Breaking Down the Pros and Cons of a Potential Warner-Paramount Merger | Analysis

A potential deal for Warner Bros. Discovery to merge with Paramount Global could be the next blockbuster Hollywood merger in a wave of consolidation that keeps reducing the number of legacy studios.

But this deal makes eminent sense for an entertainment conglomerate like Warner that needs to get still bigger to compete, and a legendary Hollywood brand that is trapped in a depressed stock price cycle and declining linear assets.

As news of discussions between the companies reverberated through the industry on Wednesday, TheWrap broke down the pros and cons of what a Warner-Paramount deal could mean for both companies.

PROS

Max would become the No. 2 streamer

Combining Max and Discovery+ with Paramount+ with Showtime would add 63 million subscribers to Warner Bros. Discovery’s current 95 million, pulling its streaming business just ahead of the 150 million at Disney+. This would achieve a goal Zaslav has touted around Hollywood: wanting to be a genuine challenger to Netflix, which has 247 million subscribers.

Warner Bros. Discovery turned a $111 million profit in its direct-to-consumer division during its third quarter of 2023 — a $745 million year-over-year improvement and its second profitable quarter in a row. Paramount, which narrowed its direct to consumer division’s losses by 31% year over year to $238 million in the third quarter of 2023, expects full-year streaming losses for 2023 to be lower than in 2022, with fourth quarter 2023 losses similar to the fourth quarter of 2022. The segment remains on track to drive “significant earnings improvement” in 2024.

Shari Redstone could keep a toehold in Hollywood, though not as owner

The fate of Paramount has largely hinged on Shari Redstone, the controlling shareholder of Paramount Global through the holding company National Amusements. As TheWrap reported just last week, her intentions were not entirely clear. Is she ready to give up an empire built by her father Sumner, and that she defended in a contentious board battle with former CBS CEO Les Moonves?

A deal with WBD would ensure that she retains significant shares in an important entertainment player, keeping her involved in the industry even as she spends more time focused on educational initiatives around tolerance and antisemitism. And Redstone, 69, would be selling to a known quantity in Zaslav, with whom she meets for dinner a few times a year.

Paramount would get family-focused IP – and CBS News

A deal would give Warner Bros. Discovery the ability to leverage Paramount’s portfolio of intellectual property, which includes the family focused-brand Nickelodeon and popular hits like the wildly popular “Yellowstone.” Warner badly needs a base of family-focused content if it intends to compete with Disney.

Meanwhile, WBD could also take control of CBS News without violating the Federal Communications Commission’s two network rule — a key challenge that would make a possible merger difficult for other legacy media players like NBCUniversal parent Comcast.

WBD talks would create deal momentum

Even if the talks don’t lead to a final deal, news that Paramount is in discussions with Warner Bros. Discovery puts more chum in the water for a significant deal to take place – soon.

News of the talks could put more pressure on other potential suitors, including Comcast – which has long been floated as a potential buyer of either Warner or Paramount – or Amazon and Apple, both of which have reportedly previously held conversations with Redstone, to make more attractive offers. On Wednesday, Byron Allen renewed an offer to buy BET Media Group from Paramount Global, for $3.5 billion. Paramount began exploring a possible BET sale in March.

A deal “makes sense for Paramount and probably a little less so for Warner Brothers Discovery,” Moody’s debt analyst Neil Begley told TheWrap.. “But if [Warner Bros. Discovery’s] angle is to try to avoid being prey to Comcast or anybody else, it’s probably the best deal for them.”

CONS

Uncle Sam’s regulatory hurdles

In April, Warner Bros. Discovery will reach the two-year anniversary of its 2022 merger, which was executed under a Reverse Morris Trust for tax advantages. Once the RMT’s two-year lockup period expires, WBD will be free to make acquisitions without incurring a hefty tax bill.

And while Warner would not run afoul of the Federal Communications Commission’s two-network rule by acquiring CBS, a potential deal would still combine two of the five major movie studios and two major television studios, creating a high concentration of linear network ownership. Such a merger could potentially face an antitrust challenge from the Biden Administration’s Federal Trade Commission under chair Lina Khan and from the Department of Justice.

Even if President Joe Biden loses in 2024 and a Republican winner — likely to be former President Donald Trump given current polling — were to bring in new regulators, “we still think the regulatory hurdles would be high,” TD Cowen analyst Doug Cowen wrote in a note to clients on Wednesday. Cowen noted that Trump’s DOJ head, Makan Delrahim, made an unsuccessful bid to block the AT&T-Time Warner merger. “A WBD-Paramount tie-up “would be more problematic from a consolidation standpoint,” he said. “We also note that WBD’s news network CNN has been a verbal target of Trump in the past, and we would guess that he probably still holds a grudge.”

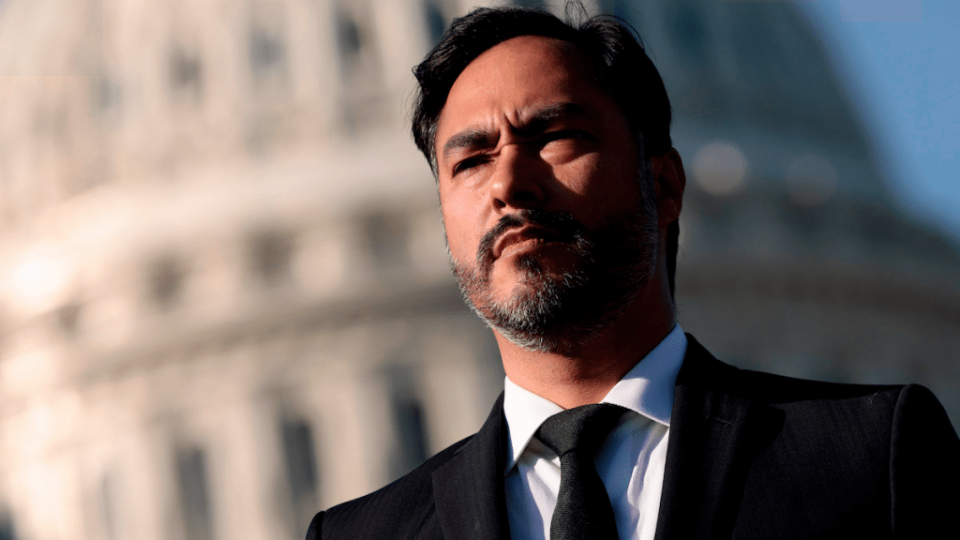

Other stuff: In November, Texas Congressman Joaquin Castro called on the FTC to investigate Warner for “predatory and anticompetitive” practices following news that the film “Coyote vs. Acme” almost became the latest of the company’s finished movies to be killed for tax purposes. Warner has since reversed course on that decision, instead allowing the film to be shopped to other distributors.

Change of control and that pesky debt

A merger would saddle WBD with Paramount’s debt, while it already has plenty of debt of its own. As of the end of the third quarter, Warner Bros. Discovery reported $45.3 billion in gross debt, while Paramount Global reported long-term debt of approximately $15.6 billion.

A deal could also trigger “change of control” provisions in Paramount’s senior notes, which are designed to protect bond investors from a leveraged buyout of a company. If Redstone were to sell more than 50% of her Paramount voting shares through National Amusements, that would activate the change-of-control provision for $11.2 billion of the company’s $15.6 billion in debt.

There’s a second trigger in the event that could lead to the three major credit agencies — S&P Global, Fitch and Moody’s — to downgrade Paramount’s debt to below investment grade. That would mean bondholders could give notice to the trustee that they want to tender their bonds and get paid back 101% of the face value. Fitch rates Paramount at BBB, two notches above investment grade, while Moody’s downgraded Paramount to a rating of Baa3 in August, the bottom rung of investment grade.

“A lot of costs will be taken out, they have very like-kind types of assets, so there’s lots of shared overhead even below the C Suite,” Begley said. “So there’s a lot of cost savings that can be had to de-lever the company.” That would be good for Paramount, he said, and for bondholders.

Begley pointed out several billion dollars of cost cuts and merging Paramount+ into Max would allow WBD to “pretty easily” pay down Paramount’s debt. He estimates that, without any transactions or additional major asset sales, Paramount’s leverage could be between 4.25 times and 4.6 times by the end of 2025. Warner Bros. Discovery expects to bring its net leverage below 4 times by the end of its fourth quarter.

Zaslav said during WBD’s third quarter earnings call last month that the company’s debt reduction efforts will give the company the balance sheet and stability to be “really opportunistic over the next 12 to 24 months.”

More linear TV is a “financial death sentence”

While linear TV is still a profitable business for the moment, it is bleeding subscribers at an alarming rate due to cord-cutting. “While scaling up and taking out cost is certainly the David Zaslav playbook, it has certainly not worked well to-date for WBD and we suspect investors would further punish WBD shares if they increased their exposure to linear television,” Lightshed Partners analyst Rich Greenfield wrote in a Nov. 21 blog post. That unwanted exposure would include adding substantial sports licensing costs that continue to escalate, he said.

In a separate post on Wednesday, Greenfield warned that WBD or any other legacy media company choosing to add more linear TV assets would feel like a “financial death sentence.” Rather than acquiring Paramount, WBD would be better served to rebrand Max (back) to HBO and remove any content that does not fit the HBO brand, Greenfield said.

As for Paramount, the analyst said the company should unwind the integration of Showtime and look to sell the network, shift exclusive sports content back to linear TV, license out high profile originals to third-parties, shut down all existing overseas launches, forgo launching new markets and potentially even revert back to the prior CBS All-Access branding.

Paramount could also look to improve its financial health by “shifting aggressively towards a content arms dealer approach,” Greenfield said. “We still believe Paramount will ultimately be sold, but this would allow it to be in a stronger financial/negotiating position.”

Talent might not like it

Talent. That’s a big flag. Through his tenure at Warner Bros. Discovery, Zaslav has rankled the creative community by scrapping completed films, pulling content off Max and more or less gutting TCM. Paramount is the home to Hollywood’s biggest star, Tom Cruise, whose “Mission Impossible” franchise and “Top Gun” reboot has driven billions of revenue for that studio.

Would Cruise want to work with David Zaslav – or would he find another place to focus his talents, despite his success with the “Mission: Impossible” franchise? Zaslav would have real work to do to shift his reputation as a ruthless cost-cutter who does not value the work of creatives. Then again, there was that time that Sumner Redstone threw Cruise off the Paramount lot.

Alexei Barrionuevo and Adam Chitwood contributed to this story.

The post Breaking Down the Pros and Cons of a Potential Warner-Paramount Merger | Analysis appeared first on TheWrap.