The Case to Not Shutter Paramount+

Here is the complete list of streaming services with more subscribers than Paramount+: Netflix, Disney+, and maybe Max. (Warner Bros. Discovery does not break out linear HBO from its Max/Discovery+ number.) That’s it.

Paramount+ has 71 million subscribers, and yet the prevailing theory is that whomever buys Paramount (or control of Paramount) — if anyone does — will shutter the SVOD/AVOD service.

More from IndieWire

When 'The Morning Show' Ventured Into the Heat, the Makeup Needed Its Own Cooler

Aubrey Plaza: 'I'd Rather Humiliate Myself' for Roles to Make Audiences Feel More Confident

Why’s that? Well, for starters, Paramount+ has yet to make money. It’s on the clock, though: Paramount management has the streamer pegged to turn a profit in the U.S. in 2025. It’d be a shame to close something that has lost billions of dollars right before it starts to make money — unless you’d make more money licensing the content currently on the platform, that is.

And that is almost surely what Sony would do if it ended up as the owner of Paramount’s assets, though David Faber of CNBC just threw some cold water on that scenario. Years ago, Sony saw that its Crackle service would never compete with other streamers, so it sold the platform and became an arms dealer for Netflix, primarily. Sony’s POV on licensing Paramount productions vs. placing them on Paramount+ is likely the same; many media analysts share the perspective.

Of course, licensing can be regrettable as well. Paramount+ doesn’t even have Paramount’s number 1 series: The “Yellowstone” streaming rights were auctioned off to Peacock before Paramount (or anyone this side of Taylor Sheridan) knew the hit it had on its hands. “Yellowstone” is a Paramount Network original series.

Paramount+ has some stuff: like “Star Trek: Discovery,” “Halo,” and a litany of “Yellowstone” spinoffs. They’ll occasionally make Nielsen’s weekly Top 10 original streaming-programs list, and CBS procedurals often make the acquired-programs list. It’s not enough.

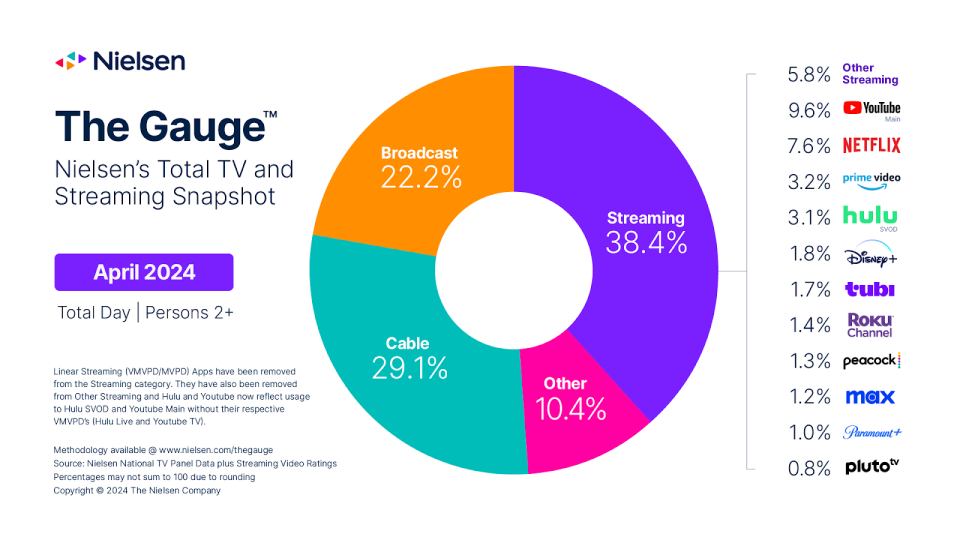

Per a recent Antenna study, in 2023, Paramount+ had 13 percent of all U.S. premium-SVOD subscriptions, second only to Hulu and Netflix. (Hulu is only available in the U.S.) But in April 2024, Paramount+ had just 1 percent of all streaming usage, according to a Tuesday Nielsen report, less than every major SVOD and/or AVOD service not named Apple TV+. It was also below FAST and FAST-adjacent services Tubi (1.7 percent) and the Roku Channel (1.4 percent). Streaming as a whole accounted for 38.4 percent of April’s total TV and streaming usage.

See Nielsen’s The Gauge report for April:

Nielsen’s The Gauge report, March 2024

So there is some good and a concerning amount of bad here. We tried to level that out over Zoom with Paramount ad chief John Halley.

Halley may be biased, but he believes Paramount+ “has been extremely successful — it’s added more subscribers since its launch than any other streaming service.”

Well, sure, but Paramount+ was way late to the game, and the game is very frontloaded. (CBS All Access was early money on streaming, but the big rebrand to Paramount+ came about 15 months after Viacom and CBS re-combined.)

There is a significant amount of money where Halley’s mouth is. Setting aside live sports and news, which skew hard linear, Paramount’s streaming platforms (Paramount+ and Pluto TV) bring in “close to half” the company’s overall ad revenue, he told IndieWire. Pluto is unquestionably a success story.

Ahead of this week’s upfronts, when TV and streaming platforms pitch advertisers on their upcoming slates, we asked Halley to pitch us on why a Paramount buyer, if it goes down that way, should keep Paramount+ up and running.

Halley called Paramount+ an “incredible advertising platform.” In the first quarter of 2024, Paramount’s streaming revenue rose 31 percent from the prior year; most of that was Paramount+. Throw in the subscription-revenue growth, and overall Paramount+ revenue rose 51 percent. There is room to raise the Paramount+ monthly price, though we’ve previously questioned its value as-is.

A Wharton man, Halley understands business, not just the business. Halley acknowledged that the “economics” of streaming are not a replacement for linear TV’s. Like it or not, it is “the direction of the business [and] the direction of the consumer,” he told IndieWire, adding that Paramount+ has “some of the most-engaging work out there.”

Most of that programming is from Paramount’s studio, the crown-jewel asset of Paramount Global that pretty much everyone is after. David Ellison wants to merge it with his Skydance, it is about the only piece of the company that private-equity firm Apollo Global Management wouldn’t slice, dice, and flip, and Sony is definitely down to create a mega-studio ahead of more Hollywood consolidation.

Like Viacom’s struggling cable channels, Paramount+ needs the strength of protection that can come from numbers. There was some talk of creating a bundle with Paramount+ and Peacock, which could reduce churn (customers canceling), but that seems to have flown the coop; on Tuesday, a coming bundle between Peacock, Apple TV+, and Netflix was announced. There are other bundles in the works, but thus far Paramount+ has not been invited — even the ones with sports, which is what it probably does best.

The future for Paramount+ may not look very bright at this moment, but it is also not yet written.

“There are going to be a variety of different points of view around what the future of the company is,” Halley said. “We can’t speculate on what that is. Whatever does happen is not gonna happen [imminently]. It’s gonna take a long time.”

Best of IndieWire

The Best LGBTQ Movies and TV Shows Streaming on Netflix Right Now

Guillermo del Toro's Favorite Movies: 54 Films the Director Wants You to See

Nicolas Winding Refn's Favorite Films: 37 Movies the Director Wants You to See

Sign up for Indiewire's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.