Best Buy, Nordstrom, auto sales — What you need to know in markets on Thursday

Mercifully, February is over.

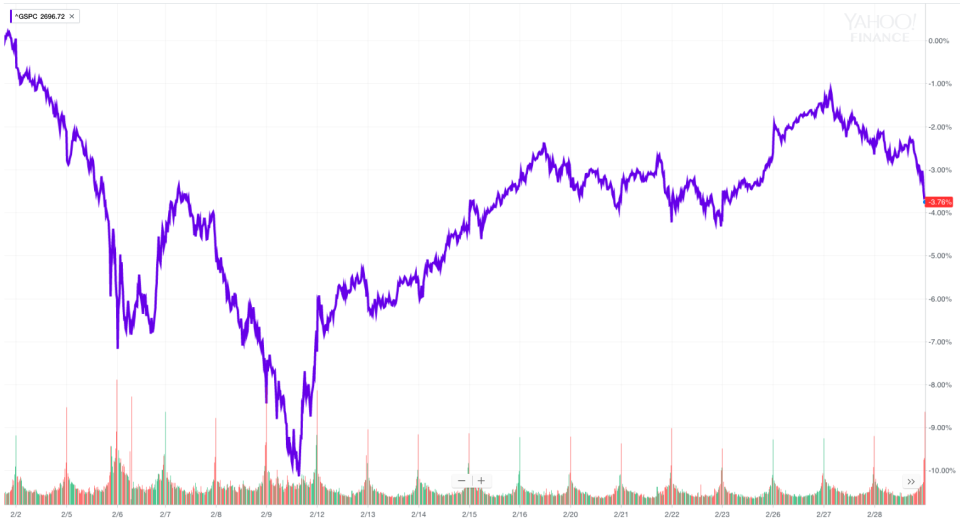

To cap an ugly month for markets that saw the S&P 500 break a 15-month total return winning streak, each of the major indexes finished sharply in the red with the Dow logging the largest losses.

The blue chip index lost 380 points, or 1.5%, while the S&P 500 lost 1.1%, or 30 points, and the tech-heavy Nasdaq declined by 0.8%, or 57 points. For the month, the Dow lost 4.4%, the S&P 500 fell 3.8%, and the Nasdaq lost 1.5%.

On Thursday, the economic schedule will be busy once again with readings on personal income, spending, inflation, initial jobless claims, manufacturing activity, construction spending, and auto sales all set for release.

Auto sales, which are expected to roll in throughout the day, will be in focus as the auto industry looks to find its footing as vehicle sales fell in 2017 for the first time since the financial crisis. Economic expect the annualized rate of sales in February hit 17.2 million cars, up from 17.07 in January.

And on the earnings side, Thursday will be retail-heavy with highlights expected from Kohl’s (KSS), Best Buy (BBY), Nordstrom (JWN), Gap (GPS), and gunmaker American Outdoor Brands (AOBC).

History says March will be better

February was a rough month for markets.

The 15-month winning streak for the S&P 500 (on a total return basis, that is; in March 2017, the index declined on a price basis but was slightly higher including dividends) came to an end as volatility returned to markets in a big way.

As Bespoke Investment Group noted on Wednesday, 15 of the 19 trading days during the month saw triple-digit moves for the Dow with two days witnessing unprecedented quadruple-digit moves. Over the final seven trading days of the month, the Dow did not move fewer than 164 points in either direction.

History, however, is on the market’s side in the months ahead.

Ryan Detrick, senior market strategist at LPL Financial, notes that over the 10- and 20-year periods March and April are the two strongest months of the year.

On average, the S&P 500 has gained 2.4% and 2.1%, respectively, over the last 10- and 20-year periods, bested only by the returns seen in April during this period. Detrick adds that 65% of the time, March has seen the S&P 500 finished higher over the last two decades, and in years when the benchmark index does post gains the average rise is 4.1%.

Of course, the news flow from the economy, central banks, corporate earnings, and the Trump White House are likely to provide a series of daily challenges to investors. Not to mention that the sell-off we saw in February was triggered by a confluence of factors, no one of which was easily identifiable as the obvious cause of the decline.

For investors, then, the environment in 2018 is proving — and seems likely to continue to prove — more challenging than 2017. So while history may be on the market’s side as we head into the next two months of trading, 2018 could be a year when history is just that.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

A few major topics were missing from Warren Buffett’s latest annual letter

The Trump tax cut earned Warren Buffett’s Berkshire Hathaway $29 billion in 2017

Goldman Sachs says U.S. economic data right now is ‘as good as it gets’

One candidate for Amazon’s next headquarters looks like a clear frontrunner

Tax cuts are going to keep being a boon for the shareholder class

Auto sales declined for the first time since the financial crisis in 2017