploring the best aspects of going to the theater, from pumping up concession offerings to rolling out rewards programs. Taffer proposed mounting “popcorn dressing stations” and tailoring coupons for different types of moviegoers. As he put it, “Make [the theater] a place I like to go, even if the movie sucks.”

AMC Theater

Theater subscription services boost box office.

With the box office up considerably in the last few months of 2018 despite the demise of primary subscription services, there’s evidence that theaters’ loyalty programs are working. For Pathe Gaumont, subscriptions account for 24 percent of total tickets sold, said Seydoux. “With some businesses, even when you have less great blockbusters, it’s a cheaper price but it gives you a level of tickets sold. It’s not a bad business. But it cannot be too big; then, the average price is really too low.”

“Netflix is a very good company in terms of tech,” he said. “We need to be better than we have been, they force the industry into more concentration. We need to carry enough research and be efficient as the industry will go for more concentration in future.”

Use more data to reach new customers.

Exhibitors admit that they have been behind the curve on maximizing the reams of data they have collected from their customers; they know that they are doing a better job of reaching the ones they already have, rather than targeting the ones who are staying away.

“The customer side of our industry is the one slow area,” said Mitchell. “We have not been doing a good job of understanding not only our customers, but who should be our customers. We need to understand why. CRM (Customer Relationship Management) will pay dividends for all of us.”

Ramirez Mangana added: “We need to use the information we are getting daily from customers to entice them to go in the down cycle, when we are waiting for ‘The Avengers’ or ‘ The Lion King.’ We have not ever had such powerful analytical tools to reach and customize for our customers.”

Additional reporting by Kate Erbland.

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.