Big Tech Is Even Bigger Than You Think: $2.7 Trillion Apple Is Now Worth 11 Disneys | Charts

Big Tech just keeps getting insanely bigger.

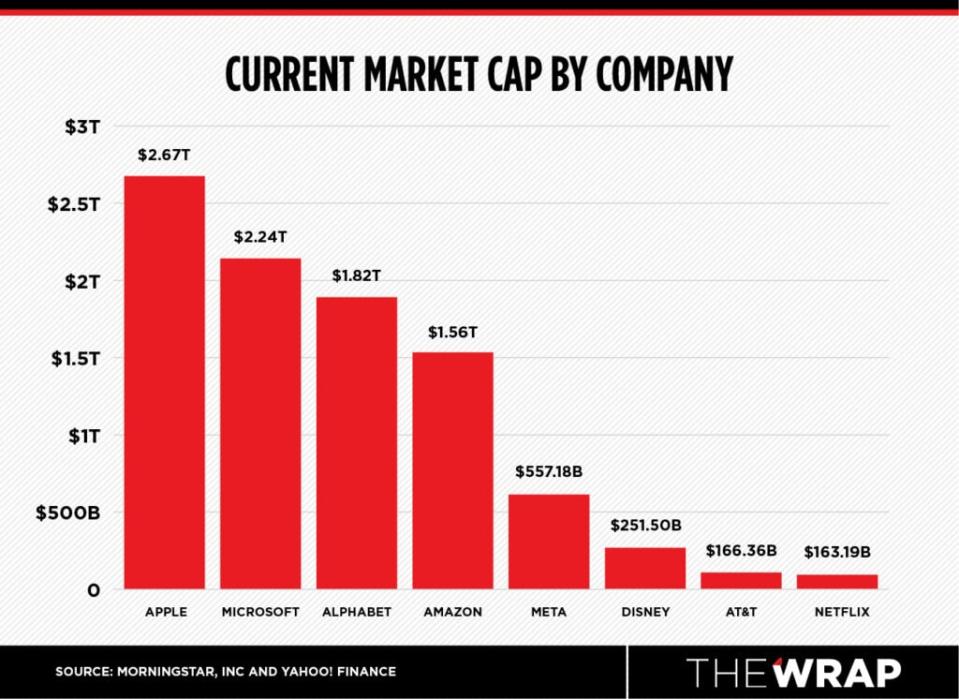

This year, the Big Five tech players have a combined market cap of $8.9 trillion — easily eclipsing big oil companies ExxonMobil or BP and far outpacing legacy media giants like Disney and AT&T/WarnerMedia.

It just goes to show how much these behemoths dominate our lives, especially with electronics and digital demands accelerated by the pandemic. Plus, Big Tech players from Amazon to Apple have the deep pockets to become more vertically integrated by gobbling up Hollywood studios and producing original and exclusive content for their platforms.

Just how big is Big Tech?

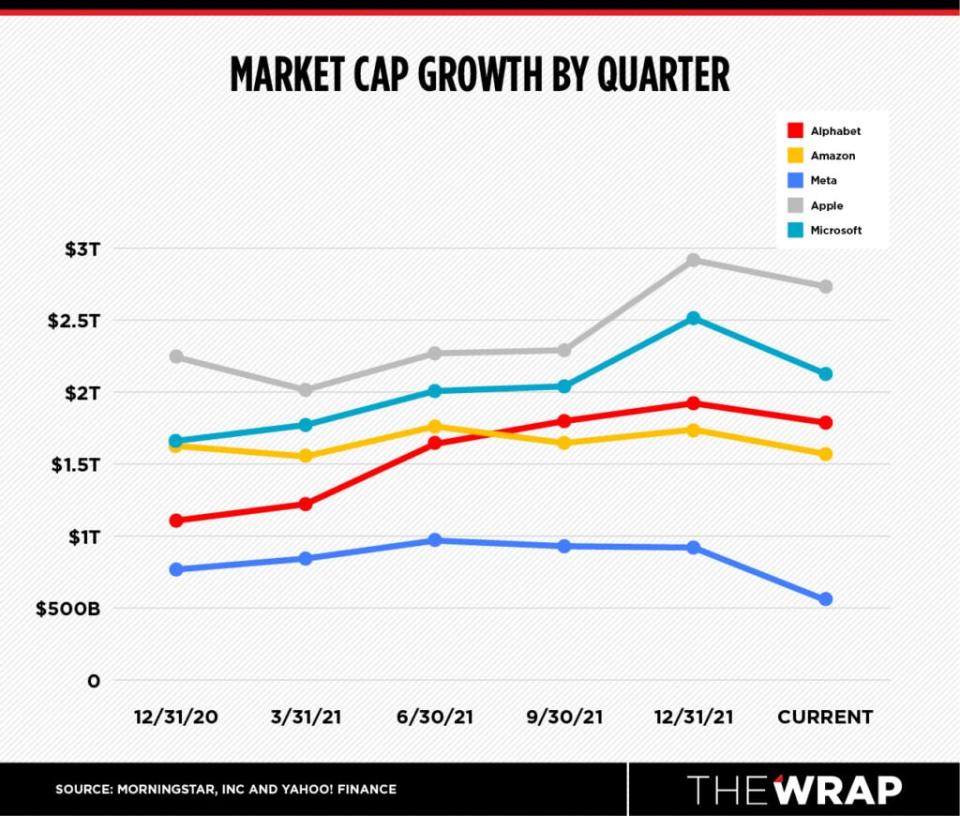

Together, Alphabet, Amazon, Meta, Apple and Microsoft run everything from advertising and hardware to cloud services and logistics. By market cap, or value of the company on the stock market, Apple and Microsoft have well surpassed $2 trillion, whereas Google parent Alphabet follows closely at $1.8 trillion. Amazon isn’t far behind at nearly $1.6 trillion, while Facebook parent Meta is worth $557 billion after reaching a $1 trillion market cap for the first time last year.

“These are durable businesses they have all built,” Mandeep Singh, tech analyst at Bloomberg Intelligence, told TheWrap. “They have grown their top line and done so in a way that margins are much better than the traditional media companies.”

There’s no telling how much bigger Big Tech can get, and it seems like nothing can hurt them so far. Although some may face ongoing supply chain issues or slowdowns in advertising, experts say they have a healthy enough core business to withstand short-term losses.

“[Tech has] such a big weight on the profitability of the S&P 500, and they have created a moat around their businesses. All of them have been compounding in top line and earnings,” Singh added.

For example, while Microsoft wrestles with supply chain challenges affecting its hardware side, it’s cushioned by a booming enterprise software business. In 2021, Microsoft’s server and cloud business alone increased $11.2 billion in revenue from 2020, totaling $60 billion. The company’s total revenue last year reached $168 billion, up 18% year-over-year.

And while Meta is betting billions on developing metaverse tech, it still owns the majority share of the ads market driven by its social media apps. Facebook and Instagram together make up almost half (42%) the digital display ad market share in the U.S. in 2022. Google, which includes YouTube, accounts for about 10% in second place, according to data firm Statista.

How do the media giants stack up against Big Tech?

Another way to picture the enormity of tech is by looking at media giants, which control everything from theme parks to publishing. Compared to tech’s trillions of dollars in value, Netflix’s market cap is (just) $163 billion. Even legacy media is but a fraction of Big Tech valuations: Disney’s current market cap is $251 billion and AT&T’s is $166 billion just ahead of its offloading of WarnerMedia to Discovery. That means it takes about 11 Disneys to amount to Apple’s $2.7 trillion market cap.

“Big tech has undoubtedly been able to grow at a faster pace than most other sectors,” Sahak Manuelian, head of equity trading at Wedbush, said. “A world that is dominated by … meaningfully technological services or products has certainly buoyed these mega-caps in what has been a technological revolution. These trends can last many more decades, and these companies are still in the sweet spot.”

Just one of these $2-plus trillion corporations nears the size of California’s gross state product of some $3 trillion — the largest economy in the U.S. The scale of tech even rivals the economy of entire countries. In 2020, Germany, Europe’s largest economy, had a gross domestic product of $3.8 trillion, while France had a $2.6 trillion GDP, according to the World Bank.

Can anything stop Big Tech from getting bigger?

With the exception of Meta, the other four “have enormous scale” to keep growing, Manuelian explained. They’re navigating the supply chain issues better than most and benefiting from strong leadership. Although Meta’s recent earnings met some analyst expectations, its flagship platform is starting to shrink with global user growth mostly stagnant. The company is also dealing with Apple’s privacy changes that affect its ad business. Of the five, Meta appears the least diversified, something investors want to see in a large tech company.

“[Meta] is more exposed to advertising [changes] and making a big bet on building the metaverse. Investors are skeptical about the metaverse this year,” Singh said.

As for the upcoming year, analysts are watching how federal interest rates, high inflation and the developing war in Ukraine are going to impact the tech sector. Manuelian also mentioned that valuations in tech have been compressing (for those that may be overvalued), but Big Tech will mostly be unscathed.

“It has been a choppy and challenging start to the year, and we think this probably continues as there are so many moving parts in play,” Manuelian told TheWrap.