California’s Film & TV Incentives Program Generated $21.9B in Economic Output, Report Says; 110,000 Jobs & $7.7B In Wages Over 5 Years

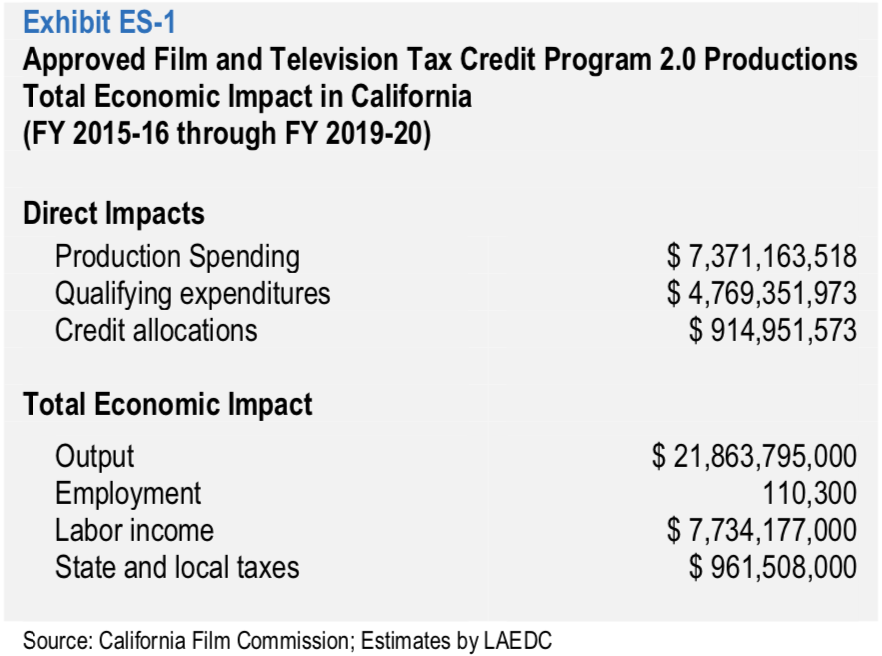

UPDATED with quotes: California’s Film & Television Tax Credit 2.0 Program generated nearly $21.9 billion in economic output in the state over five years at a projected cost to taxpayers of little more than $1.5 billion, according to a new study commissioned by the Motion Picture Association, using data from the California Film Commission.

The study (read it here), which makes a compelling case that tax incentives helped preserve California’s signature industry from runaway production, was conducted by the Los Angeles County Economic Development Corporation, a private, nonprofit organization established in 1981 by the Los Angeles County Board of Supervisors.

More from Deadline

Read statements from California’s lieutenant governor, the Entertainment Union Coalition and reps from MPA, CFC and LAEDC below.

Ebay

The $330 million-a-year 2.0 program began in July 2015 and was sunsetted for the 3.0 program in June 2020, which was enhanced with an additional $90 million per year for the current and next fiscal years. According to the study, a total of 169 productions were allocated tax credits under the program as of February 26, 2020, which “supported the equivalent of more than 110,000 jobs in the state paying $7.7 billion in labor income, with California state and local governments estimated to have earned $961.5 million in tax revenues as a result of this activity.”

“One way to interpret the value of the tax credit is to measure the economic impacts resulting from one dollar of tax credit allocated,” the study’s cost-benefit analysis says, “For every tax credit dollar approved under California’s Film and Tax Credit program, at least $24.40 in output, $16.14 in gross domestic product, $8.60 in wages, and $1.07 in initial state and local tax revenue will result from production in the state of California.”

In other words, the program pays for itself while creating thousands of jobs and billions in wages.

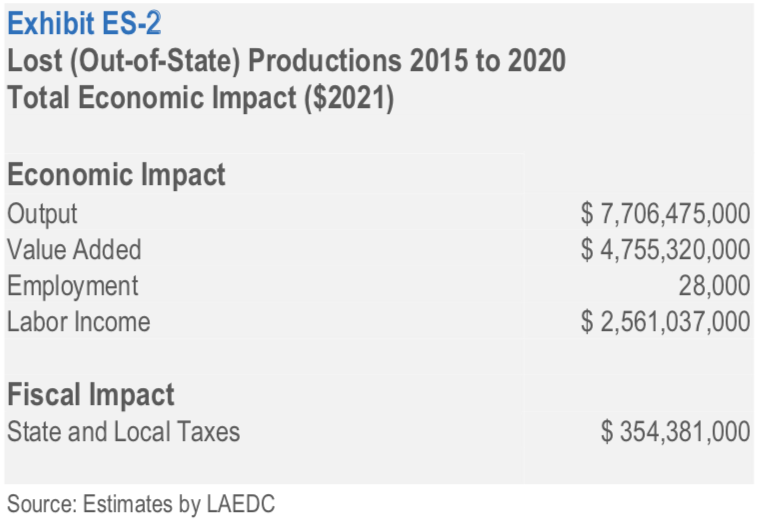

The study, which recommends a major expansion of the incentives program, also looked at the economic impact of productions that left the state because they weren’t approved for the tax breaks here and filmed somewhere else. More than 30 other states offer incentives, as do many foreign countries.

California Film Commission

“From 2015 to 2020, 157 out of 312 projects (50%) that applied for but did not receive a California tax credit left California for another state,” the study says. “If these productions had stayed in the state, California would have reaped the economic benefits. Instead, the loss of this spending in California cost the state $7.7 billion in generated economic activity; 28,000 total jobs; labor income of approximately $2.6 billion, and state and local tax revenues which would have totaled $354.4 million.”

The study noted that these numbers represent the projects that could be tracked by the California Film Commission, which administers the tax credit program, and that “It is possible, and even likely, that more of these productions that did not receive a tax credit were filmed outside of California, or they were never made.”

“Since 2000, the incentives offered by other states have led to the development of film production industry clusters elsewhere, threatening the loss of jobs from California which has traditionally been the nation’s unrivaled center for this activity,” the study notes.

“Over 30 states have production incentives in place to attract film, TV and streaming productions. These incentives take the form of rebates, grants and tax credits. Incentives offered as tax credits are generally either refundable tax credits, where the state redeems the tax credit at a discount, or as transferrable tax credits, which can be sold to a company with in-state tax liability.

“California is one of just two states whose tax credits are largely nonrefundable and non-transferrable. California’s program is also distinguishable from those of many other states and countries in that the wages of the above-the-line high wage earners, such as directors, actors, composers, are not qualified wages for purposes of calculating the amount of tax credits earned, and California’s economy derives significant benefit from those salaries earned in-state.

“Currently, California is the only major production center without a stand-alone visual effects (VFX) tax credit. VFX companies use specialized software and live footage visuals, altered videos, and computer-generated imageries to augment productions in post-production, incorporating scenes and imagery that would be too costly, too difficult or dangerous, or downright impossible to film.”

California Film Commission

The study makes numerous recommendations to make California more completive. “From the research conducted for this report and its key findings, a set of recommendations has been identified to continue to support California’s iconic film and television production industry, helping to prevent further runaway production to other jurisdictions with more attractive credit programs and helping to ensure continued growth of the industry, its workforce, its infrastructure, and the clustering effect of the industry that helps generate additional activity across the varying supporting industries.

Those recommendations include:

• Consider increasing the annual allocation of tax credits to avoid future shortfalls.

• Consider extending the period of the program, making it a longer-lasting tax credit incentive program to encourage additional investment in infrastructure.

• Consider addressing California’s lack of a standalone visual effects (VFX) tax credit to prevent the further loss of this growing part of the industry.

• Consider making California’s tax credit certificates refundable or transferable similar to other states’ programs to attract productions with larger job numbers. Consider setting a cap on the amount of tax credits to be refunded or transferred in any one year.

• Consider expanding the tax credits available in the new California Sound Stage Filming Tax Credit Program (SB144) to ensure California continues to grow its much-needed sound stage production infrastructure.

Filming has always been an international business, but tax incentives greatly expanded the globalization of the industry. The 1994 North American Free Trade Agreement that gave Canada a “cultural exemption” to subsidize its film and TV industry set off a flood of American productions heading north of the boarder to take advantage of 35% tax credits there. Other countries followed suit, luring productions to all corners of the globe with generous subsidies in the hope of bringing jobs and American dollars to their shores. In an attempt to stem the flow of runaway production, or to create film communities where none existed before, dozens of states then began to offer their own subsidies.

California started its subsidy program in 2009 with a relatively modest $100 million annually in tax credits. That was boosted to $330 million a year in 2015. The study notes that as of July 2020, the Credit program 2.0 has allocated $1.55 billion, with $915 million tax credits certificates issued by the California Film Commission over five years “to ensure California is and remains domestically and internationally competitive as other states, provinces, and countries vie for preeminence in the international film and television production industry.”

Said California Lt. Gov. Eleni Kounalakis:

“California is the home of entertainment and with each iteration of the Film & Television Tax Credit Program, we continue to see the benefits to the California economy and employment. This year the program has already attracted 30 new movies — 11 studio films and 19 indies — to shoot in the state. These films have the potential to generate $439.2 million to support the numerous crew members and in-state vendors that make film and TV happen. These programs are investing in local workers and small businesses here in California. This program also has an immeasurable impact on tourism in this state, by inspiring people to visit and explore California. These tourists fill our hotels and our restaurants, bringing even more dollars to our state.”

Added Bill Allen, President and CEO of LAEDC: “The effect of the California Film and Television Tax Credit Program continues to be vital to keeping well-paying entertainment jobs in California. These programs are investments that have a real impact on the wallets of Californians who work in film and television and on those who sell goods and services to them. If we extend the periods of these tax credits to beyond five-year increments, we see the potential for even more Californians to benefit, including those in real estate and construction as more companies are willing to build soundstages and offices here.”

Colleen Bell, Executive Director of California Film Commission, said: “Our uniquely targeted tax credit program enables us to level the playing field, fight runaway production and deliver a significant value to taxpayers. Our program welcomes big-budget films, small-budget indies and everything in between. It has also been very successful with TV production, incentivizing new and recurring projects while prompting dozens of series to relocate here from other states and nations.”

Said Charles Rivkin, Chairman and CEO of the Motion Picture Association: “More than 100 years ago, the American motion picture industry was a fledgling business that found its home in California. Today, as this study shows, our industry is an economic powerhouse in the state thanks to the California Film and Television Tax Credit. The film, television, and streaming industry has pumped $21.9 billion into the economy and created 110,000 good quality, high paying jobs over the last five years through the 2.0 Film and Television Tax Credit program. The Motion Picture Association commends the Los Angeles Economic Development Corporation for compiling this important study, and thanks to Governor Newsom, Lt. Governor Kounalakis, the California Film Commission’s Executive Director Colleen Bell, and the members of the Legislature who continue to help our industry grow.”

And the Entertainment Union Coalition said in a statement: “In 2013 almost all film and television production had left California for other states and countries with strong tax incentive programs. Our state, the 100-year home of motion picture production, had no work to offer and highly skilled and talented cast and crew were faced with three options: unemployment, move from family to work in states where there was production or change careers entirely. That all started to turn around in 2014 when the Legislature passed, and Governor Brown signed into law, the California Film & Television Tax Credit Program 2.0. The LAEDC report tells the story of the huge economic impact of the program during its five years—almost 24 times more money put back in the states than the state provides in credits. We can attest to the other side of that story. Our members, the cast and crew who faced job extinction nine years ago, are fully employed and at home with their families.” Members of the EUC are the California IATSE Council, Directors Guild of America, LiUNA!Local 724, SAG AFTRA, Teamsters Local 399.”

Best of Deadline

What's New On HBO Max For March 2022: Day-By-Day Listings For TV Shows & Movies

New On Netflix For March 2022: Day-By-Day Listings For TV Series, Movies & More

Sign up for Deadline's Newsletter. For the latest news, follow us on Facebook, Twitter, and Instagram.