'This was a banner jobs report': What economists are saying about the July jobs numbers

The July jobs report topped expectations

and sent the unemployment rate to a 16-year low.

And economists almost uniformly see this report as good news for the economy.

“This was a banner jobs report,” said Jed Kolko, chief economist at Indeed.

“With the strong payroll number in July, job growth in the past three months is ahead of the 2016 pace and way ahead of what’s needed to keep up with population growth. Working-age adults are now more likely to be employed than at any time since the recession.”

In July the U.S. economy added 209,000 jobs and the unemployment rate fell to 4.3%. Expectations were for payrolls to grow by 180,000. The unemployment rate fell as expected.

Shortly after the report’s release, President Donald Trump tweeted about the report, saying “Excellent Jobs Numbers just released – and I have only just begun.”

“For the second straight month, payroll employment beat consensus expectations,” said Neil Dutta, head of economics at Renaissance Macro.

“The July employment report was solid all around with strong payroll growth, rising earnings, and an improvement in labor force participation. The labor market data seems consistent with an economy growing 2.5 to 3.0 percent, not 2.0 percent.”

By industry, job gains were concentrated in the services sector with leisure and hospitality employment rising by 62,000 in July while the education and health services industry added 54,000 jobs. Professional and business services jobs rose by 49,000 in July.

Overall, 22,000 jobs were added to the goods-producing sector, with 16,000 jobs added in manufacturing and 6,000 added in construction.

The underemployment rate, which includes those out of work as well as folks working part-time but who would like full-time work, held steady at 8.6%. This rate has gotten more attention of late as President Trump’s chief economic advisor Gary Cohn has said this number is a point of emphasis for the administration. At the peak of the last labor market cycle in 2007, this rate fell below 8%.

Wages still disappoint

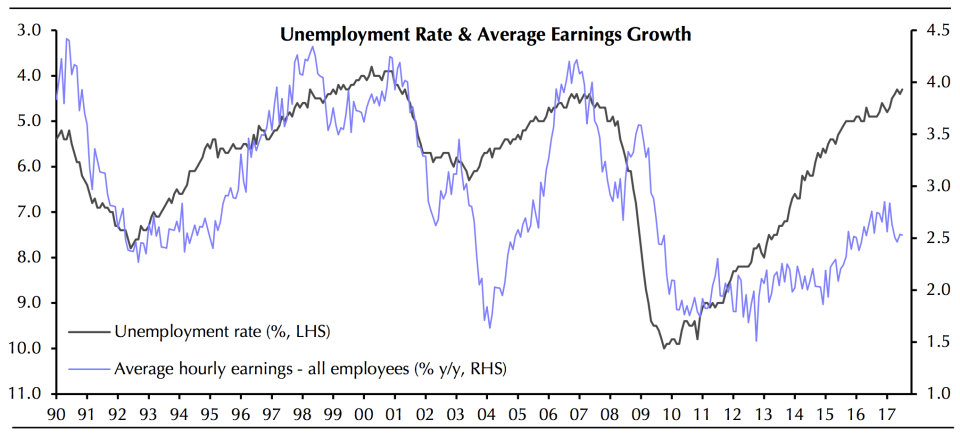

Also closely-watched on Friday were data on wage gains, which came in better-than-expected but still a bit disappointing given the job gains we’ve seen over the last couple years. Average hourly earnings in the U.S. rose 0.3% over the prior month in July and 2.5% over the prior year.

Michael Pearce, U.S. economist at Capital Economics, said in a note Friday that this report showed “signs that wage growth is starting to edge higher again.” The month-on-month increase in wages, for example, was the largest since October 2016.

The annual 2.5% increase in earnings, however, is still disappointing. “The big picture is that wage growth has been disappointingly weak given the fall in unemployment,” Pearce added.

Wage gains, however, still pose a puzzle as the Phillips Curve — an economic model that says inflation should rise as unemployment falls — has not been behaving as expected during the current cycle.

“The fact that the unemployment rate continues to slide without acceleration in wages remains a puzzle,” writes Joe Song, an economist at Bank of America Merrill Lynch.

“This could reflect a variety of factors including low productivity growth, employee insecurity about the health of the labor market, skill mismatch and sector specific stories. These factors likely will continue to be in play, but we think that it is only a matter of time before there is a modest move higher in wage growth. The bigger uncertainty is whether or not this translates to consumer price inflation.” (Emphasis added.)

Song said, however, that the July report was “positive across the board” and will allow the Federal Reserve to begin paring its balance sheet in September and raise rates again in December.

Labor participation increases

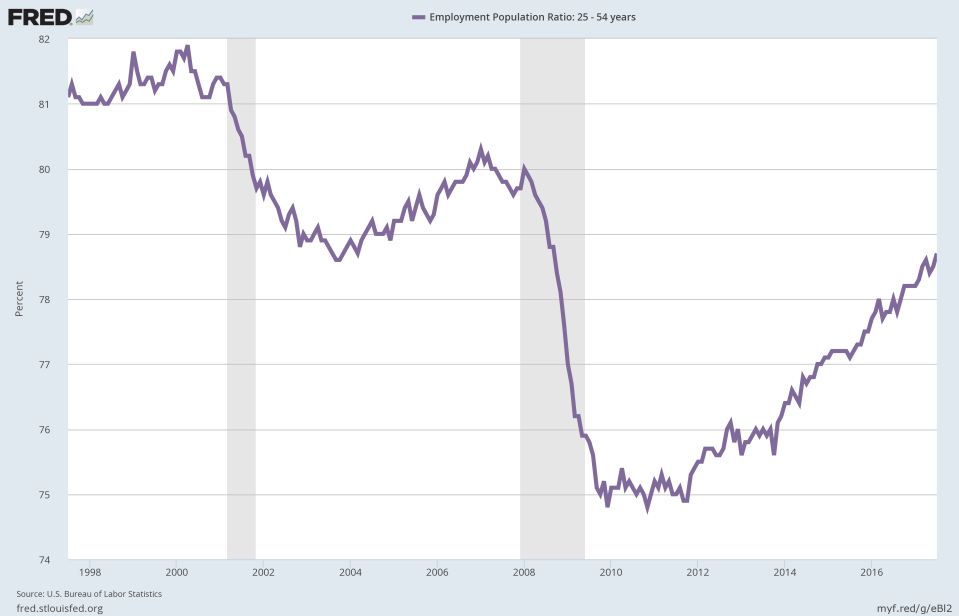

Another closely-watched measure in the jobs report is labor force participation, which rose slightly in July to 62.9%. This figure has gotten a lot of attention in recent years, with some (incorrectly) calling the balance of the population not in the labor force the “real unemployment rate.”

This number, however, has its flaws as the decline in labor force participation has not only been impacted by folks leaving the workforce following the crisis but also because of demographic factors.

A better gauge for seeing the progress made on labor participation is the employment-to-population ratio for workers between 25-54, which are considered “prime-age” employees.

In July, this rate moved to 78.7%, the highest since 2008 when this number was on its way down from a 2007 high over 80%.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: