Did Buffett kill value investing?

This post first appeared on The Irrelevant Investor.

From 1957-1969, Warren Buffett’s partnership returned 2800%, or 29.5% a year*. Over the same time, the S&P 500 rose 153%, or 7.4% a year. Buffett has been crushing the market for seven decades, but his early success went largely unnoticed. His name didn’t appear anywhere noteworthy until Adam Smith’s “Supermoney,” which wasn’t written until 1972.

While his name gained traction in the investment community, it took many years before it became what it is today. Buffett is synonymous with investing, and if you type his name in the Amazon search bar, the machine spits back 1822 book results. His rise to ubiquity can be traced back to 1984, when he destroyed an efficient market hypothesizer.

On the 50th anniversary of “Security Analysis,” Buffett wrote an article in the Columbia Business School Magazine called “The Superinvestors of Graham-and-Doddsville.” A few weeks prior, Buffett faced off against Michael Jensen, a professor from the University of Rochester and the school of efficient markets. In the speech, which was translated into the article, Buffett told a story that would remove any doubt that value investors’ outperformance should be attributed to skill rather than luck. Imagine that 225 million Americans all flipped a coin. If you landed on heads, you lived to flip another coin. If this was repeated twenty times, 215 people would be expected to remain.

But then some business school professor would probably be rude enough to bring up the fact that if 225 million orangutans had engaged in a similar exercise, the results would be much the same…I would argue, however, that there are some important differences in the examples I am going to present. For one thing, if (a) you had taken 225 million orangutans distributed roughly as the U.S. population is; if (b) 215 winners were left after 20 days; and if (c) you found that 40 came from a particular zoo in Omaha, you would be pretty sure you were onto something. So You would probably go out and ask the zoo keeper about what he’s feeding them….A disproportionate number of successful coin-flippers in the investment world came from a very small intellectual village that could be called Graham-and-Doddsville.

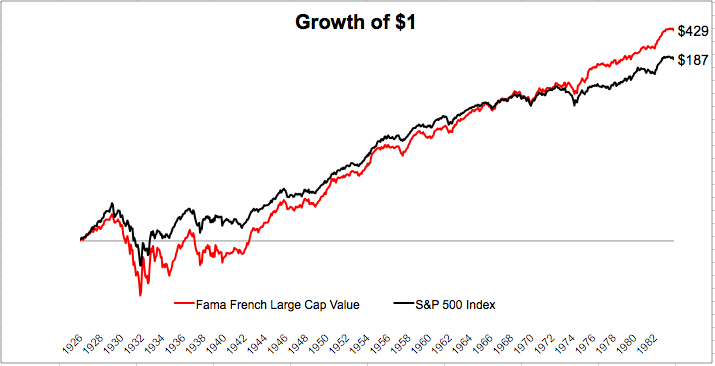

From 1926 until the time that Buffett wrote this article, the Fama French U.S. Large Value Index, which did not exist until the early 90s, crushed the S&P 500. But you can see that until 1970, the red and black line were neck and neck. So all of the outperformance over this 58-year period came in the 14 years leading up to Buffett’s coin-flipping speech.

From 1970-1984, the Fama French Large Value Index outperformed the S&P 500 by more than 400%, or 6.5% a year. With the wind at their backs, the superinvestors that Buffett highlighted in the article — Walter Schloss, Tweedy, Browne, and Sequoia — to name a few, enjoyed a spectacular run of outperformance.

Buffett wrote, “I’m convinced that there is much inefficiency in the market. These Graham-and-Doddsville investors have successfully exploited gaps between price and value.” With these words, he convinced a generation of investors to move to Graham-and-Doddsville.

Nothing attracts competition like prosperity, and nothing hurts excess returns like competition. Since this article was published, the Fama French Large Value Index has failed to keep up with the S&P 500.

Prior to the publication of “Superinvestors,” the Fama French Value index had outperformed the S&P 500 in 89% of all rolling 20-year periods, and since then, that number has fallen to 62%.

I understand there is a big difference, a huge difference in fact between the Fama French Index and real value investing via old school stock selection. Nevertheless, it is interesting that in the 33 years since 1984, value, which I think people just assume beats the index, has failed to do just that.

I would be remiss if I didn’t mention that since 1985, these superinvestors have done far better than the Fama French Value Index. Since Buffett’s speech, the Sequoia Fund outperformed the S&P 500 by 570%. Berkshire Hathaway outperformed the S&P 500 by 7000%! I would also be remiss if I didn’t point out that the tech bubble certainly affected the data. Alright, so maybe it’s ridiculous to ask if Buffett killed value investing, but it’s hard to deny that trying to distinguish between price and value has gotten harder as it’s experienced widespread adoption. Buffett’s teacher, Ben Graham, would agree.

I am no longer an advocate of elaborate techniques of security analysis in order to find superior value opportunities. This was a rewarding activity, say, 40 years ago, when our textbook “Graham and Dodd” was first published; but the situation has changed a great deal since then. In the old days any well-trained security analyst could do a good professional job of selecting undervalued issues through detailed studies; but in the light of the enormous amount of research now being carried on, I doubt whether in most cases such extensive efforts will generate sufficiently superior selections to justify their cost. To that very limited extent I’m on the side of the “efficient market” school of thought now generally accepted by the professors.

The early bird gets the worm is true in nature and in markets. Buffett was the early bird, but now there are thousands of investors chasing after the same size worm.

Source:

The Superinvestors of Graham-and-Doddsville

*Net of fees, his investors received 1500%, or a lousy 23.8% a year.

More from Michael Batnick: