Amazon: the benevolent dictator

July 5, 1994. Not exactly a date many would remember. But on that day, deep in the confines of Seattle, a nondescript gentleman launched a diabolical plot to change commerce as we know it. His launch of a company called Cadabra goes unnoticed, but the seeds of an empire were sewn. After one of his lawyers mistook the name as “Cadaver,” the young CEO filed papers changing it to, you guessed it, Amazon—a name today that strikes fear in the hearts and minds of retailers everywhere, and stops traffic on Wall Street on a day like today when it reports earnings.

Jeff Bezos, who currently has a net worth of approximately $90.9 billion (surpassing Bill Gates), came up with a business model so powerful that the largest retailers on the planet seem helpless as Amazon (AMZN) devours nearly everything in its path.

In its infancy, the internet was a new communications medium, and Amazon initially was only a threat to book stores. Twenty-three years later, CEOs from every corner of retail are struggling to come up with a plan to stay relevant. Last Thursday, Best Buy (BBY) and Home Depot (HD) shares fell hard on news that Sears (S) had capitulated—announcing it would be selling appliances on Amazon.

Home Depot, with its focus on home improvement and construction, was long-thought to be immune to the Amazon threat. Yet suddenly, it was in Bezos’ cross hairs. Earlier in the month, electronics retailer Best Buy (BBY) was hit with news that Amazon was launching a service similar to its successful Geek Squad.

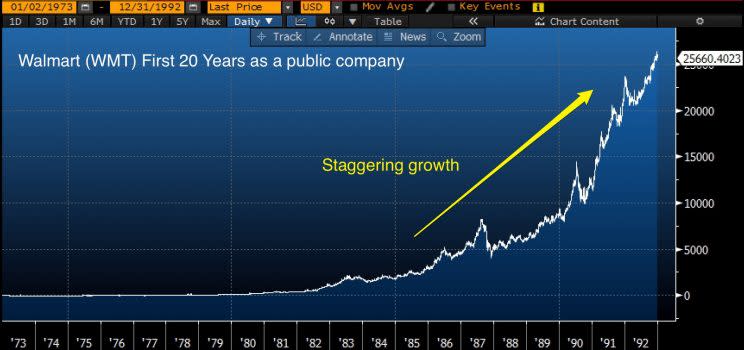

Voices in support of Amazon are similar to Walmart (WMT) defenders of year’s past. As long as the company provides low prices and/or convenience, customers are better off. In Walmart’s early years, there were few concerns, but as the company expanded, reaching into the very heart of the communities it served, voices of concern grew louder. Even academia weighed in, pointing out there was a downside to a company saving us money.

See Is Walmart Good for America, PBS transcript, 2014.

Amazon casualties continue to mount much in the same way that Walmart’s march from Bentonville, Arkansas, a half century earlier. Back then, mom-and-pop stores, unable to match the everyday low pricing, just couldn’t compete, and many were forced into bankruptcy. It wasn’t just the community stores that couldn’t fight back. Soon, suppliers discovered they had lost control over their business models.

Washington vs. Amazon

Amazon’s purchase of Whole Foods (WFM) hasn’t gone unnoticed in Washington. Attitudes are changing as can be evidenced by an FTC investigation of deceptive discounting at the internet giant. Even anti-trust concerns have been mentioned. Lawyers can weigh in, but that would seem difficult given a business model that drives prices lower not higher. Nevertheless, the Trump Administration may target the Amazon on taxes. Wednesday, Treasury Secretary Mnuchin said to the Senate, “there’s an awful lot of [sales tax] money that’s not being collected.”

The bottom line is that, as Bezos invades an increasing number of industries, Washington is on high alert looking for his next move.

In addition to retail, Amazon has become a leading force in entertainment with its Prime service (expanding to Singapore today), while its Amazon Web Services battles technology giants like Microsoft (MSFT) for dominance in the cloud. Even partners like UPS and FedEx have to be nervous as Amazon moves increasingly into logistics—some of which is a business model similar to that of Uber’s.

Amazon revenue growth

Accusations of Amazon being a monopoly are difficult to defend. Projected 2017 sales of $167 billion are dwarfed by its biggest competitor, Walmart, which projects close to $500 billion. However, if current projections of 20% annual top-line growth continue, its dominance and influence may prove unstoppable.

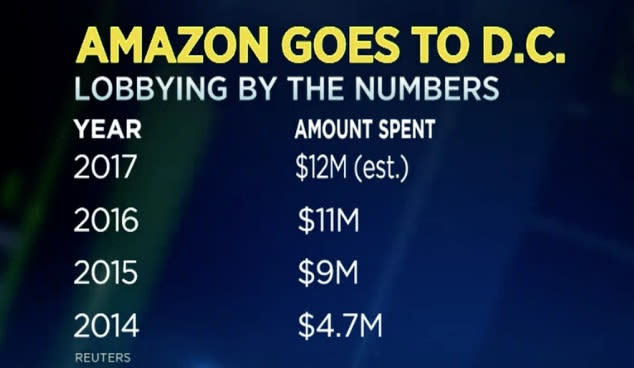

Bezos and the company understand that their success has placed a target on their backs. In just the last three years, expenses related to lobbying have increased over 250%. In a recent CNBC interview, Dave Leventhal of the Center for Public Integrity discussed Amazon’s lobbying efforts, including net neutrality, tax reform, immigration, education and even aviation, as Amazon wants to put drones everywhere.

Bezos’ purchase of the Washington Post gives him a powerful lobbying tool with a long reach that can be used to fight off legislation he feels could hurt or slow down the empire.

Amazon’s power and reach continue to expand, introducing consumers to the benefits of the modern age. Convenience, quality, advanced technology—even entertainment—are there for the asking and at a cost few can turn down. As long as the benefits outweigh the cost, customers won’t care even if it does reach monopoly status.

A monopolistic force can be a tremendous benefit to society in much the same way a benevolent dictator can run a country. Unencumbered by bureaucracy and oversight, he keeps the trains running on time and food on the table. Of course all of that works right up until the time it doesn’t.

“Power tends to corrupt and absolute power corrupts absolutely” — Lord Action to Bishop Creighton (1887)

————————————————-

Please contact your Belpointe investment advisor representative if there are any changes in your financial situation or investment objectives.

Investment advice is offered through Belpointe Asset Management, LLC. Past performance is no guarantee of future returns. Insurance products are offered through Belpointe Insurance, LLC and Belpointe Specialty Insurance, LLC. It is important to read our email disclosures available at this link: http://belpointe.com/disclosures.