Blackwells Capital Slams Nelson Peltz for ‘Disturbing’ Statements About ‘The Marvels,’ ‘Black Panther’

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

- Oops!Something went wrong.Please try again later.

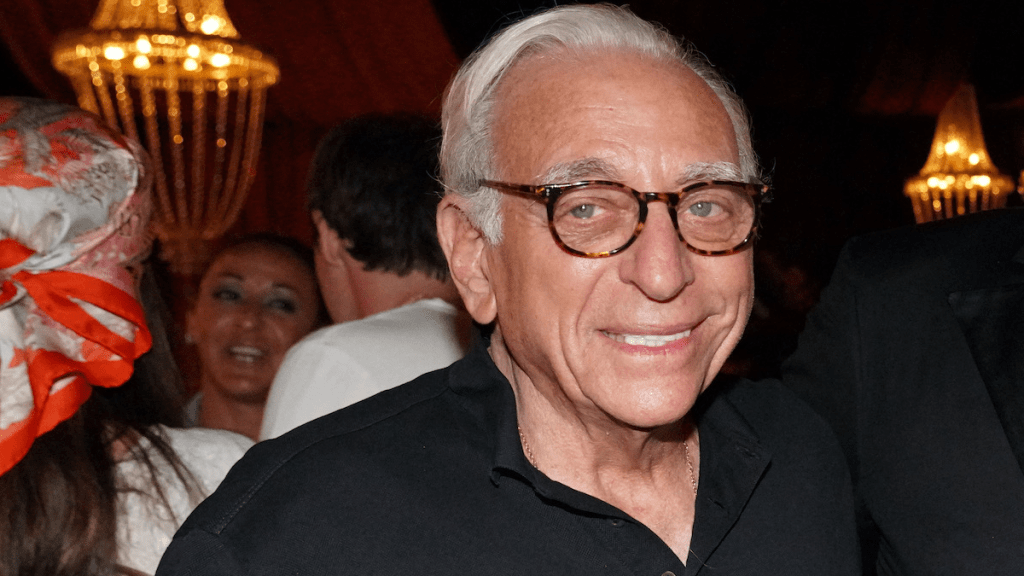

Blackwells Capital is calling out Trian Fund Management co-founder Nelson Peltz for “disturbing public statements” that the 81-year-old activist investor made in an interview with the Financial Times on Friday.

During the interview, Peltz said that Disney has become too woke, arguing that the company is focusing too much on messaging rather than quality storytelling. He proceeded to specifically take aim at “The Marvels” and “Black Panther.”

“Why do I have to have a Marvel that’s all women? Not that I have anything against women, but why do I have to do that?,” he said. “Why can’t I have Marvels that are both? Why do I need an all-Black cast?”

He also questioned Marvel Studios president Kevin Feige’s record, but noted he’s “not ready to say” if he should be fired following the super hero franchise’s recent rough patch.

Additionally, Peltz was also asked about being accused of being a “bully billionaire” in a lawsuit filed by wedding planners he hired and later let go during his daughter Nicola’s wedding to Brooklyn Beckham.

“That’s probably true,” he said. “What sense is being a billionaire if you’re not a bully? Let me tell you something . . . They got a great deal for doing nothing. But that’s water under the bridge.”

In a communication to shareholders on Monday, Blackwells said it believes Peltz’s comments are “an affront to Disney’s customers, employees and shareholders, and ultimately should disqualify him from sitting on the Disney Board.”

“Imagine the damage Peltz would do in Disney’s boardroom with these perspectives,” Disney said in its own separate statement.

The entertainment giant touted Feige’s ” unparalleled track record at Marvel, generating ~$30bn in global box office, making him the highest grossing producer of all-time” and reiterated that Peltz and his “silent partner” and former Marvel Entertainment chairman Ike Perlmutter would harm the company and “jeopardize our strategic transformation.”

Disney added that Peltz “brings no additive skills to the Board, doesn’t understand our business and has no plan to create shareholder value” and that “the surest way to impede our creative progress is oversight from an 81-year-old hedge fund manager with no creative experience.”

“Disney’s strategic transformation is working. Our Board and management are delivering on our commitments to create superior, sustainable shareholder value,” the statement concluded. “Do not let Nelson Peltz drive us off course with his outdated beliefs, uninformed ideas, and self-serving agenda.”

In addition to addressing Peltz’s comments surrounding Marvel, Blackwells’ letter knocked him for “boasting about his shortcomings” despite lacking “critical expertise.”

It noted that 15 of the 22 companies where Trian has taken a board seat have underperformed the S&P 500 during its tenure on the board. Blackwells added that the companies that have outperformed the market with Trian as a director have ” arguably been the result of management resisting or ignoring Trian’s ideas,” citing examples including Procter & Gamble rejecting a suggestion to movie its Cincinnati headquarters and Pepsi rejecting proposals to merge with Mondelez and dispose of Frito Lay.

The firm also pointed out that Trian has “faced a spate of investor redemptions due to poor performance, shuttering its U.K. fund, and overseeing a collapse of almost 40% of its assets under management” and that it has lost key personnel, including Peltz’s own son-in-law Ed Garden, which it argued is “due in part to Trian’s poor performance.”

“Shareholders, particularly those who espouse the principals of good corporate governance and believe there is a need for change at Disney, do not have to accept the false dichotomy of Mr. Peltz or the status quo Board,” Blackwells wrote. “The Board does not need nominees driven by personal grievances or animus towards management, as we believe Trian Partners’ (“Trian”) nominees Nelson Peltz and Jay Rasulo are.”

Blackwells has nominated Tribeca Film Festival co-founder Craig Hatkoff, former Warner Bros. and NBCUniversal executive Jessica Schell and TaskRabbit founder Leah Solivan to stand election at Disney’s annual shareholder meeting on April 3.

The post Blackwells Capital Slams Nelson Peltz for ‘Disturbing’ Statements About ‘The Marvels,’ ‘Black Panther’ appeared first on TheWrap.