How America's businesses are paving the way for 3% GDP growth

The Trump administration has proclaimed a pace of 3% GDP growth, a lofty rate that has been met with skepticism from economists. After all, consumer demand has been lukewarm, and consumption accounts for almost 70% of GDP.

But there’s another budding source of growth: business investment.

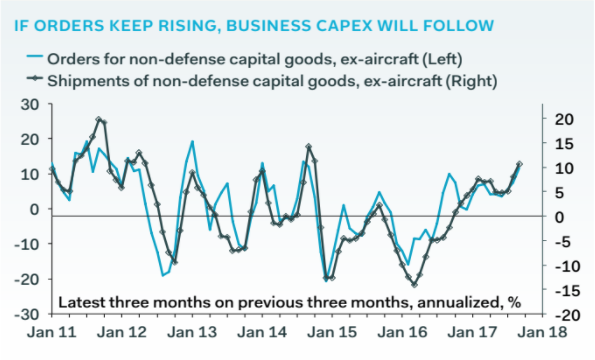

In the third quarter, orders for core capital goods orders — a proxy for business investment — rose at an 11.6% annualized rate, the best performance since the fourth quarter of 2013.

“It is entirely possible for overall growth to reach 3% even with consumption growth barely exceeding 2%,” according to Pantheon’s Ian Shepherdson. “Business surveys suggest this pace is sustainable. If they’re right, it would be reasonable to expect accelerating spending on business equipment, which accounts for 6% of GDP, to offset the sluggishness of consumption.”

Recent reports from industrial companies confirm increased investments. For example, just last week, United Rentals (URI), the largest equipment rental company in the world, increased its 2017 capital expenditure (CapEx) plan.

“Our new guidance increases our CapEx plan to up to $200 million this year and the broad growth to end market demand is strain our fleet in some geographies,” CEO Michael Kneeland said on the company’s recent earnings conference call. “Our customers need equipment for projects, and we need to be there for them.”

Meanwhile truck manufacturing heavyweight PACCAR (PCAR) announced increased spending, estimating $400 to $450 million in capital spending this year that will increase to $425 to $475 million next year.

“PACCAR is increasing its investments and delivering new products and technologies,” CEO Ronald Armstrong said on the company’s conference call. “These investments will enhance PACCAR’s integrated powertrain, deliver advanced driver assistance and truck connectivity technologies, and add additional capacity and efficiency to the company’s manufacturing and parts distribution facilities.”

And in its earnings conference call last week, American Airlines (AAL) CFO Derek Kerr emphasized the company’s fleet renewal program, with gross aircraft CapEx hitting $4.1 billion in 2017. Kerr also highlighted the company’s $1.6 billion in non-aircraft Capex to improve products and operations, which marks an increase from previous guidance.

Investment leads to outsized performance

Investing is a good thing for company performance as well, as firms investing for growth have been outperforming, according to Goldman Sachs’ David Kostin.

Kostin pointed out in a note this week that firms investing for growth have outperformed firms returning cash to shareholders by 21 percentage points since 2015 (up 17% versus down 5%), a reversal from prior trends.

Kostin expects the outperformance trend to persist in 2018, as investments increase even further. In fact, Kostin sees capital expenditures increasing by 8% to $1.3 trillion in 2018, “supported by low (albeit increasing) interest rates, tight credit spreads, easy lending standards, and the highest profit margins in more than 40 years.”

More of a boost from tax reform

A significant surge in investment may hinge on tax reform, according to a range of management teams, including AT&T (T) whose CFO John Stephens emphasized its importance in the company’s recent conference call.

“Tax reform is the catalyst we need to spur investment,” he said on the company’s earnings conference call last week. “AT&T already invests more in the United States than any other public company, but we’re ready to invest even more if tax reform becomes law.”

UPS CEO David Abney reflected this sentiment. “The current [tax reform] proposal will provide great incentives for companies to both reinvest and create jobs at home,” he said on the company’s conference call.

Nicole Sinclair is markets correspondent at Yahoo Finance

Please also see:

Why 3% GDP growth is unlikely to last

UPS CEO: Thanks to automation, we’re shipping more packages with the same number of people

Marriott CEO: Corporations overstate the impact of tax cuts on business investment

ADP CEO on proxy battle: ‘It’s really about growing the top line’

Gary Cohn: We won’t put conditions on repatriated cash, and we’re fine with stock buybacks