Boyfriend Left Woman with $88,000 in Debt — Here’s How Suze Orman Helped Her Out of It

When Haley Woods broke up with her boyfriend of eight years, she says she found herself saddled with $88,000 of debt.

“Ninety percent of it wasn’t even my own debt. My ex was just horrible at money,” says Woods, now 41. “Everything was under my name because he had such bad credit — that was one of my first big mistakes.”

Woods tells PEOPLE she co-signed for credit cards with 29 percent interest rates, co-signed for his car, and when his dog got sick, they spent more than $10,000 on experimental stem cell treatments that didn’t work.

Before she met her boyfriend in 2003, Woods had always been a saver, not a spender.

“I would always count the change,” says Woods, who grew up in in Johnson City, Tennessee. “I was always saving money.”

But, she says, she was always willing to lend a hand. Her family remembers when she was 5 and going to dinner at a restaurant that didn’t take credit cards or checks. Woods handed her father a $100 bill to cover the check.

“I’d just been saving it and carrying it around with me,” she says.

RELATED: Woman, 27, Has Funeral Photo Shoot After Paying Off $102K in Student Loans: ‘Killed Them’

An actress who graduated from New York University’s Tisch School of the Arts, Woods has taken on a variety of jobs, from playing Alice of Alice in Wonderland for FAO Schwarz in New York City to voice over gigs in Los Angeles.

“If you watch the Terminator Salvation movie and listen for a non-featured person screaming and dying, that’s me,” she says.

But as her debt piled up while she pursued her passions, she found it hard to get past the interest payments.

“It just became too much,” she says. “When I broke up with my ex in 2011, he wasn’t working, and he didn’t put a penny toward paying for our debt. Everything was underneath my name. He walked away. And he didn’t ever pay a penny.”

She says her ex tried to convince her to declare bankruptcy — but her family encouraged her to tackle the debt head-on and pay it off.

“Of course he wanted her to claim bankruptcy — because he was the one who got her into it,” says financial expert Suze Orman, host of the Women & Money podcast.

Orman met Woods in September and was struck by her story.

“He asked her to do things that he never should have asked her to do,” she says. “So of course, someone irresponsible with money is going to say, ‘Claim bankruptcy.’ Of course they are…. It’s always better to do what’s right, versus what’s easy.”

Woods, Orman says, decided to do what was right. She went to Debtors Anonymous meetings and studied Orman’s The Money Book for the Young, Fabulous & Broke, a copy of which her mother bought her.

“Reading her book, I realized that I wasn’t alone,” Woods says. “This world is filled with people going through the same thing I’m going through… It made the hard days possible.”

RELATED VIDEO: 5 Financial Mistakes to Avoid in Your 20s

Woods called her credit card companies and set up payment plans. One company, she remembers, closed the account to stop accruing interest.

“I saved thousands upon thousands of dollars just by talking to them,” she says.

Following Orman’s advice, Woods paid off her smaller bills first.

“It’s like looking at Mt. Kilimanjaro and saying, ‘I need to hike that now without any training,’” Woods explains. “Suze says, ‘Go and hike the nearby hill first.’”

In late 2011, Woods was offered a marketing job that involved traveling across the U.S. She gave up her apartment in L.A. and used the money she spent on rent and utilities to pay down debt. Starting in 2012, she began traveling full time, leading a nomadic life.

Woods lived in hotels, the cost of which her work covered for about nine months of the year, and then used hotel points she accumulated to reignite her passion for international travel. It was a far cry from when she was with her ex, when Woods says she let her passport expire.

Woods wrote down everything she bought. And when shopping, she followed Orman’s advice, asking herself if she wanted something — or really needed it. Almost every time, she opted to pay down debt instead of buying a new t-shirt.

“I took every job I possibly could,” Woods says. “I watched every penny.”

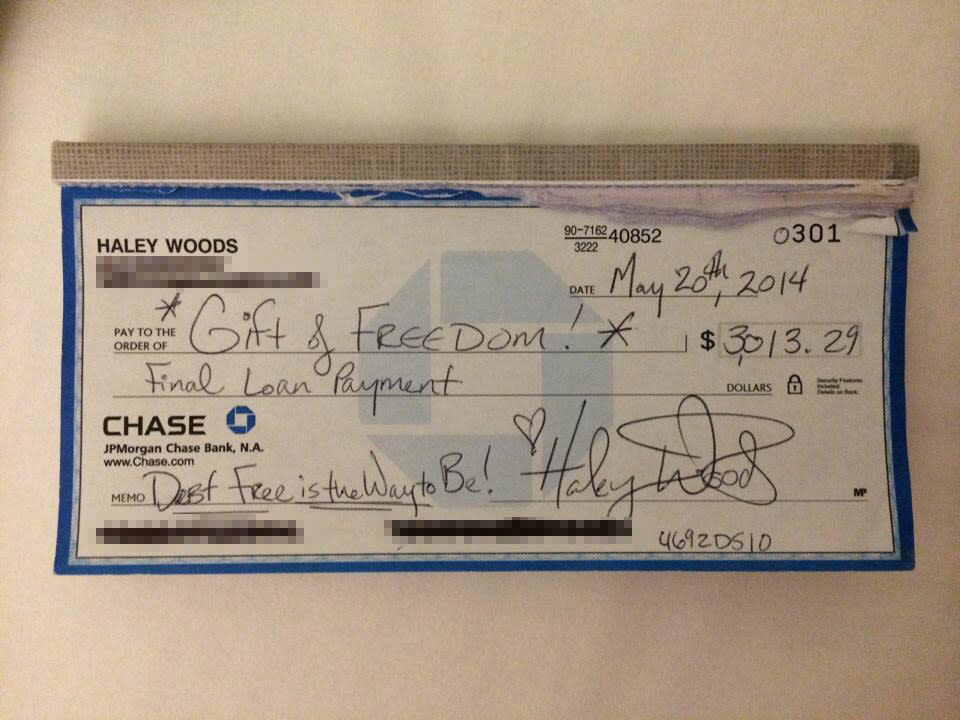

And on her 36th birthday, May 20, 2014, she wrote a celebratory faux check — representing the real check — and posted a picture of it on Facebook. “The gift of freedom,” she wrote in the caption.

“To no longer have that debt — I could just breathe,” Woods says. “I know how strangling, and how claustrophobic it feels when the walls of bills are surrounding you.”

She continued her new spending practices — and a year later, with $50,000 in the bank, she started her own business, Girls LOVE Travel. She celebrated her 40th birthday by traveling to all seven continents. Last year, she did it again, but added the Arctic Circle.

Woods doesn’t own a car or pay rent. She has more money in the bank than she ever had, and she says her FICO score, 839, is higher than it’s ever been.

“I celebrate that,” Haley says. “I don’t need a lot of money to live this life.”

A longtime champion of financial independence, Orman praises Woods’ achievements.

“How fabulous is that?” says Orman, who is releasing her new book, The Ultimate Retirement Guide for 50+: Winning Strategies to Make Your Money Last a Lifetime, on Feb. 25. “When you start saving money, you don’t ever want to stop. She’s living the life of her dreams. Why would she change? Why would you buy a house?…. She’s just a free little bird. I’m so happy for her.”

Woods talks openly about her financial rehabilitation with other women in her online travel community, which has grown to nearly a million members on Facebook. She encourages the women to travel the world — but to also live debt-free.

“I don’t want anybody to go through the experiences I’ve gone through with debt,” Woods says.

She uses her credit cards now to keep track of international travel spending and for the airline miles, but she pays off the balance every month.

“She saw that she could dig herself out of a hole — she’s never getting in a hole again,” Orman says. “More than fix her money, Haley fixed herself. She valued herself. She’s gonna fly for the rest of her life. She is never going to co-sign a loan again. She is never going to put somebody else’s wants in front of her needs. And she has time now to really fly.”