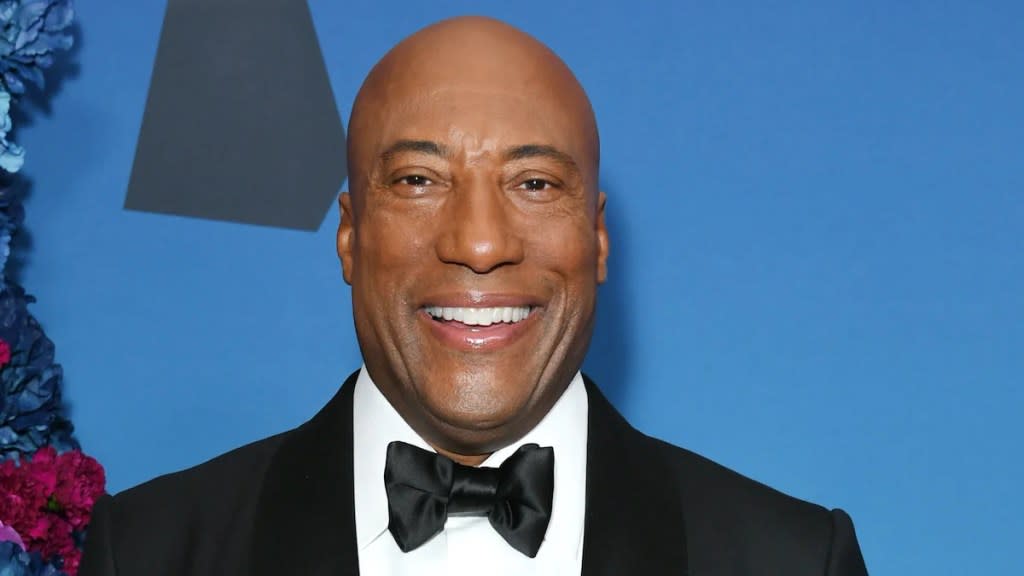

Byron Allen Offers to Buy Paramount Global for $14 Billion

- Oops!Something went wrong.Please try again later.

Byron Allen on Tuesday formally offered to buy Paramount Global for $14 billion.

According to Bloomberg, the offer, Allen is said to have sent to Paramount’s board and senior management by text and email, proposes $28.58 for voting share and $21.53 to buy non-voting shares. The deal would include the assumption of Paramount Global’s debt, bringing the total cost to $30 billion.

“Mr. Byron Allen did submit a bid on behalf of Allen Media Group and its strategic partners to purchase all of Paramount Global’s outstanding shares. We believe this $30 billion offer, which includes debt and equity, is the best solution for all of the Paramount Global shareholders, and the bid should be taken seriously and pursued,” a representative for Allen said in a statement provided to TheWrap.

According to Bloomberg, Allen plans to break the company up by selling Paramount’s film business and some intellectual property along with unspecified real estate holdings. He would keep the company’s television properties as well as the Paramount+ Streaming service — which prior to the merger of Viacom and Paramount that created Paramount Global, was known as CBS All Access.

In December, Byron Allen offered $3.5 billion to Paramount Global in a renewed attempt to acquire BET, the Black culture-oriented cable company.

Paramount Global began exploring the sale of BET last March, part of an effort to generate cash in support of, among other things, Paramount+. But the company backed away from that plan in August, when it informed bidders the sale wouldn’t generate a significant enough amount of money.

But Allen isn’t the only interested buyer. Shari Redstone, Paramount Global’s non-executive chair, is reportedly in talks to sell either the entire company or her controlling stake through her holding company, National Amusements Inc., to Skydance Media CEO David Ellison and RedBird Capital’s Gerry Cardinale.

Skydance and Redbird have signed NDAs with Paramount to explore a possible acquisition, though any potential deal is still far off, according to numerous insiders and media reports.

Warner Bros. Discovery CEO David Zaslav has also broached the possibility of merging the two companies, though news of that conversation resulted in a temporary dip in stock price for each of them.

Paramount’s stock price is down 17.4% in the past year and 4.8% year to date. The company faces a complex set of challenges: Advertising revenue tied to its linear businesses is in steep decline, including for CBS and cable channels like MTV and Nickelodeon; its streaming operation continues to operate at a loss, and has more ground to make up than its legacy media rivals’ platforms.

Speculation that Redstone is looking to part ways with Paramount, which has been in the Redstone family since 1987 when National Amusements became majority owner of Viacom, began last month when the company filed a change-of-control and severance plan, also known as a golden parachute, for certain “global senior executives.”

The post Byron Allen Offers to Buy Paramount Global for $14 Billion appeared first on TheWrap.