Cable, Satellite Providers Risk ‘Fading Into the Background Faster’ Than Expected | Charts

It’s no secret that cable companies and other traditional TV services are bleeding subscribers as customers cut the cord and make the jump to streaming.

A J.D. Power survey of over 23,500 respondents conducted between October 2022 and August 2023 underscored the pace of that decline. The data and analytics company found that the likelihood of cable and satellite customers switching their service in the next year is 21%, compared to 12% for live TV streaming services. Among the reasons for the growing divide in satisfaction: the cost of the service, performance and reliability and customer care.

In the past, cable providers may have benefitted from a legacy status that made it difficult for customers to switch or outright cancel, J.D. Power wrote in its report released Nov. 17. Even though streamers have always been more affordable, “there was always a trade-off in reliability and customer care,” the company said. “Now, with streamers succeeding in all areas, cable and satellite providers have no choice [but] to step up their game and rise to the occasion. If they don’t, they run the very real risk of fading into the background faster than anyone anticipated.”

Just how bad have cable and satellite providers’ subscriber losses been in comparison to live TV streamers’ gains?

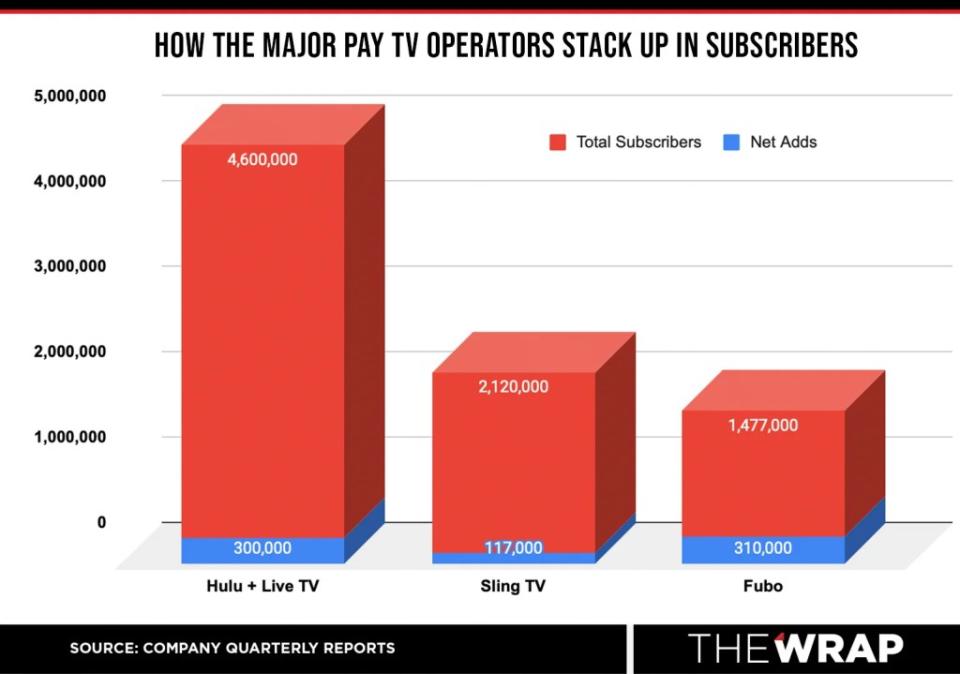

In the third quarter of 2023 alone, Comcast, Charter Communications, Altice USA collectively lost 896,400 pay TV subscribers, while Dish TV and Verizon Fios shed a total of 260,000 subscribers. In comparison, virtual multi-channel video programming distributors (vMVPDs) Hulu with Live TV, Sling TV and Fubo gained a total of 727,000 subscribers during the same three-month period.

This analysis includes Hulu with Live TV, Sling TV and Fubo because those streaming options bundle both linear and on-demand content – most closely resembling cable and satellite TV. It does not include DirecTV or Alphabet’s YouTube TV, which do not break out their quarterly figures. (As of June 2022, YouTube TV passed 5 million subscribers and trial users.)

Leichtman Research Group estimates that DirecTV, U-Verse and DirecTV Stream lost 500,000 subscribers in the third quarter of 2023 for a total of 11.85 million, while YouTube TV added 600,000 subscribers for a total of 6.5 million.

Check out TheWrap’s deep dive into the companies’ quarterly financials below.

Comcast

Comcast’s Connectivity & Platforms segment — its cable business — saw customer relationships grow by 40,000, or 0.2% year over year, to 52.3 million. However, total domestic video customers fell by 490,000, or 12.5% year over year, to 14.5 million and total video revenue fell 3.7% year over year to $7.15 billion.

The segment’s adjusted EBITDA grew 3% to $8.2 billion and total revenue grew 1.1% year over year to $20.2 billion during its third quarter of 2023. Residential connectivity and platforms revenue grew 0.7% year over year to $17.95 billion, while business services connectivity revenue grew 4.7% year over year to $2.32 billion.

Comcast has launched Now TV in an effort to retain subscribers ditching the cable giant for streaming, a $20 per month offering that combines a live TV streaming service, free ad-supported streaming TV channels and a subscription video on-demand service. Xumo, its joint venture with Charter Communications, has also started rolling out its Xumo Stream Box devices nationwide. The service allows users to choose between Spectrum TV or Xfinity Stream and streaming apps such as Apple TV+, Disney+, Hulu, Max, Netflix, Peacock, Pluto, Prime Video, Tubi or Xumo Play.

Charter Communications

Charter Communications reported 14.4 million video customers during its third quarter of 2023, down 6% year over year. Residential customers fell 6% year over year to 13.75 million, while small and medium business customers fell 3% year over year to 628,000.

The company shed 327,000 pay TV subscribers during the quarter — 320,000 residential video customers and 7,000 small and medium business customers. About 100,000 of the residential video-customer disconnects were related to the temporary loss of Disney programming in early September.

While acknowledging the overall impact of the dispute on Charter’s customer relationships was less than expected, CFO Jessica Fischer noted the company’s billing and retention call centers were not fully back to normal until early October, resulting in a “lingering customer net add impact early in the fourth quarter.”

In September, Charter and Disney reached a first-of-its-kind carriage agreement that included streaming apps in its video packages, resolving an 11-day dispute that left millions of Spectrum customers in the dark. Under the new agreement, Spectrum TV Select package customers will receive ad-supported Disney+ basic in the coming months.

Disney will also provide ESPN+ to Spectrum TV Select Plus subscribers as will the sports network’s flagship direct-to-consumer service (DTC) when it launches. The entertainment giant expects to launch its ESPN DTC service in 2025.

Charter plans to remain flexible by offering a range of video packages at varying price points based upon customer viewing preferences and will use its distribution capabilities to offer Disney’s streaming apps to its customers, including its broadband-only subscribers.

Chris Winfrey, Charter’s president and CEO, said the new agreement showcased that “a new hybrid distribution model is good for consumers” and “better aligns” video content and DTC apps.

“We created a glide path to bridge from linear video to new growth,” he added.

While Spectrum will continue to carry ABC Owned Television Stations, Disney Channel, FX, the Nat Geo Channel and the full suite of ESPN networks, Baby TV, Disney Junior, Disney XD, Freeform, FXM, FXX, Nat Geo Wild and Nat Geo Mundo will no longer be included in Spectrum TV video packages.

Altice USA

Cable provider Altice USA reported a total of 4.77 million customer relationships, including 4.39 million residential customers and 381,100 small and medium business customers. The company shed 77,600 residential video customers for a total of 2.23 million, a 10.3% year over year decrease, and lost 1,800 small and medium business video customers, or 7.2%, for a total of 91,900.

Total revenue fell 3.2% year over year to $2.32 billion. Residential revenue fell 3.4% year over year to $1.83 billion, driven mostly due to the loss of higher average revenue per user video customers over the last year. Residential ARPU for the quarter came in at $138.42, down slightly from $139.24 in the year ago quarter.

Verizon Fios

Verizon shed a total of shed 79,000 Fios customers during its third quarter of 2023, with residential Fios losses narrowing 17.9% year over year to 78,000 and business Fios customer losses remaining flat year over year at 1 million. The telecommunications giant reported a total of 3.01 million residential Fios customers and 63,000 business Fios customers. Residential Fios revenue fell 0.2% year over year to $2.897 billion, while business Fios revenue grew 1.3% year over year to $308 million.

In March 2022, the telecommunications giant launched Verizon+ Play, which allows users to purchase and manage subscriptions across entertainment, audio, gaming, fitness music, lifestyle and more in one place. Streaming partners include Netflix, Disney+, Discovery+ and AMC+.

Dish TV and Sling TV

Dish Network shed a total of 64,000 pay TV subscribers during its third quarter for a total of 8.84 million. Dish TV subscribers fell by 181,000 to 6.72 million, while Sling TV subscribers increased by around 117,000 to 2.12 million.

“We continue to experience increased competition, including competition from other subscription video on-demand and live-linear OTT service providers, many of which are providers of our content and offer football and other seasonal sports programming direct to subscribers on an a la carte basis,” the company wrote in its 10-Q filing.

Dish Network’s pay-TV business generated $2.81 billion in revenue during the quarter and operating income of $589.47 million. Pay-TV average revenue per user grew 3.1% year over year to $105.25, primarily attributable to Dish TV and Sling TV programming price increases that took effect in the fourth quarter of 2022.

On Oct. 12, Dish raised the price of its satellite television packages by an additional $5 per month, citing rising programming costs. Earlier this month, the company resolved a carriage dispute with Hearst that resulted in the temporary loss of 37 channels, including local network affiliates, in September.

Hulu and Live TV

Hulu with Live TV added 300,000 subscribers during the quarter for a total of 4.6 million. Hulu with Live TV average monthly revenue-per-paid subscriber decreased from $91.80 to $90.08 primarily due to lower advertising revenue.

When combined with Hulu’s 43.9 million SVOD-only subscribers, the service boasts a total of 48.5 million subscribers.

Disney, which said it will pay at least $8.61 billion for Comcast’s minority stake in Hulu, is set to complete an appraisal process in 2024 to determine the asset’s full value. The company plans to launch a beta version of a combined Disney+ and Hulu app offering in December, before an official rollout in early spring 2024.

Fubo

Paid Fubo subscribers in North America grew 20% year over year to a record 1.48 million during its third quarter of 2023. The company’s total revenue in North America grew 43% year over year to $313 million, with ad revenue in the region climbing 34% year over year to $30.3 million. Average revenue per user in the region grew 17% year over year to $83.51.

Meanwhile, Fubo’s Rest of World segment saw paid subscribers grow 15% year over year to 411,000 and revenue grow 45% to $8.4 million total revenue. (ROW includes the results of Molotov, a French live TV streaming service acquired in December 2021.)

Looking to full year 2023, Fubo raised its revenue and paid subscriber guidance in North America, with the streamer now expecting between $1.319 billion and $1.324 billion revenue for the year, a 34% year-over-year growth at the midpoint, and paid subscribers in the range of 1.58 million and 1.60 million, representing 10% year-over-year growth at the midpoint. The company previously stated full-year revenue guidance of $1.26 billion to $1.28 billion and paid subscribers between 1.57 million and 1.59 million.

The post Cable, Satellite Providers Risk ‘Fading Into the Background Faster’ Than Expected | Charts appeared first on TheWrap.