Call Traders Chime In as Chewy Stock Hits Record High

The shares of online pet store Chewy Inc (NYSE:CHWY) are seeing a surge in call volume today, with 48,000 contracts traded compared to just 6,000 puts. Most popular is the weekly 6/5 50-strike call, where new positions are being opened. Second is the 45-strike call in the same session, which also happens to be the sixth most popular open interest position.

Worth noting, however, is that short interest has skyrocketed 100.8% in the most recent reporting period. These 16.71 million shares sold short now account for 34.5% of the stock's available float, or a little over four days' worth of pent-up buying power at CHWY's average pace of trading. This means that some of this call volume could be shorts hedging against the potential of a further upswing.

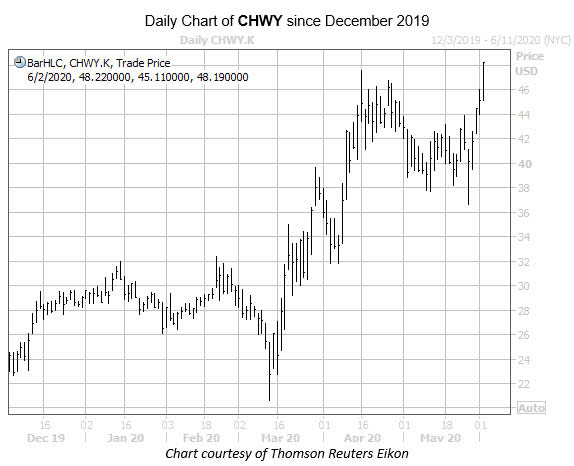

Following an especially strong rally for the stock after sales quintupled from 2016 through 2019, the equity now marks a 72% gain over the past three months. CHWY is continuing its rally on the charts today, up 6.8% at $48.19 at last check, earlier hitting a fresh record high of $48.90.

Plenty of analysts remain hesitant on CHWY, with five out of the 13 in coverage carrying a tepid "hold" rating, while the remaining eight sport a "buy" or better. Regardless, the 12-month consensus price target of $41.18 is a 14.1% discount to current levels.