From Artificial Intelligence to Profitability: 5 New Rules for Streamers in 2023 | Charts

The major streamers had a rough ride in 2022, with their stocks falling anywhere from 29% (Comcast Corporation) to 62% (Warner Bros. Discovery) in the past year. But 2023 will offer a fresh opportunity to turn those stock declines around — if they can adapt to the new rules for streaming success.

Last year’s battering on Wall Street was spurred by “too much competition all at once, accompanied by a recession and fears of persistent inflation,” Wedbush Securities analyst Michael Pachter told TheWrap.

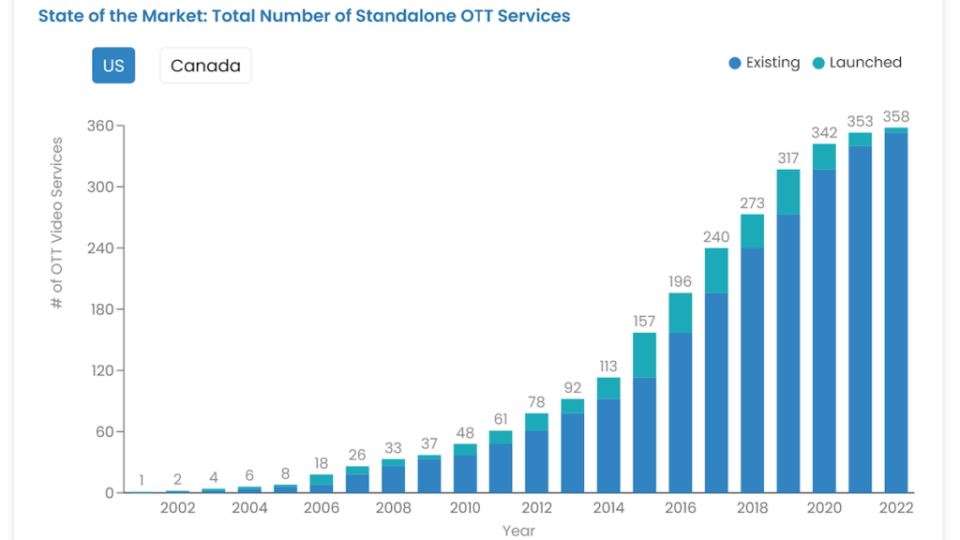

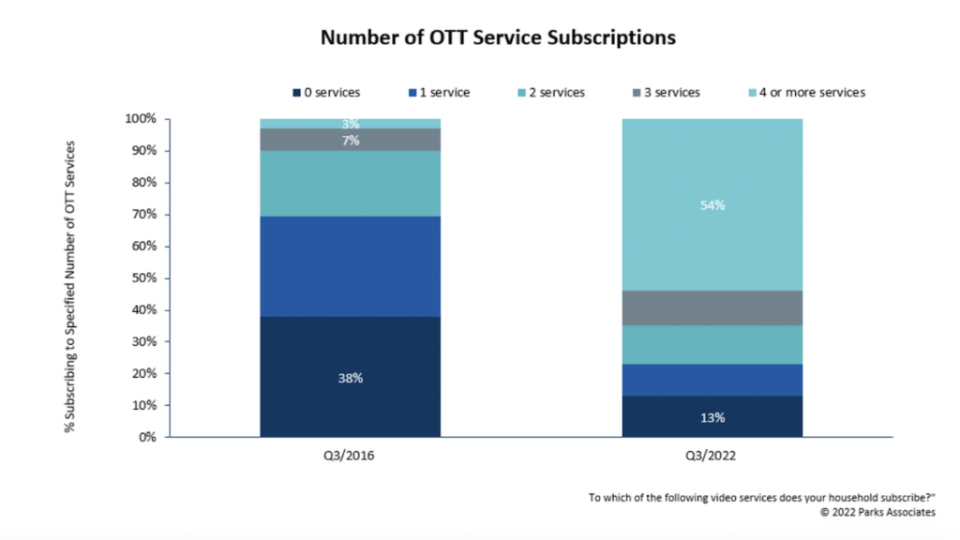

Parks Associates, which tracked over 350 standalone over-the-top (OTT) streaming services in United States alone in 2022, found that 87% of U.S. internet households subscribed to at least one in the third quarter of 2022, up from 62% during the same quarter in 2016. About 54% of U.S. internet households reported subscribing to four or more OTT streaming services during the third quarter of 2022.

“I think this will normalize next year but consumers are overwhelmed by streaming choices, unclear who owns which content and not willing to subscribe to everything,” Pachter said. “That leads to a lot of indecision, resulting in slower traction for the smaller services and slower growth at the bigger services.”

Below is a roundup of advice from Wall Street analysts and industry insiders on how streamers can find success in the new year.

Profitability will be the new metric for streaming success

Moving forward, it’s clear that subscriber growth is no longer the primary metric of success. The key metrics that Wall Street is looking at next year are profitability and average revenue per user (APRU) in subscription video on demand (SVOD) and advertising video on demand (AVOD), streaming media analyst Dan Rayburn said.

“You have to define winners and losers based on the balance sheet, because that’s how we define companies in any space from a single profitability standpoint. And if you’re profitable, you’ve got free cash flow coming in,” Rayburn told TheWrap. “What does that allow you to do? It allows you to do more creative deals, it allows you to up your content spend or maybe acquire another company.”

When Netflix came on the streaming scene in 2007, its primary competitors were Hulu and what was then known as Amazon Unbox (later Amazon’s Prime Video). Fast forward to 2022 and AppleTV+, Disney+, Peacock, HBO Max and Discovery+ have all emerged as new threats to the streaming king’s empire.

Also Read:

The Streaming Services That Are Priced Right – and the Ones That Miss the Mark | Chart

Unlike Netflix, Prime Video and AppleTV+, most of the streaming services are part of entertainment conglomerates that push out content through a wide variety of often very profitable non-streaming distribution channels including movie theaters as well as broadcast and cable TV networks — which often offer much more favorable profit margins — at least at the moment.

In order to break into the world of streaming, those conglomerates have been forced to forgo profits in their streaming divisions as they spend billions of dollars towards scaling their product and producing content to attract subscribers.

Going into 2023, Netflix has the advantage of being the only major streamer to turn a profit — though it took a battering from investors after reporting two straight quarters of losses in total worldwide subscribers last year. (Not to mention bursting the streaming bubble for many other companies newer to the game.)

Also Read:

2022 Was a Year of Hard-Earned Lessons for Streamers – Here Are the 5 Biggest Ones | Charts

Netflix’s profitability, achieved as the longest-standing streaming service, could force competitors like Disney to reevaluate their own strategies as they face more shareholder pressure in 2023. After all, Disney CEO Bob Chapek was ousted just weeks after reporting $1.5 billion in streaming division losses just for the quarter ending Sept. 30.

“Netflix competitors have to decide whether streaming is just one leg of the stool and not going to be the all-encompassing channel for their business,” CFRA Research analyst Kenneth Leon told TheWrap. “Streaming seems to be the story if you’re a pure play. But if you’re not, then you’re trying to harmonize streaming with all the great assets you have.”

Wells Fargo analyst Steven Cahall predicted in a Dec. 20 note to clients that returning Disney CEO Bob Iger could spin off linear networks ESPN and ABC.

“Spinning ESPN/ABC is the best path forward and we see it as a reasonably probably late-’23 event,” Cahall wrote. “Splitting would leave [the remaining Disney company] as an attractive pureplay IP company.”

Also Read:

As We Say Good Riddance to Hollywood’s Annus Horribilis, Caution Is the Watchword for 2023

He added that Iger could also consider selling its two-thirds stake in Hulu to minority owner Comcast to “shore up the balance sheet and assuage fears from debt rating agencies.”

But analysts at MoffettNathanson have disagreed, arguing in their own note to clients on Dec. 5 that they “don’t think the math is a slam dunk for the risks involved.”

“Rather, the preferred path forward is to re-imagine all of Disney’s DTC assets starting with Disney+

Hotstar, Hulu Live and Disney+’s pivot to general entertainment,” the firm added.

Leon predicted that Disney will ultimately “move into the camp where [streaming is] one of many distribution channels.”

Content spending and release strategies will require more scrutiny

While content will continue to be king in 2023, reaching profitability and growing ARPU may require a reevaluation of content spending. In 2022, content spending on streaming ranged from as little as $3 billion at Peacock to $17 billion at Netflix (Disney and Warner Bros. Discovery spent in the tens of billions on content — but not all of that went towards programming strictly for their streaming services).

“Really good shows are still the best way to attract people. But there have been so many of them, just an embarrassment of riches really by the standards of any other point in time, that even the best, most expensive show can have trouble attracting an audience because there’s just not enough minutes in the day,” Hub Entertainment Research founder Jon Giegengack told TheWrap. “We saw Netflix in the last couple of years having a much bigger number of cancellations. I think those risks are no longer going to be tenable.”

Also Read:

12 Predictions for Media, Entertainment and Tech for Every Month in 2023 | PRO Insight

However, given the increasingly crowded streaming field, Ampere Analysis co-founder and executive director Guy Bisson warned major players risk losing their competitive edge by scaling back their content spend too much.

“For all sorts of reasons, precedents have been set in the market around an ability to binge content around the amount of new content you can expect on a platform each week,” Bisson told TheWrap. “So the market has moved to a point of no return in terms of content [spend], but that doesn’t mean that things can’t be done to put more money towards some of the cheaper formats, be a little more careful and cautious with what’s getting commissioned, and perhaps make more use of data and analysis to try and get it right.”

While Netflix ushered in streaming’s binge model, Giegengack said that all of the major streamers will inevitably shift to weekly releases as they are “forced to get more value out of every dollar they spend on content” to mitigate churn.

In the third quarter of 2022, premium SVOD subscription cancellations across Netflix, Hulu, AppleTV+, Disney+, Discovery+, HBO Max, Paramount+, Peacock, Showtime and Starz grew to 32 million, according to Antenna, up from 28 million cancellations in the previous quarter and 25.2 million cancellations in the same quarter a year ago.

“If people can binge-watch a whole show and then drop their subscription until the next season comes out, that’s a pretty tough calculation if you have to come up with a brand new, super expensive show to reengage them every time,” Giegengack said. “If you parse those shows out and the episodes come out once a week… and then parse them out further apart after that, each piece of content that you’re investing with can keep people engaged for a longer period of time.”

Advertising will be key to tapping into new subscribers and growing revenue

Another major hurdle in 2023 will be streamers’ fight amongst each other for advertising dollars as heavyweights like Disney+ and Netflix have launched cheaper ad-supported tiers.

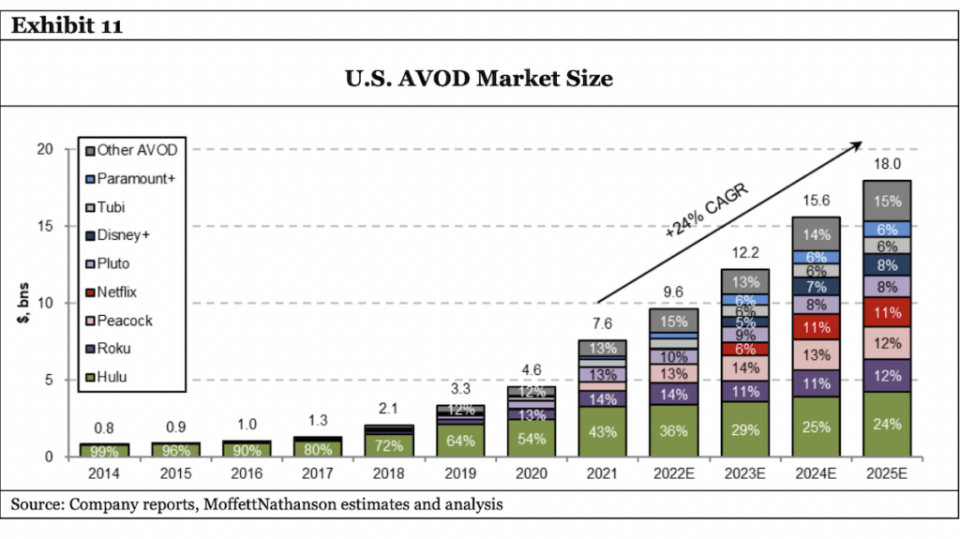

The U.S. market for AVOD services is projected to grow from $9.6 billion in 2023 to $18 billion in 2025 as engagement shifts away from linear TV, according to analysts with MoffettNathanson. Of that total, analysts expect Hulu to account for 24% by 2025, while the remainder will be divvied up between Roku (12%), Peacock (12%), Netflix (11%), Disney+ (8%), Paramount+ (8%), Tubi (6%), Pluto (6%) and other AVOD services (15%).

“Where advertisers and marketers go or spend their dollar is going to be certainly with the best and largest,” Leon said.

As subscription fatigue weighs on consumers, Third Bridge analyst Jamie Lumley expects niche streaming platforms like AMC+ and Crackle to be particularly vulnerable in this fight given the cost of content development and scale needed to attract ad-dollars.

“Considering their narrower appeal and smaller audience bases compared with giants like Netflix or Disney, there is less room to maneuver as they navigate this challenging environment,” Lumley said.

Streamers who strike bundle deals will separate themselves from the competition

As streamers look to navigate the current period of economic uncertainty, Morning Consult entertainment and media analyst Kevin Tran predicts 2023 will be the “year of the bundle.”

“Video streaming services will lean more heavily on bundling in 2023, as an emphasis on accessibility becomes heightened amid a tough macroeconomic backdrop,” Tran said. “We’ll see new examples of video streamers striking bundle deals with entities like music streaming services and non-media sector giants (think of the Walmart+ offering including Paramount+) to accelerate growth.”

Also Read:

Why Google Ceded the Race to Debuting a Superior Chatbot | PRO Insight

Brian Frons, the former president of ABC Daytime and a professor at UCLA’s Anderson School of Management, speculated that Amazon could accelerate consolidation in the streaming market by gaining share through deals with services such as AMC+, Shudder, Starz and Fubo.

“Amazon might take a minority stake in a few of the smaller streamers, in exchange for better sales support for subscriptions at Amazon.com,” Frons told TheWrap. “Then eventually Amazon can take them out and just use them as house brands in their video service — think Kirkland at Costco. They need a bundler with power, and that’s Amazon.”

Representatives for Amazon, AMC+, Shudder, Starz and Fubo declined to comment.

Streamers who leverage artificial intelligence will gain a competitive edge in keeping consumer attention

With the rise of new artificial-intelligence based technologies like Chat GPT, Samba TV CEO Ashwin Navin noted AI coupled with real-time viewership data will be “a complete game-changer to determine who wins the next few innings in the war for consumer attention.”

“Gone are the days of a few powerful people who are the tastemakers for an entire population that determine what shows get made and when they show up on everyone’s television. AI takes all that creativity and amplifies it dramatically,” he explained. “With more limits on budgets in 2023 and more severe competition for attention, data and AI will be the key ingredients to win the hearts and minds of every viewer one-by-one, in a scalable and efficient way and at global scale.”

Also Read:

5 Things to Expect From Streaming in 2023 | PRO Insight