Binging on debt? How to avoid a financial holiday hangover

The holiday season is once again upon us. Last minute gifts are being bought and the egg nog is flowing. But as we warm our hands by the fireplace channel, Credit Canada CEO Laurie Campbell says we should think about the potential financial hangover.

Despite a string of interest rate hikes, Canadians are still piling on debt. Statistics Canada says the debt-to-income ratio inched up to 177.5 per cent. In other words, we owe nearly $1.78 for every dollar of disposable income.

Canada Mortgage and Housing Corporation also recently issued its own warning about household debt. But, according to a recent survey by PwC, eight in 10 Canadians say they plan to spend the same or more this holiday season. More than three-quarters of respondents plan to use credit cards, and only 19 per cent worry about credit card debt.

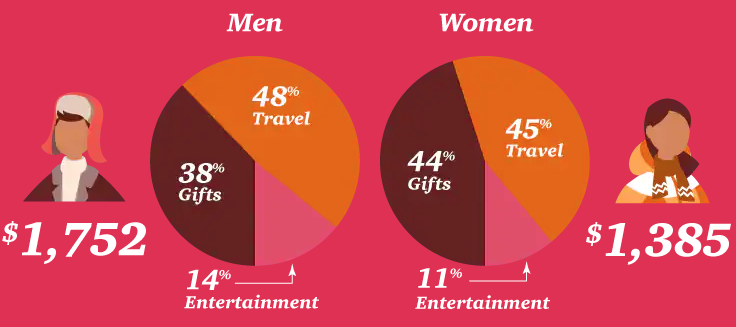

PwC says travel makes up the biggest portion of holiday spending, followed by gifts, and entertainment. Men are expected to spend more than women.

Keeping your debt in check

Campbell has 10 tips to stay financially sane this holiday season, without going into debt.

1. Review your income and expenses to see what you can safely afford to spend on your holiday needs.

2. Establish a budget and remember that there’s more to consider than just gifts.

3. Make sure your kids have realistic “Santa” lists.

4. Try a holiday potluck.

5. Get crafty.

6. Gift your time by offering your services to older relatives or neighbours.

7. Barter for gifts.

8. Don’t go overboard on holiday clothes as they are worn for a short period of time.

9. Plan early for next year by setting aside some of your holiday budget this year.

10. Stay within your budget.

Download the Yahoo Finance app, available for Apple and Android.