Behind the Slow-Motion Implosion of Regional Sports Networks

- Oops!Something went wrong.Please try again later.

While regional sports networks — in L.A., think Spectrum SportsNet LA for the Dodgers — aren’t dead yet, the ripple effect of their business model challenges are already being felt across the TV ecosystem. But the game is in the early innings.

RSNs, the pay TV channels built around live local sports, mostly featuring teams in the NBA, MLB or NHL, usually have full slates of programming. But, of course, it’s the live games that are key, and fans within local markets can watch them all only if they have access to an RSN via cable or satellite providers.

More from The Hollywood Reporter

Hollywood Diversity Initiatives May Be Challenged After Supreme Court Affirmative Action Ruling

Hollywood's High-Stakes Strike: Actors and Writers Make History With Bid to Reshape Industry

Hello, Chief Content Officer. Why the Title Is the New Go-To in Hollywood Executive Shake-Ups

A sea change is being driven by cord-cutting, which has put the pinch on RSN finances. While some bigger-market RSNs are staying the course for now, many others are challenged. Warner Bros. Discovery, for example, told its league partners that it wants to exit the space (it owns RSNs in Colorado, Houston and Pittsburgh) and hand its rights back to the teams and leagues.

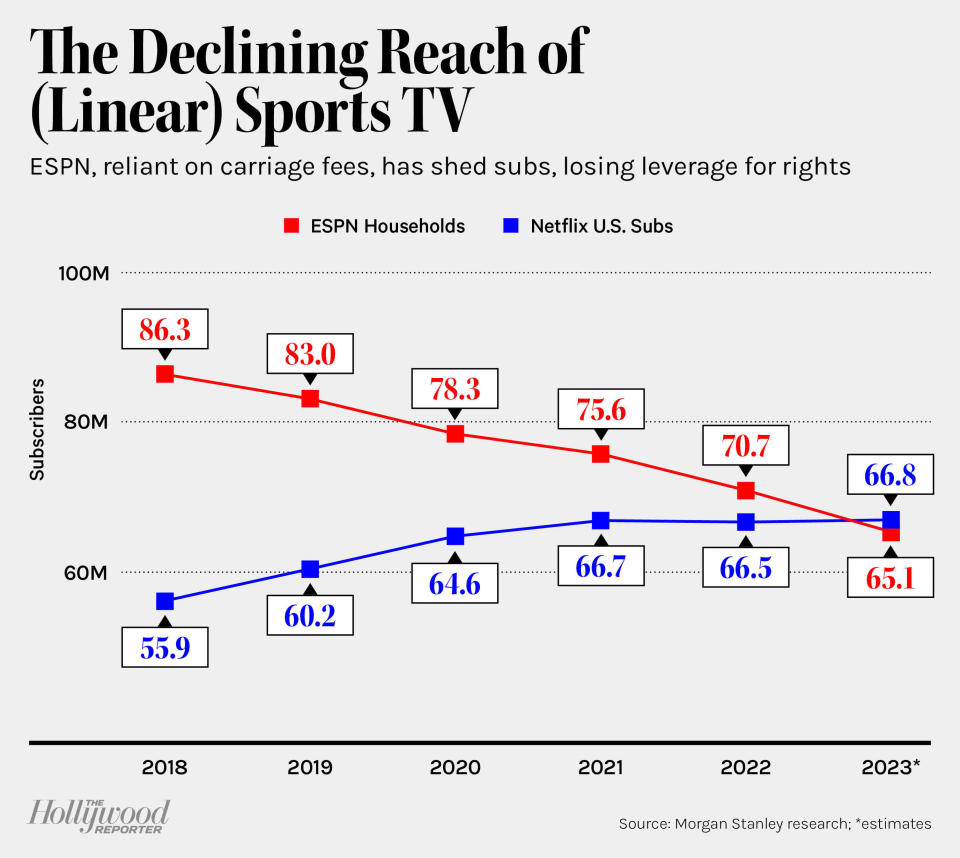

But no company has been more impacted than Diamond Sports. Formerly the Fox Sports RSNs, Diamond was launched by Sinclair Broadcast Group in 2019 in a $10.6 billion deal premised on leveraging the scale of all the RSNs to force pay TV providers to raise fees. However, Morgan Stanley’s Ben Swinburne noted in a June 21 research report that the deal was “ill-timed and over-leveraged,” with cord-cutting eating into the company’s ability to pay interest. Diamond filed for Chapter 11 bankruptcy protection in March and has already given up control of San Diego Padres games — the MLB took over production, and games are available to stream for free and on some local stations — and other teams are expected to see their rights cut loose, or fees cut down.

So, what next? Wall Street analysts, executives and league officials see multiple possible visions, though they come with a warning: The near and medium term is unlikely to be as lucrative for teams as pay TV’s heyday.

A sign of what’s to come can be seen in new broadcast deals announced by the NBA’s Phoenix Suns and Utah Jazz. The deals combined the oldest of old-school media technologies — games on local broadcast TV — with a new twist: a direct-to-consumer streaming service for cord-cutters or superfans. The catch, of course, is that the new deals are not paying as much in rights fees as the RSNs could. “Recall that before there were RSNs, local broadcast stations carried all the local team games,” says Moody’s senior vp Neil Begley. “But [local stations] are also being pinched by declining pay TV losses and they would need to get higher affiliate fees than they currently receive to cover much of the licensing costs to the teams.”

Adds Karen Brodkin, co-head of WME Sports and executive vp content strategy and development at Endeavor, “I think what broadcast groups are seeing in other markets is there is a path that includes some level of risk on both sides.” And while there may be ways to make up that rights fee revenue gap (Brodkin notes that revenues from, for example, ticket sales and jersey patches are “materially and positively impacted by broadcast distribution”), that is far from assured, and may depend on the individual team and market.

A direct-to-consumer offering, meanwhile, can help engage serious sports fans as well as cord-cutters, but pricing and the specifics of the offerings remain in the experimental phase, and subscriptions may rise and fall based on the team’s success, Begley notes.

Diamond Sports’ streaming offerings, which use the Bally Sports brand name, cost around $20 per month, but the company so far has amassed only some 203,000 subscribers. Boston-based NESN and the New York-based YES Network have also launched streaming apps, with MSG Networks and Spectrum SportsNet offerings still to come.

But there are signs of experimentation at play, as well. YES Network, which airs New York Yankees and Brooklyn Nets games, debuted a “YES Rewards” system in June, enabling users to earn prizes like gift cards for watching games or other programming.

At Monumental Sports Network, which televises Washington Wizards and Capitals games, the RSN is experimenting with producing alternate announcer feeds for live games, taking a cue from ESPN’s successful ManningCast.

“We wanted to create more immersive and interactive experiences, we wanted to give viewers choice,” says Zach Leonsis, president of media and new enterprises for Monumental Sports & Entertainment. “That’s a really meaningful new programming opportunity, with our most valuable IP, that I think will benefit our fans.”

Monumental, which owns the Wizards and Capitals, acquired the RSN from Comcast last year, and Leonsis noted that under NBCUniversal ownership they experimented with stats and betting-focused alternate feeds.

“One of the key learnings from that experience, which was only about 10 games, was that the cumulative audience was a creative and not cannibalistic,” he says.

The biggest challenge for RSNs looking to go DTC is “going to be the customer acquisition process — that is a whole other kettle of fish,” says Hillary Mandel, exec vp and head of Americas for IMG Media. “Broadcast captures the casual fan and the DTC captures the true fan who wants to see all the games. And then you have to build interesting things and giveaways on top of that to get other people to tune in.”

But Begley and Swinburne, among other analysts, believe that ultimately the future of live local sports could be national, with companies like Amazon, YouTube or Apple emerging as local sports middlemen, or the leagues themselves could fill that role.

“Either the rights get folded into streaming contracts (for national rights) or regional offerings on national streaming platforms, or RSNs form a RSN consortium to share expenses,” Begley says.

“If the leagues could aggregate local rights across all its teams and sell them to national distributors, there is likely a model there although again we would be surprised if the new revenues match the old revenues in aggregate,” Swinburne writes, adding that to “maximize the value” the biggest teams need to be included.

In other words, companies like Amazon, YouTube or Apple could emerge as local sports middlemen, or the leagues themselves could fill that role.

But the RSN struggles are already impacting the TV business writ large, with major players in the space making strategic moves that appear designed for a post-RSN world.

On July 10, the cable TV giant Charter announced a significant change to its TV lineups, splitting its Spectrum Select service into two options: One that will include RSNs, and another, cheaper version that will not, a stark change from the old standard of all subscribers paying for RSNs, whether they watched or not.

“While viewing habits continue to shift, it’s clear that regular season professional sports programming remains extremely popular with a core base of traditional cable, satellite, and OTT customers,” said Dan Finnerty, senior VP and GM of Spectrum Networks. “That said, given these customers represent a relatively small percentage of the overall video subscriber base, and recognizing the marked increase in direct-to-consumer choices, the model for RSNs needs to evolve to reflect the realities of the current marketplace.”

In May, Paramount Global unveiled plans to take eight of its owned local TV stations in markets like Philadelphia, Seattle and Atlanta, and cut them loose from their affiliations to The CW. A big reason why? According to CBS News and Stations co-head Wendy McMahon, it’s in part to “look at new opportunities” including live local sports.

The CW, now owned by Nexstar, is also exploring if there are local sports rights opportunities in its station footprint, sources say.

The landscape is shifting every week, as the future of the RSN business grows more uncertain.

But the changes also underscore an undeniable fact: “The RSN business, over an extended period of time, has shown there is real value in live local sports rights. It’s just that you have to turn the model on its head,” Brodkin says. “What’s been proven in the time that we’ve been looking at alternatives to RSNs is that others—networks and platforms– want these rights and are prepared to take risks to get them.”

In fact it was the rights that were key to Monumental’s deal with Comcast: “We are believers in the value of our live local rights, and that’s what we really acquired back from NBCUniversal and Comcast,” Leonsis says.

And while Diamond and a handful of other companies still hold many of those live rights, when they become available either through bankruptcy or expiring deals, it’s apparent that the local sports media landscape will undergo a major transformation.

A version of this story first appeared in the July 14 issue of The Hollywood Reporter magazine. Click here to subscribe.

Best of The Hollywood Reporter

Meet the World Builders: Hollywood's Top Physical Production Executives of 2023

Men in Blazers, Hollywood’s Favorite Soccer Podcast, Aims for a Global Empire