Check Point (CHKP) Q2 Earnings and Revenues Top Estimates

Check Point Software Technologies Ltd. CHKP delivered better-than-anticipated second-quarter 2021 results. The company reported non-GAAP earnings of $1.61 per share beating the Zacks Consensus Estimate of $1.56 per share. The bottom line improved 2% from the year-ago quarter’s earnings of $1.58 per share.

The company’s quarterly revenues increased 4% year over year to $526 million surpassing the Zacks Consensus Estimate of $523.4 million. Double-digit revenue growth in CloudGuard and Harmony solutions, and triple-digit sales increase in Infinity platform contributed to this upside.

Prioritizing secure connectivity in the work from anywhere environment, Check Point continued to enhance its endpoint protection capabilities. During the quarter under review, it extended the capabilities of the Cloud-Native Security Platform to offer workload protection solution with its CloudGuard Workload Protection.

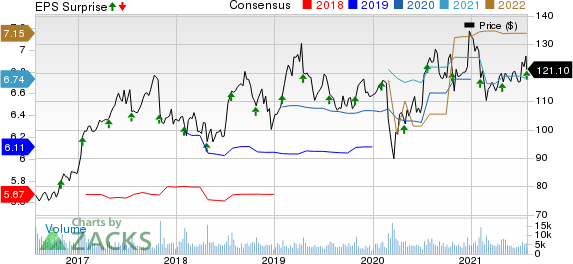

Check Point Software Technologies Ltd. Price, Consensus and EPS Surprise

Check Point Software Technologies Ltd. price-consensus-eps-surprise-chart | Check Point Software Technologies Ltd. Quote

Quarterly Details

Subscription revenues reached $184 million, climbing 12% year over year on solid demand for its advanced solutions, primarily CloudGuard and Harmony solutions. The company revealed that its CloudGuard and Harmony solutions now jointly account for 20% of subscription revenues.

Products and licenses revenues declined 2.9% year over year to $119.1 million. Products are currently in the process of transitioning to cloud solutions, which are included in the subscription line.

Total revenues from product and security subscriptions amounted to $302.8 million, up 5.7% year on year.

Software update and maintenance revenues increased to $223.3 million from $219 million reported in the year-ago quarter.

Region-wise, the America region accounted for 44% of the second-quarter revenues, the Asian-Pacific region generated 12%, and the Europe, Middle East and Africa region made up the rest 44%.

As of Jun 30, 2021, deferred revenues were $1.47 billion, up 10 percent year over year.

Non-GAAP operating income for the second quarter of 2021 totaled $257 million, up 1.6% year over year. Non-GAAP operating margin contracted 100 bps to 49%.

Balance Sheet & Other Financial Details

Check Point exited the second quarter with cash and cash equivalents, marketable securities, and short-term deposits of $4 billion compared with the previous quarter’s $4.06 billion.

The company generated cash worth $263.6 million from operational activities during the second quarter. During the first-half of 2021, it generated $638.1 million of operating cash flow.

It repurchased 2.7 million shares for about $325 million during the second quarter. In the first six months of 2021, it bought back shares worth $650 million.

Guidance

For the third quarter, Checkpoint is expecting total revenues between $515 million and $540 million. Non-GAAP earnings are estimated in the range of $1.54 to $1.64 per share.

Zacks Rank and Key Picks

Check Point currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector include Digital Turbine APPS, Intuit INTU and Zoom Video Communications ZM, all sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings growth rate for Digital Turbine, Intuit and Zoom is currently pegged at 50%, 14.7% and 15.6%, respectively.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Check Point Software Technologies Ltd. (CHKP) : Free Stock Analysis Report

Intuit Inc. (INTU) : Free Stock Analysis Report

Digital Turbine, Inc. (APPS) : Free Stock Analysis Report

Zoom Video Communications, Inc. (ZM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research