Banks face a reality check, and we could learn the Trump rally is 'pretty much dead'

Investors may soon learn that the Trump trade is dying as the big banks start reporting their second-quarter earnings results this week.

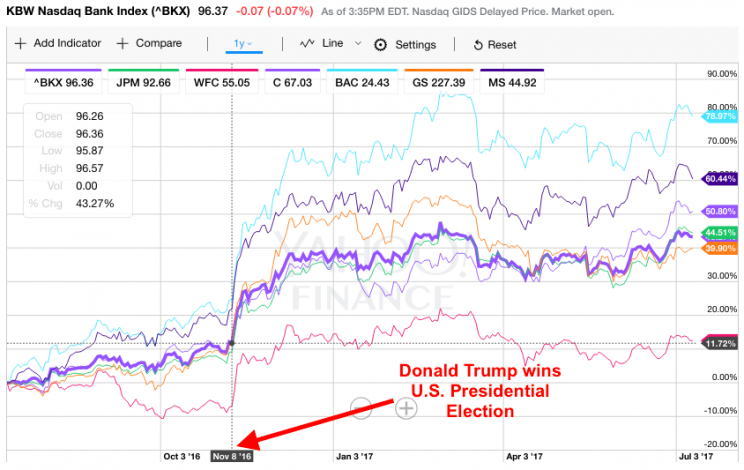

JPMorgan Chase (JPM), Wells Fargo (WFC), and Citigroup (C) kick off earnings season for the big banks on Friday, while Bank of America (BAC), Goldman Sachs (GS), and Morgan Stanley (MS) report their results next week.

The bank stocks were some of the biggest beneficiaries of the Trump rally, but while the stock prices have benefitted, the companies themselves haven’t.

“It has not benefitted company earnings because loan volume is weak, loan losses are going up, trading activity is disappointing,” said Dick Bove of Rafferty Capital Markets. “So while people may have been very optimistic and purchased the stocks on the expectation of what will happen, it hasn’t happened, and it’s unclear if it will ever happen.”

For Bove, the Trump rally right now is “between hold and dead.”

“I think the reason is because there’s no real conviction left that there’s going to be a healthcare bill, a tax cut, a tariff, fiscal stimulus, a wall built,” said Bove. “It doesn’t appear that any of these things are going to happen in the short run. Many are not going to happen at all. Some may happen, but in a truncated form. The net effect is I don’t think anyone is buying bank stocks on the Trump rally.”

Chris Whalen of Whalen Global Advisors told Yahoo Finance that the Trump bump “is pretty much dead” and “was never real.” Whalen expects that the “only lift” for financials this year will be changes in leadership at regulatory agencies.

‘Back to reality’

Whalen sees a quarter of banks missing or just meeting earnings expectations.

“Banks will meet or miss earnings, but top line will be light in many cases,” Whalen said. “Lending volumes are falling across the board, investment banking is light, and there is little momentum behind earnings for rest of the year. Residential mortgages could be a negative for many banks due to very competitive secondary market.”

Edward Jones analyst Shannon Stemm noted that a lot of optimism had been baked into some of the stock prices ever since the election. There was even a lot of optimism going into the summer with the Fed’s annual stress test results.

“Now the focus is going to shift a little bit back to reality as these companies report second quarter earnings,” said Stemm. “Again, there’s a lot to be optimistic about as it relates to future capital return, but if you look at some of the fundamentals behind revenue growth that could be challenged in the upcoming growth.”

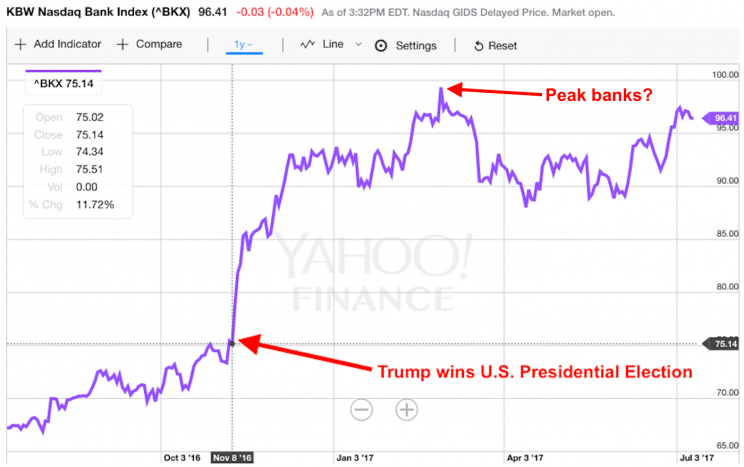

Bank rally loses ground

KBW Nasdaq Bank Index (^BKX) rose 3.9% during the second quarter, bringing its return for the first half of the year to 4.2%. The S&P 500 gained 8.2% in the first half of 2017.

Rafferty’s Bove pointed out that bank stocks peaked on March 1 and plummeted for a period of time on the recognition that earnings were not going to be that good. Last month, there was a raft of positive information about the safety of the banking industry when they all passed the Fed’s stress tests. There were also announcements of increased dividends and stock buybacks. They have since regained some of those losses, but they’re still below where they were on March 1.

“The question is what’s going to drive them over the next few quarters? I think the answer is earnings,” said Bove.

For the second quarter, Bove expects it to be “mediocre” with flat and slightly higher earnings.

For the capital markets banks, Bove expects there will be issues with their core business because of lighter trading activity. In late May, executives from JPMorgan and Bank of America signaled that there had been a slowdown in trading during the first two months of the quarter.

Investment banking activity should also see a slowdown because of uncertainty.

Edward Jones’ Stemm noted that a lot of company management teams are in a “wait and see” mode until they get better clarity around policies being proposed and discussed by the Administration.

“One of the main ones is corporate tax reform. Any progress there would likely be a positive,” said Stemm. “We would see a hold off on M&A and making investments until they get better clarity around the political landscape. Some of that could be delayed or pushed a little further into the future.”

Elsewhere, the traditional banks have been facing a tougher environment regarding weaker loan volume.

“The engine behind the growth in lending in the last couple of years has been on the commercial and industrial side. I think we are seeing a slow down there,” said Stemm.

Loan growth is a key driver for bank revenues. The deceleration from both the consumer and the commercial and industrial side could be indicative of the industry getting later into the business cycle.

Going forward, Bove expects that loan volume will stay weak, loan losses will increase meaningfully, and that banks will have to worry about the cost of deposits going up sharply.

On the whole, Edward Jones’ Stemm thinks there’s a fair amount priced into the stocks at this level, but there are still some opportunities. She noted that they have a fair number of hold ratings because they think the upside and the downside look balanced.

—

Julia La Roche is a finance reporter at Yahoo Finance. Follow her on Twitter.