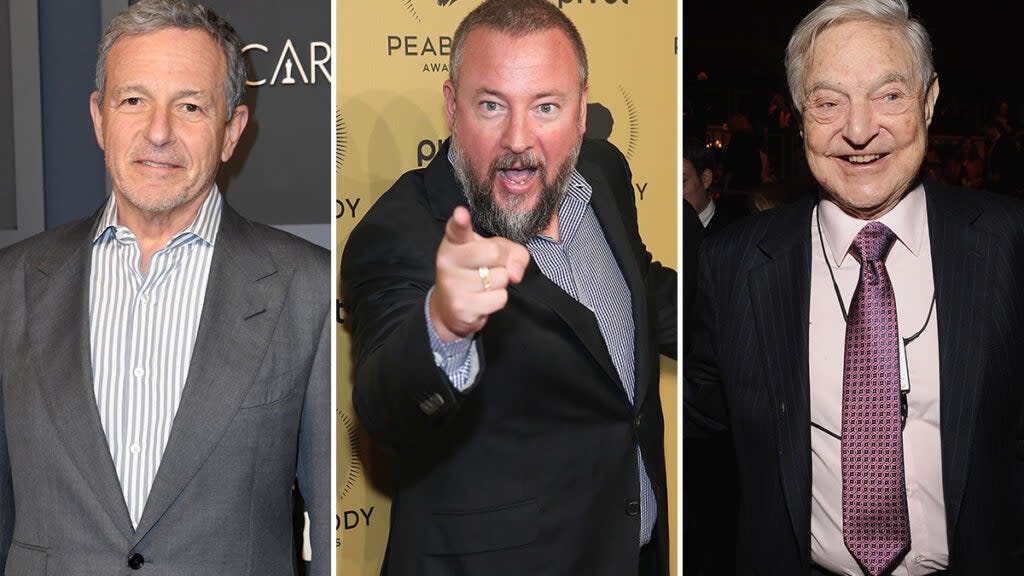

Who Bought Into Vice Media? From Canadian Taxpayers and Disney to George Soros

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

Vice Media may be technically bankrupt as of Monday morning, but it couldn’t have gotten this far, or sent so many lantern-jawed journalists to such far-flung places, without a host of committed investors along the way. And it all started with a little bit of seed money from Canadian taxpayers.

The year was 1994 — no one could have known the internet was about to change everything about media — and the government of Canada agreed that Montreal’s thriving underground music, art and culture scene would do well with a bit more print-magazine love. Two years later, the Voice of Montreal was a successful venture, founders Shane Smith, Suroosh Alvi and Gavin McInnes changed the name to Vice, and the world’s wildest digital-media snowball began rolling downhill.

It’s hard to believe now, but Vice, in one form or another, has existed for three decades. It’s an impressive run, given the constant churn of investors, flagrant excesses that came with warp-speed expansion and continued reliance on a “youth culture” that has never changed faster than over the most recent 30 years.

Starting with those hip Canadian culture ministers, Vice Media would soon be partying on the dime of the world’s biggest whales, like George Soros and Fortress Capital. Those backers are now part of a consortium that appears ready now to take over in a Chapter 11 rescue package of $225 million — on top of the hundreds of millions of dollars they’d already put in.

That’s a long way down from Vice’s vertiginous $5.7 billion valuation of a half-dozen years ago. In all, Vice Media took in $1.6 billion of investment and debt over the years. That’s almost all gone, according to bankruptcy filings, with current liabilities between $500 million and $1 billion.

Also Read:

Vice Media Files for Bankruptcy

The first individual investor to take a flyer on Vice was Richard Szalwinski, a Canadian software magnate who pitched in $4 million to kickstart the fledgling company’s move to New York City in 1999. Expanding into broader topics and commentary far beyond local culture, the founders did well enough to buy that stake back a couple of years later from Szalwinski, who died in 2016, just as the other investments were turning corporate — into the tens, and soon to be hundreds, of millions of dollars.

Here’s a timeline of who’s put big money behind Vice Media since its humble founding:

2011, WPP (amount not disclosed)

After a dizzying decade of expanding the magazine to international, digital and film/TV production markets, Vice took on its first major investment from the British multinational advertising holding company WPP. It was a minority stake, and the figure wasn’t disclosed, but with more money to spend than it ever had before, Vice was off to the races, soon expanding its coverage to news and international events. Valuation: above $30 million.

2013, 21st Century Fox ($70 million)

Fox put a reported $70 million into Vice, a 5% stake at a valuation just below a billion-and-a-half dollars. With television production and other income streams coming online, including a deal for an HBO series, the company reported a $40 million profit on $175 million in revenue. Valuation: $1.4 billion.

2014, Disney (via A&E Networks, $250 million), Technology Crossover Ventures ($250 million)

By now, Vice was the envy of all digital media ventures, with a finger in every type of content-production pie imaginable (except virtual reality, which it would take on the following year by throwing millions at director Chris Milk) and an unbreakable brand. Vice News launched. It was an enticing time for legacy media companies struggling to find younger audiences, to get in the Vice business, and the twin investments each amounted to a 10% stake. Valuation: $2.5 billion.

Also Read:

Ben Smith Talks Digital Media’s Death Dive: ‘You Could Feel That Moment Coming to an End’ | Video

2015, Disney ($400 million)

The Walt Disney company more than doubled down at the end of the following year with two separate $200 million investments. Vice and A&E launched cable channel Viceland, and Vice became one of Snapchat Discover’s original launch partners. Valuation: $4 billion.

2017, TPG ($450 million)

U.S. private equity firm TPG threw down Vice’s largest single cash infusion with $450 million, leading to its peak value — a figure it would stop sharing publicly as it began the ride down in 2018. Valuation: $5.7 billion.

2018

Disney wrote down $157 million of its $400 million in Vice Media, and would soon declare its stake to be worthless. Shane Smith stepped down as CEO following sexual harassment complaints throughout the company. Months later, Vice conducted 10% across-the-board layoffs under new CEO Nancy Dubuc, formerly of A&E. It’s here where Vice’s meteoric expansion investments halted. From here on, it would grow mostly through acquisition and debt. Valuation: unknown.

2019 ($250 million, consortium debt)

Vice acquired Refinery29 for $400 million in stock, then raised $250 million in debt from a consortium that includes Fortress Investment Group, Soros Fund Management, 23 Capital, Monroe Capital and James Murdoch’s Lupa Systems. Valuation: unknown.

2021, Lupa Systems ($85 million)

Murdoch’s company threw another chunk of cash at Vice Media after merger talks stall. Valuation: unknown.

2023 ($30 million, Fortress debt)

With bankruptcy looming and no buyer stepping up, Vice took another $30 million in debt from Fortress Investment Group.

As the top debt holder, the Fortress consortium, with participation from Soros and Monroe, is now the primary bidders for Vice Media in a planned bankruptcy sale. If Vice doesn’t find a higher bidder, Fortress will gain full control of Vice’s assets for the agreed $225 million. It has already agreed to float Vice another $20 million to operate while it restructures. Existing shareholders are likely to be wiped out in the deal.

The company has five distinct business that plan to still operate, for now: Vice.com, Vice Studios (film/TV production), Vice TV, Vice News and a creative services agency called Virtue.

Individuals close to the talks have told TheWrap that Fortress is considering offloading Vice’s assets as separate parts, though a company spokesperson said that was premature.

Also Read:

Vice’s Bankruptcy Filing Was Inevitable – and Still Managed to Surprise | Analysis