Bold Prediction of the Year? All Four Major Studio-Backed Streaming Platforms Will Be Profitable Within 18 Months

Having incurred billions of dollars in annual losses building direct-to-consumer streaming platforms, the major Hollywood conglomerates are close — as in just months away — from profitability on streaming.

That’s the contention of London’s Ampere Analysis, which claims The Walt Disney Co. will turn the corner as soon as Q1 of next year — two quarters earlier than it originally told investors several years ago.

Warner Bros. Discovery will follow in the third quarter of 2024, Ampere added. And by Q1 2025, Paramount and NBCUniversal will have reached profitability, as well.

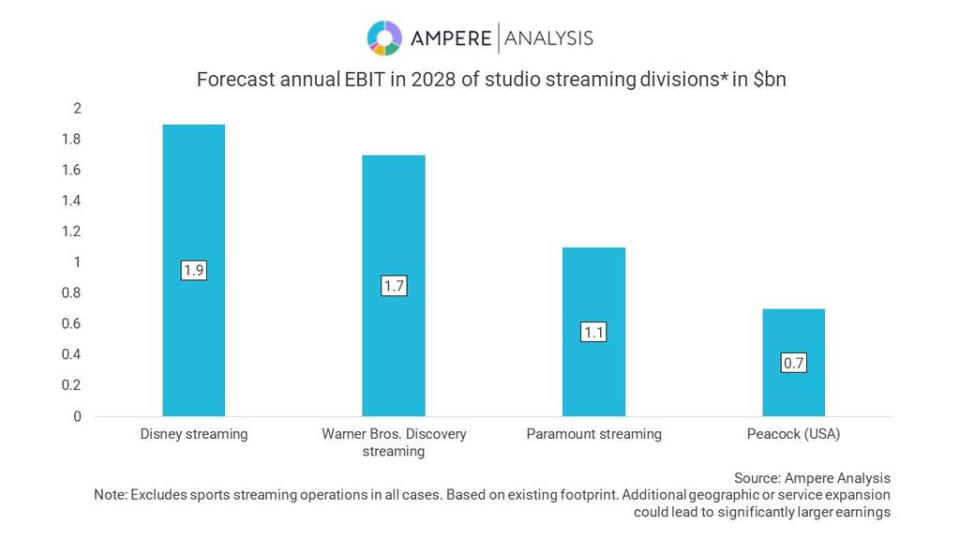

By 2028, Ampere predicts, the major studios will earn between $1 billion to $2 billion annually in earnings before interest and taxes (EBIT) from direct-to-consumer streaming, just based on their current geographical market footprints.

To us, it feels a little counterintuitive against other data we’ve been seeing — including a report released by MoffettNathanson the other day that showed growth slowing for the major subscription streaming services.

But for its part, Ampere attributes some of the turnaround to “cost rationalization.” Through rigid austerity, for instance, Warner Bros. Discovery reported Q3 DTC adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $111 million vs. an EBITDA loss of $634 million in the third quarter of 2022.

Direct-to-consumer adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) were $111 million, compared to a $634 million loss a year ago.

A new embrace of advertising dollars has been key, as well.

“The analysis shows that streaming direct is not a broken business model but an important revamp of an existing content exploitation window,” Guy Bisson, executive director at Ampere Analysis, said in a statement.

“Understanding that this model is on the point of consistent and notable profitability is crucial as the ability of streaming to continue driving content origination and investment has wide implications for the creative sector,” Bisson continued. “Additionally, with studios now able to position streaming correctly as a profit-making direct subscription window that is complimentary to theatrical exhibition, transactional and free television, sectors that had previously been deprioritized should also see a boost. The rationalization of streaming is already seeing renewed support among studios for the theatrical window and revisiting of the content-licensing model.”