Big banks, retail, consumers — What you need to know for the week ahead

Markets finished mixed but little-changed on Friday, capping a week that saw the S&P 500 extend its streak of record high closes to six while the September jobs report disappointed.

In the week ahead, investors will have a fairly muted economic schedule to contend with while third quarter earnings season will get underway.

The economic highlights should come on Friday, when we will get the September reports on retail sales as well as inflation, two key readings for the Federal Reserve. Following Friday’s jobs report, market data indicated traders see about a 75% chance the Fed will move to raise rates at its December meeting.

On the corporate side, third quarter earnings season will begin with the financial sector starting the proceedings. Earnings from BlackRock (BLK) are expected on Tuesday, while JP Morgan (JPM) and Citi (C) will report earnings on Thursday, and Bank of America (BAC), Wells Fargo (WFC), and PNC Financial (PNC) will report earnings on Friday.

This past Friday, we learned that the U.S. economy lost 33,000 nonfarm payrolls, a surprising decline that economists attributed to the impact of Hurricane Harvey and Hurricane Irma, which affected Texas and Florida, respectively. This decline broke a 90-month streak of job growth in the private sector and was the first negative print for nonfarm payrolls sine 2010.

The largest impact was seen in leisure & hospitality jobs, which fell by 111,000, the most on record for a single month. Though there was some good news in the report, with wages rising 2.9% over the prior month in September, more than expected while the unemployment rate fell to a 16-year low of 4.2%.

Overall, though, the report was viewed by economists as sort of a throwaway — economists at Bank of America said to “take a mulligan” on the report — with the hurricanes adding a ton of noise to an already noisy data series.

“Overall, this was a mixed report,” said economists at Barclays, “with a much stronger-than-expected drag from the hurricanes in September, but at the same time, the unemployment rate fell unexpectedly and earnings growth was more robust than anticipated.

“We think that the FOMC will want to separate noise from signal and will likely interpret the weakness as temporary and driven by special factors.”

Economic calendar

Monday: No economic data.

Tuesday: NFIB small business optimism, September (105 expected; 105.3 previously)

Wednesday: Job openings and labor turnover survey, August (6.17 million jobs open previously); FOMC Minutes

Thursday: Initial jobless claims (252,000 expected; 260,000 previously); Producer price index, September (+0.4% expected; +0.2% previously)

Friday: Consumer price index, month-on-month, September (+0.6% expected; +0.4% previously); “Core” consumer price index, year-on-year, September (+1.8% expected; +1.7% previously); Retail sales, September (+1.4% expected; -0.2% previously); University of Michigan consumer sentiment, October (95.3 expected; 95.1 previously)

Inflation isn’t gone forever

This past week, much of the discussion around the Federal Reserve focused on who the next leader of the central bank will be. What the Fed’s actual policy will be going forward seemed like an afterthought.

And to some observers, a change at the top of the organization won’t alter how the Fed acts over the next year or so.

After a September jobs report that saw job growth actually decline while wage gains were better-than-expected, inflation is again at top of mind for investors. Federal Reserve Chair Janet Yellen made waves by saying that lower-than-expected inflation this summer was a “mystery” to the central bank.

And while persistently below-trend inflation has been one of the defining stories of the post-crisis economic recovery, not all economists are ready to write-off inflation as an economic trend from a bygone era.

In a note to clients on Friday, Ethan Harris at Bank of America Merrill Lynch said the one big “call” for next year that matters is whether inflation returns or not.

Right now, Harris notes that markets expect the Fed will raise rates just one time in 2018. The Fed’s forecast indicates there will be three additional rate hikes next year.

As Harris points out, the “mystery” Yellen referred to is a reflection of a basic economic trend breaking down in 2017.

“One of the striking things this year is the sudden and sustained divergence between US inflation fundamentals and actual inflation,” Harris writes.

“Historically, the best indicators of inflation pressure have been tight capacity and imported inflation. In 2016, the standard models worked well: tightening capacity and the weak dollar seemed to trigger a normal slow acceleration in wage and core price inflation. By contrast, this year, as the fundamental case for higher US inflation continued to improve — across the board — actual inflation has fallen.”

Bolstering the fundamental case for inflation to be higher is the decrease in the unemployment rate — which in September hit a 16-year low — while consumers remain confident in the labor market, job openings remain near record highs, and participation has stabilized.

And moving past the labor market, the amount of spare capacity that appears available in the broader economic is shrinking.

Harris notes that supplier deliveries have slowed according to PMI surveys, indicating that supply chains are stretched across the economy, while rental and homeowner vacancies remain low and unfilled orders are on the rise.

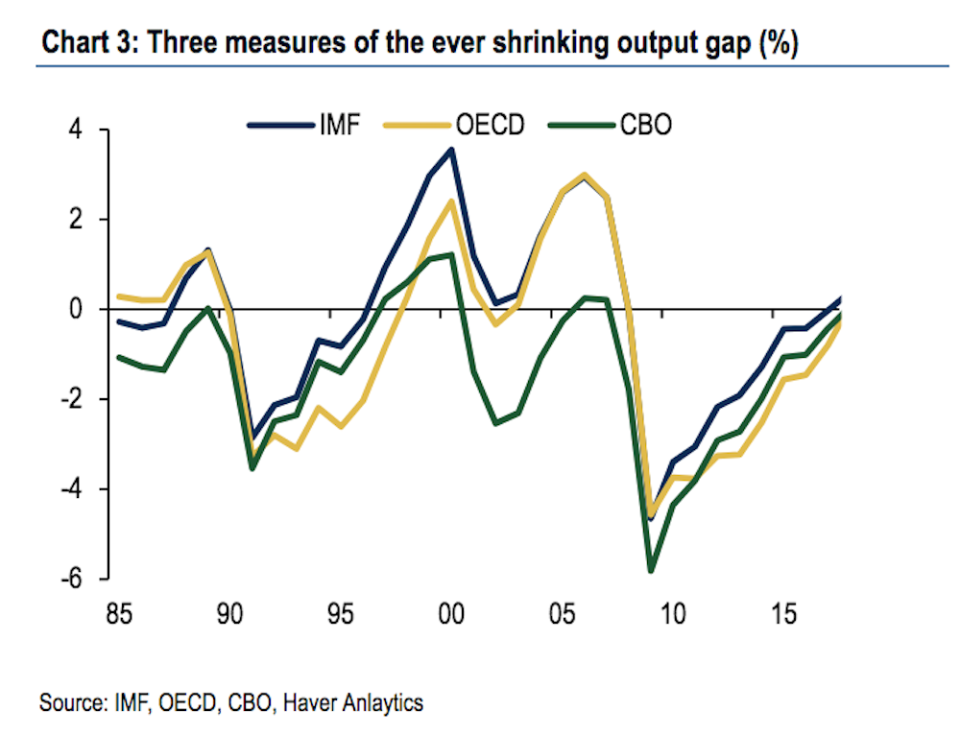

Additionally, the “output gap” — which economists define as the gap between actual GDP output and the estimated potential GDP output — continues to shrink in the U.S.

Now, some observers would say that the impact technology is having on the economy has held down inflation as measured by traditional methods.

Rick Rieder, chief investment officer of fixed income at BlackRock, is among those who has been pounding the table the loudest in favor of this view, arguing that demographic factors as well as technology are keeping a lid on a rise in the economy’s overall price level.

And as Harris notes, inflation expectations have been on the decline in recent years. Expectations in prices can then become a self-fulfilling prophecy, which is part of why economists fear deflation so much. (Low expectations for inflation means no spending is pulled forward in anticipation of higher prices, thus keeping overall spending and growth muted.)

The economic backdrop supporting higher inflation in the future, however, keeps Harris steadfast in a view that higher inflation is coming. Eventually.

“History shows that it is hard to pinpoint the exact thresholds for higher inflation,” Harris writes. “However, if GDP growth continues to exceed potential, finding those thresholds is just a matter of time.”

The implications for investors here are many, but the biggest takeaway is that if inflation rises faster than expected, the Fed will continue to raise rates and do so against market expectations.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: