Based on China EV Maker NIO’s US IPO Pricing Model, — Here Is A Documented Case For The Upcoming Kandi-Geely JV Public Offering To Take Partner Kandi Technologies (KNDI) Stock To At Least $24 in 2019…

By: Arthur Porcari

Harvest Exchange

December 11, 2018

Based on China EV Maker NIO’s US IPO Pricing Model, — Here Is A Documented Case For The Upcoming Kandi-Geely JV Public Offering To Take Partner Kandi Technologies (KNDI) Stock To At Least $24 in 2019…

That’s right, by the time you finish this article, I will make the mathematical case that China-based, NASDAQ listed Kandi Technologies, Inc. (KNDI) who is a 50% JV partner in the JV, will independently trade with at least a $1.5 billion market cap (around $24/) based on price arbitrage over the next year and will probably have its own Wall Street support by the likes of Goldman and Morgan.

10 weeks ago at the time of the NIO Auto (NYSE-NIO) IPO, China’s second pure EV company to list on a major US stock exchange behind KNDI, I published an Article on Harvest that was picked up by Yahoo Finance titled: (NOTE: if the venue you are reading this article does not show active links in the body, see Note at the end of this Article)

NIO Inc, China’s $12 Billion EV Startup Becomes 2nd US Exclusive Listed Pure EV Maker --After 10 Years of Successful EV Trailblazing, NASDAQ Listed Kandi Technologies Shareholders Welcomes NIO Aboard.

The NIO IPO Underwriting team was led by Goldman Sachs and Morgan Stanley. While NIO had a cool reception on day one even at its sharply reduced IPO price of $6.25, it more than doubled over the following few days to over $13 increasing its Market Cap to over $14 Billion. Curiously, and important to this article, Goldman and Morgan were two of the same lead underwriters that for years worked closely with Kandi JV 50% partner Li Shufu and his personal holding Company, Geely Holdings’ on numerous financings. In fact, they were commissioned earlier this year to bring his wholly owned Volvo Cars public. After much publicity Li wanted an IPO price as high as $30 billion on this $1.6 billion purchase from 2010, that deal was put on hold due to a disagreement on pricing valuation at the time. Later you will see how this is an integral part of getting KNDI to the $25+ price.

OK, those who have read my past articles on KNDI, know they are usually lengthy writings with a lot of history and pertinent facts. This is not happening so much this time. If you want or need a lot of KNDI background info with links then I suggest you start by reading the detailed version with links of my last KNDI article on Harvest.

I originally planned on putting this out in a detailed article after the new year but based on news coming out of China regarding the lynchpin of my prognostication, the JV licensing, it now seems very possible Kandi JV could win this license before this year's end. So I decided to put out this “heads-up” on the true significance of this event so when it happens, savvy investors will be ready to immediately capitalize. (there is a lot of information here so don’t hesitate to bookmark)

The New 2019 Kandi-Geely Global Hawk Fleet

Here Is My Logical Premise For A Quick $25 KNDI Stock Price.

It really is quite simple. After three years of preparation since Kandi Geely JV BOD approval to bring the JV Public, once the Kandi Geely JV receives its Manufacturing License from the China government, the IPO preparations will accelerate. When it is priced, it is most likely that 50% JV partner multi-billionaire auto-industrialist Li Shufu total owner of Geely Holdings, who has personally “written checks” totaling some $200 million USD for his 50% Kandi Geely JV stake over the past few years will demand of his Underwriters at least a $2 to $3 billion JV IPO pricing.

Assuming at the time of the offering, 20% is sold to the public ─then KNDI’s 40% JV equity ownership alone will be mathematically valued at between $15 and $22.50 a share. It is my belief that Li Shufu will bring on-board his long-standing Underwriting team led by Goldman and Morgan who are currently on hold with the Volvo IPO. Coincidentally, this is the same underwriting team that led and priced the NIO offering with a $7+ billion MC. Whether the offering is done in China or the US, these high profile underwriters have high exposure and big clout in both markets.

Having owned an underwriting IPO firm in a former life, I can assure you that Underwriters want to bring offerings as high a price as possible. The higher the price, the bigger the fee. Add to that the reputation, quality, and profile of the target and its Management and whether any additional business can be directed and the pricing becomes even higher. In most IPO cases brought by high profile issuers, there is no real way to pre-play the offering. In this rare case, there clearly is ─through KNDI shares!

Common sense would dictate that before the JV IPO could be priced at a demanded level, its 50% pubic partner shares must be trading at a premium to its perceived IPO equity value. If not, then arbitrage undertaken by the underwriters and others will either have to take public partner-owners price (KNDI) to an equity premium. If this doesn’t happen then the JV IPO will have to be done at a lower price. In KNDI’s case with its, micro-cap float, value disconnect due to confusion over its JV structure (which the IPO will finally unlock) strong independent business, wholly owned $160 million real estate asset and a massive short position, should make the move up on KNDI to a premium of its residual JV ownership a simple task for quality underwriters like a Goldman etc.

Now I Will Make My Case By Assembling The Pieces.

For the sake of this article, I am going to all but ignore KNDI; the US traded Company that owns half and also manages the Kandi Geely JV. Outside of the JV, KNDI is also an independent OEM for EV products which it sells to the JV and others. Kandi sells products such as EV Motors, Batteries, Battery Management Systems, Air Conditioners, and various lesser EV parts. It is also the sole owner of US-based SC Autosports, a recent accretive acquisition which in its first full quarter was a significant contributor to KNDI’s strong Q3 revenues.

Be Aware: Through its 100% owned SC Autosports, KNDI will be the First China EV Maker to sell EVs in the US Market. Initial sales will begin with the EX3 and K22, in early Q1 2019. In fact, KNDI SC has already received US IRS approval for KNDI EVs to receive $7,500 tax credits besides state and local making its “flagship” EX3 mini-SUV loaded with a 220-mile range priced after incentives under $20,000 and under $10,000 for the K22. The start of sales in the US should create US National recognition and a big boost for KNDI shares. Though listed in the US, KNDI still has miniscule US identification. On the last Conference Call, the Chairman said that once sales are ready to begin, he would come to the US for a major media event. ─IMO, likely even a “bell-ringing” on NASDAQ.

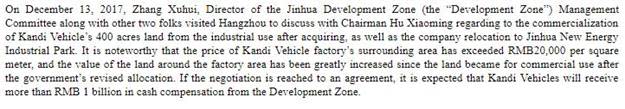

As an example of KNDI’s free-standing independence, in this last quarter, KNDI had total revenues of $38 million almost double the $19.8 million generated by the KNDI JV. KNDI’s revenues do not include any revenues from the JV since KNDI does not own over 50%. Let me also note here that KNDI solely owns a legacy manufacturing facility in Jinhua China on prime property with a lot of land, where the local Government is in negotiations with KNDI to purchase this facility for approximately 4 billion RMB ($160 million). This facility is currently being carried on KNDI’s books at around $9 million. From Pg. 8 10K

If you need to learn more about KNDI and its value sans its 50% ownership in the JV, you can read my prior article. For the sake of reaching the titled >$25 per share claim for KNDI, I can show you the path with over 80% coming from the JV. And I don’t mean speculative stock market valuation, I mean by hard arbitrage valuation.

Let us begin.

Assumptions necessary for KNDI to reach my $24+ conclusion

KNDI Owns 50% of the Zhejiang Kandi Electric Vehicles Co., Ltd. (Kandi-Geely JV)

Kandi-Geely JV is Awarded its own Manufacturing License in the very near future

Kandi-Geely JV follows through on past reported intent to then immediately activate and execute its plan to bring the JV Public.

20% of the JV will be sold on the public offering leaving KNDI with a 40% ownership.

Market Cap on the public offering at least $2 Billion or around 30% of the severely reduced NIO IPO market cap that the Goldman Morgan led Syndicate settled on and 25% of NIO’s current market cap.

KNDI and JV Chairman Hu From the last 10K Conference Call pg 16

That's it. This is all that has to happen and like magic, KNDI’s share price will have to be trading in the $24 per share area at the time of the JV public offering… Why? Because if it isn’t the IPO price has to be reduced. Something I don’t think Li Shufu would accept.

OK, if you really need it, let me put some JV and KNDI pieces, along with NIO together for you (most of this is extracted from my last article)…

The Kandi Geely JV. This was initially a JV formed between KNDI and Geely Auto, the HKSE listed (HK-0075) Geely Auto which is the fastest growing automaker in China over the past two years. However, there is also a second Geely company called Geely Holdings. Though confusing to even the media at times, Geely Holdings only tangible common thread with Geely Auto is it being its largest shareholder.

Geely Holdings is a private company 100% owned by Li Shufu one of China's ten wealthiest men and unquestionably Top Auto industrialist. Li is Chairman and owns 44% of Geely Auto, 100% of Volvo, 100% of London Black Cab, and varying major interest in half a dozen other known companies like Lotus and Daimler,. Unquestionably by any measure, he is the best possible partner KNDI or any EV Auto start-up could ever have hoped for in China.

To clear up some past confusion. While the JV started as a 50-50 partnership with Geely Auto, because of a change in the government requirements for an EV company to get its own EV Manufacturing license, in October 2016 Li Shufu personally acquired Geely Auto’s 50% interest for approximately $120 million cash along with liability assumptions from Geely Auto. That requirement change is that in order for an EV company to get its own independent license a company must have no shareholder with an existing auto license (as Geely Auto did) owning over 20% of the applicant's shares. So Geely Auto position was taken out at a small profit by Geely Holdings and its Chairman, Li Shufu. The JV received an agreement in perpetuity to continue to allow Geely Auto’s license to be used by the Kandi Geely JV to make and sell EVs and instead of a license fee, Kandi JV buys some $300 per EV in body parts from Geely Auto.

An important point re. China EV licenses. While it may change when the new awards soon come out, before the suspension of issuances 18 months ago, the rule was the licenses could be issued in two stages. Of the original 15 applicants issued, 14 were issued two-part licenses and one (BAIC NEV) who like Kandi JV owned its own facilities with plenty of capacity and was already selling EVs, received an almost simultaneous full license at the beginning. In the case of the two-part license awards, the manufacturer was first issued a “conditional license” based on a lot of cash and approved plans to build manufacturing facilities over the following two years. If the plant was built on time, was approved on a final inspection and began selling EVs, the Manufacturer would get his final license. To date, nine conditional licenses met the test, started selling EVs and now joined BAC NEV with full licenses. The rest look likely to lose their slots.

So, for the moment, KNDI is building and selling EVs in a similar agreement as NIO has with JAC motors but with significant differences. The primary differences being:

NIO

Owns no operating Manufacturing Facility However has started construction started on its first with a 2021 Expected completion date.

While NIO has some oversight management in place, all of its current EVs are contracted out, made and licensed through JAC Motors, a China State Owned Enterprise (SOE) Automaker.

NIO states in its prospectus it expects to get its own license in “two to three years” pg., 21

Therefore, NIO must rely on a third party for full manufacture and licensing.

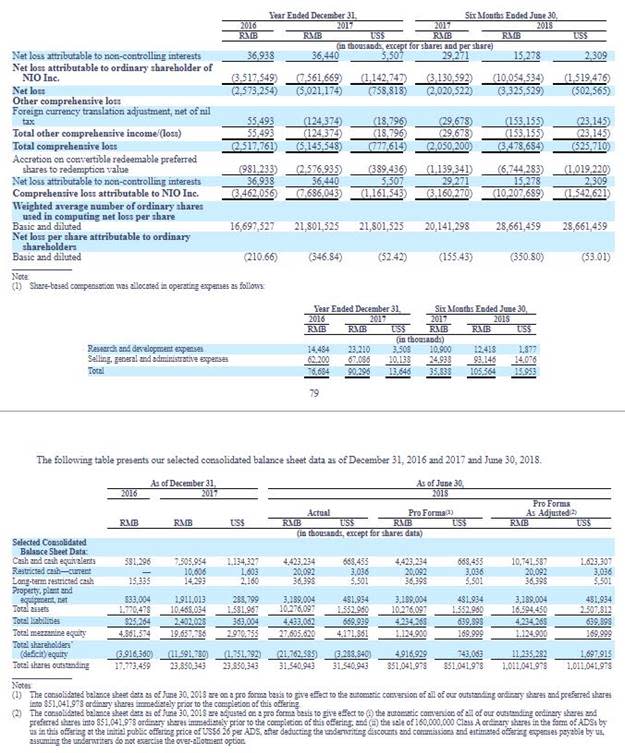

Before their IPO, Jun 30, NIO reported Total Assets of $1.43 Billion Shareholders Equity of $743 million. For the six months ended June 30, loss of ($1.55 billion) reported. Pg. 11-12.

NIO had Total Assets of $1.5 billion prior to the IPO. The reduced IPO pricing was set just under 5 times TA.

Kandi Geely JV

As pictured above, Kandi JV owns and fully operates four (three built by KNDI) 100,000 capacity pure EV facilities. Shanghai, — Changxing, Zhejiang Province — Rugao, Jiangsu Province and Haikou, Hainan Province. (Total Replacement Value, >$900 million)

All plants and employees belong to the JV.

Kandi JV’s current 2019 fleet of fully certified EVs, EX3, K27, K23, and K22 are made in these JV owned facilities. (pictured above)

KNDI Geely JV, as seen below in the SEC filing extract, has favorably completed all certification testing for its own manufacturer's license. Management was notified that when the window for new licenses re-opens, the JV will be the first to receive the award.

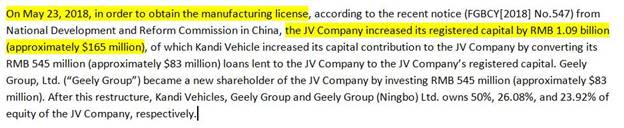

As further confirmation of its imminent licensing status, KNDI reported in its Q2 10Q that KNDI and its partner Geely Holdings was notified in May that the new requirement for an award of a license was a doubling of paid-in capital to 2 billion rmb. KNDI and its partner in late May each contributed $81.5 million bringing the paid-in capital now to over $310 million. Pg. 5

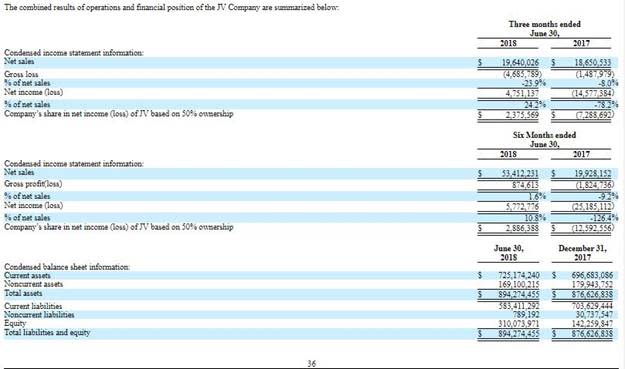

As per KNDI Q3 10Q, Kandi Geely JV had $894 Million in Total Assets and $310 Million in shareholders' equity. For the six months ended June 30, JV Net of $5.6 million reported. Pg.36.

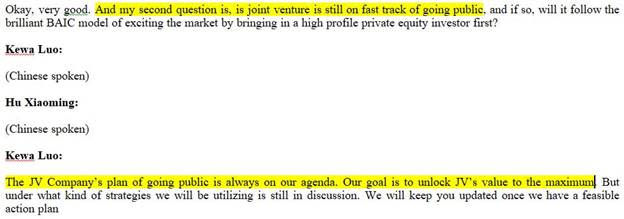

Is being awarded a Manufacturing license mandatory for the IPO? The simple answer is no. Look at NIO, By its own declaration, it is years away from even expecting a license and it was brought public with a $7+ billion Market Cap. However in Kandi Geely JV case, the mutual agreement reached two years ago by Xiaoming Hu, Chairman of both KNDI and the JV, and Li Shufu, Geely Holdings owner of the other half, stated —they want to bring the JV public in China and both feel it very important to go public without having to rely on a third party license holder for future growth.

So based on knowing this self-imposed requirement, I am writing this to give a major Heads-Up to smart investors to be cognizant of the uber-importance of the simple announcement I believe will come in weeks as reported below, not months, of the KNDI JV being awarded its own license.

How The NIO IPO Relates

NIO was brought public as a purely speculative start-up and high-end future competitor of Tesla. In other words, it was created to build EVs for the top 5% of consumers. Because of tariffs and related escalating trade talk, initially, China markets and now US markets are suffering large declines mostly due to investor malaise. As early as this past spring, there was much Wall Street talk about bringing NIO public with a $15 billion-plus Market Cap, this despite they only having one EV on the market and some 2,500 total sold of this $60,000+ EV. In the first half of 2018, as you can see from the tables further on, NIO burned through over $1.5 billion in losses leaving it with less than half that amount remaining in Shareholders equity from their past private placements. It should be obvious by the time of the NIO offering three months after this filing, if the burn rate was the same, adjusted Shareholders equity was likely pushing zero. This a likely reason they were willing to suffer such a large reduction in IPO pricing expectations.

Note: I am not trying to belittle NIO’s current $8 billion Market value with my comments, Based on market potential, it seems to be undervalued compared to TSLA, For example in October TSLA sold only 211 EVs in China compared to 1573 for NIO and 943 for KNDI JV. I only want to establish Market Cap value base from which an underwriter might look at KNDI Geely JV.

Now let's look at Kandi Geely JV condensed income statement and balance sheet for the same period as NIO.

Note: Though KNDI JV seems to have an inordinate amount of AR, close to $300 million of this is due from the China National Government in owed past subsidies going back to late 2015. While this slow-pay might be a concern in the US, not so much in China, where banks are always willing to lend money at attractive rates against this government paper. Make a note from this filing that the JV is in excellent financial shape with positive working capital over $141 million. Commensurately, the JV owes KNDI some $110 million for “parts” fronted by KNDI to the JV. This little-known fact has caused continuing consternation by short-seller who have been promising either KNDI’s financial demise or drastic need for an equity financing. As any worthy 50% JV partner would espouse, KNDI Chairman Hu, if ever feeling financially pressured would either force the JV to do its own Private Placement offering to pay back its debt to KNDI or foreclose on its assets. This before doing a KNDI equity offering at the current prices. No further proof is necessary that Chairman Hu has no interest in a KNDI stock offering than to note that as recently as a few months ago, Hu has bought over $3.2 million in KNDI stock and has never been a seller. Additionally as mentioned above. Li Shufu wrote a cash check for over $81.5 million to match KNDI’s JV contribution in order to not be diluted from his 50%. Also evidence he has no interest in the JV doing a cheap financing.

The Kandi Geely JV spent the first half of this year designing and replacing its complete, now legacy, EV fleet of K10, K11, K12, and K17 which had ranges of 120 to 200km and outdated looks, with a new fleet of K22, K27, K23, and EX3. Each of the new cars has multiple versions with ranges from 200+ to 380km all in the upper range of all EVs. It can only be considered impressive in KNDI JV still reaching profitability while liquidating old inventory as it has the first two quarters of 2018.

As of the beginning of Q4 18, three of their four new EVs are now fully approved for sale, sales tax abatement and federal subsidies reaching as much as $10,000 total per EV. The fourth, the K23 is expected to reach that point any day now. Here is the new fleet.

With 943 of the new EVs sold in October, mainly the EX3 that was only released for sale on Sept. 26, this brings JV’s year to date sales total to 7,542. Again a respectable number considering 90% of these sales were liquidating legacy EVs. This compares to 4,941 for NIO though ten months (JV Nov. numbers won’t be out until around Nov. 12) and well on its way to breach 15,000 units for the full year now that all new EVs are being sold. Should this level be reached, the JV would likely have Q4 revenues of over $150 million and net income of >$16 million. While the Company has given no guidance for Q4, a “tell” of a strong “next quarter” is the large jump in prior quarter KNDI revenues. KNDI ships parts to the JV one to two months before the EVs being built. That KNDI just reported its best revenue quarter in two-and-a-half years at $38 million, is a “tell” that a lot of parts will go into a lot of cars that should show up on the JV top line in Q4.

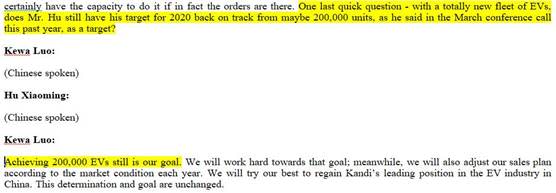

For those concerned about the huge excess capacity in the JV, Management has often stated that these new facilities were built at optimum times when Government largess was at its peak for EVs. The cost of building a 100,000 capacity new facility is not much more than building a 25,000 capacity plant in China. Even maintaining basic maintenance is not overly costly as seen by the JV’s ability to turn a profit even at 5% of capacity. This mainly due to non-union auto workers. While things have slowed somewhat since the KNDI Q2 CC in August, Chairman Hu confirmed the JV company’s goal to be on track for 200,000 EVs per year by the end of 2020 as you can see from this excerpt from the Aug. 9 Conference Call. pg. 18

What To Expect On KNDI’s Strong Move Up.

Step 1. Look for the announcement that the Kandi JV is awarded its own its own license which likely will be a full license at one time.

Step 2 Expect Li Shufu to have the JV retain Goldman and Morgan as Investment Bankers/Underwriters.

Step 3. Expect Li Shufu to ask for at $3 billion Market Cap but if not doable, at least $2 billion.

Step 4. If the Underwriters balk, expect Li to remind them of the NIO’s $7+ Billion IPO pricing that Goldman and Morgan established and compare it to Kandi JV’s long history, license, 50,000 units in past sales, much stronger relative balance sheet and income statement and most of all, some $900 million in new facilities with four new EVs and much larger target market.

Step 5. Once the IPO Market Cap is established, expect KNDI’s price to stealthily but rapidly increase to above $20 if the pricing is on the low $2 billion and upper $20’s to $30+ at the $3 billion higher end.

Step 6. KNDI stock has languished due to not having any analysts following. Look at KNDI’s residual post IPO equity ownership in the JV, somewhat as you could look at Altaha (AABA) which is the residual proxy for the Alibaba shares kept by Yahoo shareholders who have now seen its price rise to over $80 a share thanks to BABA’s rise earlier this year. A price the old Yahoo itself hasn’t seen in almost 20 years. For a similar reason, KNDI shares will have to rise to a premium to its JV equity value for if not, a prospective equity investor would buy KNDI shares rather than the JV. The major difference being is AABA is basically a holding company with no business other than to hold shares, primarily of BABA, whereas KNDI besides tracking the value of its own JV shares, it will also continue to sell parts and even EVs itself in the US. Based on history since the JV was formed, KNDI has been generating revenues well over 50% of the JV just by selling parts to the JV.

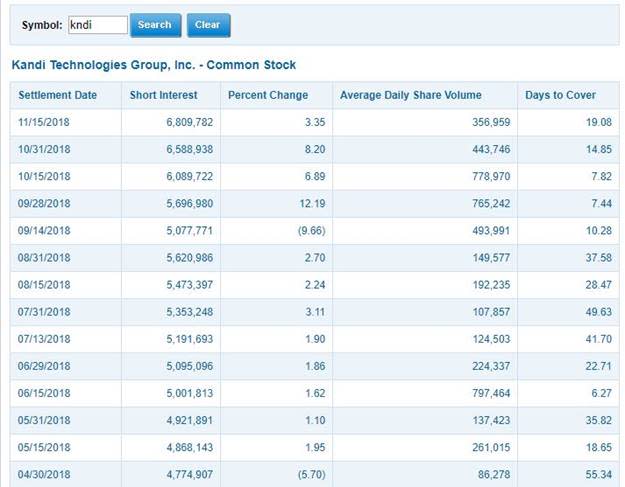

Step 7. Recent stock activity. ─As you can see from the below table, KNDI’s almost 7 million shares reported short position has grown dramatically by over two million shares the past six months with 1.8 million in just the past four reporting periods (two months). All of this last move at or around current prices. Why? Anyone's guess, but three high-value positive events stand out as a likely contributor. The first being a large 3 million share day with an inter-day move from $4.05 to $5.25 which coincidentally was Sept. 14 the day after NIO came public and the day I put out my last KNDI Article. Also noteworthy, Oct. 29, with a 2 million share day when a heavily followed stock subscription letter published by Paul Mampilly told his subscribers to get back in KNDI with the stock back at the $4 level. Inter-day it hit $5.00 and week later $5.29 all on above-average volume. And most recently on KNDI earnings day and Conference Call, the Company delivered a large upside revenue surprise of $38 million vs. around $20 million expectation but also took an unexpected one-time $6 million R&D expense which took it to a small net loss for the quarter. Before the Conference Call even started, the pre-market had the stock down some $.30 to $4.96 from its prior day close of 5.26. Then during active trading, it closed at its low that day at $4.71. These contrary actions were likely caused by the large Institutional hedge fund short sellers attempting to temper excitement causing retail investor concern. Effectively making a “sows ear out of a silk purse” coinciding with the good news to demoralize investors.

These three “triggers” likely caused the already large KNDI short interest to balloon during this short time in attempts to kill each chance of the stock gaining sustainable upside momentum by these positive events. In the short run, as Jim Cramer a decade ago related on TV found still on Youtube the following: “Jim Cramer reveals dirty tricks short sellers use to manipulate stock prices down” Cramer educates about several short seller tricks he used in his hedge fund days that are clearly still in use today to obfuscate the story and demoralize supporter from squeezing his short. Even though a lot of the tricks were illegal, the end justified the means. .

But the bottom line is “use your own common sense”. Is it logical that both Chairman Hu who recently bought another 156,000 shares of KNDI stock at an average price around $4.50, and Li Shufu who increased his $120 million investment by an additional $81.5 million of the JV stock in the last six month both lost their sanity? I would think a bet on Management over trapped short sellers would be the wise path to choose. Once the JV gets its license and signals the JV IPO is underway, finally, the playing field will level as new opportunist funds and large investors will recognize KNDI for the grossly undervalued opportunity caused by the short by its obvious wrong-way short bet.

So, What To Do?

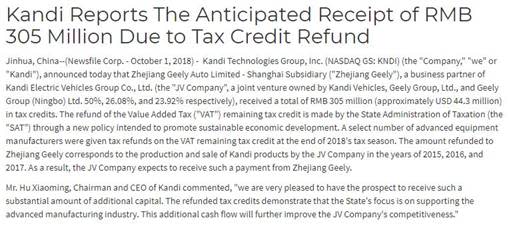

IMO, at the current price of $4.14 KNDI with only a $212 million Market Cap, KNDI is grossly undervalued. Why? It has been marginally profitable most recent quarters; It has a reported tangible book value of $4.80 a share which would increase to $7.70 if the aforementioned 100% all KNDI owned Jinhua facility sale to the local Government completes at the currently discussed price of 4B RMB ($160 million). Also not included in the recent financial report is the value of the KNDI half of a recently awarded $44.3 million VAT tax refund. October 1st, the Company announced the JV received a surprise notice by the National Government that it had been named from a select group of advanced equipment manufacturers to be given a $44.3 million rebate of its 2015-2017 VAT tax paid. By one day, it was too late to be reported on Q3 numbers so it will be a reported as a Q4 windfall.

KNDI itself is owed a final $15 million installment check from Hainan Province to be paid as soon as the new K23 begins sale and that is supposed to happen by the end of December. And the Management stated on the last Conference Call that it was expecting a large chunk of the almost $300 million in National Subsidies would be paid to the JV by year-end who will, in turn, pay off some of the $110 million the JV owes KNDI.

If you think the short who has been in a 4-7 million share short position in KNDI for the last seven years knows more about this eleven year listed company than Chairman Hu whose salary is less than $30,000 a year yet recently resumed buying stock or Li Shufu who in the last six months wrote a check for $81.5 million to the JV to maintain his 50% ownership than you should pass on buying any right now. Even if let’s say it is at $10 a month from now because the License has been awarded, you still have plenty of upside over the following few months prior to the IPO as it roars through the twenties.

On the other hand. If you believe Management knows more about what is happening in Kandi and the JV Company than the short-sellers, by all means, nibble here. When you do see the announcement, or if you are lucky, you might even hear or read about it on Twitter or Stocktwits where it was gleaned early from the China Media who often get the news first, then be a true capitalist and take strong advantage of your good fortune to buy this stock below even the high it hit the first day trading in March 2007.

Let me leave you with one thought why you want to own an EV stock in China, even if it is NIO. Currently, China has approximately 165 Autos per 1000 population. The US has 910 per thousand. China has four times the number of people as the US. So in order for China to reach the US numbers, it has to sell more than 12 times the number of Cars to catch-up with the US. China has already said it is going to go “all green” as rapidly as possible. No Matter what happens to either the US or China economy, China, due to environmental concerns has to fully support EV expansion. So if your concern is it is too late to get involved in the China EV sector, or even if you think KNDI JV having so much excess capacity is problematic, don’t be. In a few years, KNDI is going to have a “three digit handle”, no matter who holds the shares at that time.

The author is long KNDI Common and Call Options.

NOTE: I have no way of knowing whether this article will be picked up by Yahoo Finance News as my last article was. For some reason, when Yahoo finance picks it up, it seems to lose all article links. IMO, a very important part of the article I strive to make available for reference and confirmation. If that happens and you found this on Yahoo Finance, at the bottom of the Yahoo article, you should find an independent link to the original source article on Harvest. I suggest you follow that link as that article will be complete with all links provided.

Originally Published at: Based on China EV Maker NIO’s US IPO Pricing Model, — Here Is A Documented Case For The Upcoming Kandi-Geely JV Public Offering To Take Partner Kandi Technologies (KNDI) Stock To At Least $24 in 2019…