Altria: A Dividend King With an 8%+ Yield

- By Nathan Parsh

Shares of tobacco giant Altria Group, Inc. (NYSE:MO) sufferred a 16% price drop before recovering somewhat. They are now down a net of 2.4% since the last time I looked at the company this past August, which may cause investors to lose confidence in the stock.

However, the stock continues to offer a very high dividend yield that appears well covered. Altria is a Dividend King, one of just a handful of stocks in the entire market that has raised its dividend for at least 50 consecutive years. A dividend growth streak of this length means that the company has been able to grow its distribution through multiple decades.

Warning! GuruFocus has detected 5 Warning Sign with MO. Click here to check it out.

NYSE:PM) in March of 2008, Altria's focus is now entirely on the U.S. market. The company operates three business segments: Cigarettes, with brands such as Marlboro and Virginia Slims; Smokeless products; and other. Cigarettes accounts for ~90% of annual sales. Altria also owns a 10.2% interest in Anheuser-Busch InBev SA/NV (NYSE:BUD) and a 35% stake in e-cigarette maker JUUL. The company has a market capitalization of $77 billion and generated sales of nearly $20 billion in 2019.

The above chart covers a 30-year period, where you can see that revenue trended gradually higher in the 1990s through the early part of this century. The sharp decline in revenue in 2008 lines up with the spin off of Philip Morris.

Sales from 2010 through 2019 are more or less flat, with the company's top-line growing with a compound annual growth rate of just 0.3% over this period. The decline in smoking rates among adults has been a long-term trend and an issue that Altria and the rest of the tobacco industry is dealing with, with varying degrees of success.

Tobacco companies have adjusted to this in part by raising the prices of their products. The introduction of non-combustible products, like Altria's e-cigarette brand IQOS, will also be needed to help grow revenues.

While revenue growth has stalled out over the last decade, Altria has greatly improved its ability to grow profits. Altria's net profit doubled between 2010 and 2019 as the net profit margin increased from 16% to 31.4%. This allowed Altria to grow earnings per share at an 8.5% annual rate during this period of time.

With growth like this, it isn't surprising that Altria scores well in terms of profitability:

Altria receives a 7 out of 10 in profitability from GuruFocus. The current operating margin of 52.5% is higher than nearly 95% of its peers in the tobacco industry. This is also at the very top of the company's own historical average, which isn't shocking considering how well Altria has seen its margins improve over the last 10 years. The company also scores well on return on capital, topping nearly 90% of the competition.

Where Altria does struggle is on revenue growth over the last three years, which is lower than 56% of peers and right around the middle of the company's 10-year range. Given that revenues haven't really grown for the company or industry as a whole during this period of time, middle of the pack seems to be a acceptable in my opinion.

There is no sugar coating it, Altria's business has been stagnant over the last decade as consumers are choosing not to smoke traditional tobacco products. Price increases can only offset these declines for so long, which is why Altria has made investments in e-cigarettes and other alternatives in recent years. Of course, these investments aren't without their pitfalls. One only has to look at the company's multiple write downs on its investment in JUUL for evidence of this.

Despite some headwinds, Altria is a very profitable company. Its net profit margin has doubled in the span of 10 years and EPS has grown with a high single-digit rate. This is what I consider the best possible outcome for a company with a stagnating business.

Dividend analysis

Following a 2.4% increase for the Oct. 9 distribution, Altria has now raised its dividend for 51 years. The Dividend Investing Resource Center, which maintains a database of companies that have at least five consecutive years of dividend growth, claims that only 27 other companies have a longer dividend growth streak going. Altria has increased its dividend by an average of:

12.5% over the past three years.

10.8% over the past five years.

9.7% over the past 10 years

The most recent increase is well below any of the listed growth rates. For context, the increase in the previous year was 5%, but the raise in 2018 was above 14%. We will have to wait until next year to see if dividend growth accelerates or not.

In any case, the company ranks pretty high on its dividends and buybacks:

Altria's dividend yield is better than 87% of peers and near the higher end of its own historical average yield over the last decade. The company also ranks very highly against peers in three-year dividend growth rate, forward dividend yield, five-year yield on cost and three-year average share buyback ratio. The tobacco industry is often very shareholder friendly since they are not very cost intensive businesses, so large capital returns are quite common. Altria is one of the best in the industry at returning capital to shareholders.

With a forward yield of 8.3%, Altria's current dividend is almost at a 30-year high. Today's yield is more than 300 basis points higher than the 10-year average yield of 5.1%.

While a high yield can often be a warning sign of a declining business and an eventual dividend, I don't believe this to be the case for Altria.

Except for 2019, Altria's dividend has been covered by EPS every year since 1990. Free cash flow has also provided enough cushion for distributions as well.

Let's examine dividend coverage in the more recent term. Altria has paid out $3.40 of dividends per share over the last four quarters while EPS totaled $4.39 for an earnings payout ratio of 77.4%. This is a high payout ratio, but compares favorably to the company's 10-year average payout ratio of 81.7%.

The company's free cash flow payout ratio is almost the same. Altria distributed $6.3 billion of dividends over the last four quarter while generating free cash flow of $8.2 billion, which equates to a free cash flow payout ratio of 76.7%. Though elevated, this is an improvement from the free cash flow payout ratio of 89.4% that Altria averaged over the previous three years.

Altria's payout ratios are higher than I normally would prefer, but the company has a stated goal of returning almost all of its capital to shareholders in the form of dividends and share repurchases. The trailing 12-month EPS and free cash flow payout ratios are also an improvement over the longer-term historical averages. The lower than usual dividend increase might disappoint investors, but the company has raised its dividend 55 times over the last 51 years. I am willing to give the company the benefit of the doubt that the most recent raise was a prudent move on their part and not a warning that the dividend was in jeopardy. The 8%+ yield also helps to make up for the low raise.

Recession performance

Normally, this section would compare a company's performance before, during and after the last recession, but since Altria spun off Philip Morris in the midst of the Great Recession, an apples-to-apples comparison is not very helpful.

However, I have listed Altria's EPS results following the spinoff below:

2008 EPS: $1.66

2009 EPS: $1.76 (6.3% increase)

2010 EPS: $1.87 (1.4% increase)

2011 EPS: $1.64 (12.3% decrease)

2012 EPS: $2.06 (25.6% increase)

Altria was able to grow EPS at a solid rate in its first full year following the Philip Morris divestiture. The company did suffer a double-digit decline in 2011, but rebounded to post a new high the very next year. Altria then went on to post earnings growth every year from 2012 through last year.

Listed below are the company's dividends paid during and after the last recession.

2008 dividends: $1.68

2009 dividends: $1.32 (21.4% decrease)

2010 dividends: $1.46 (10.6% increase)

2011 dividends: $1.58 (9.4% increase)

2012 dividends: $1.70 (7.6% increase)

The year-over-year decline in 2009 stems from the combined company distributing one dividend prior to the separation in 2008. Following this, Altria had solid dividend growth right out of the gate as an independent company.

Altria's dividend growth streak dates back more than five decades. The company has managed to increase its dividend through six separate recessions. Based on this and the company's goal of paying out the majority of excess capital in the form of dividends, it is likely that Altria will be able to increase its dividend in the next economic downturn.

Financial strength and debt analysis

As well as the company scored on its profitability and shareholder returns, Altria doesn't rate too well in terms of financial strength according to GuruFocus:

Altria receives a 4 out of 10, with low scores nearly across the board. For example, the company's cash-to-date ratio is lower than 78% of peers. Worse, the current ratio is almost at the bottom of the company's 10-year range. Altria's interest coverage is lower than 72% of peers, but just about in the middle of its range over the last decade. The company does receive a 5 for Piotroski F-score, which indicates that Altria's financial situation is typical for a stable company.

On the plus side, Altria's balance sheet appears in decent shape. The company ended the most recent quarter with $46.7 billion of total assets. The company has current assets of $6.4 billion, including $4.1 billion of cash and cash equivalents. Altria has total liabilities of $43.4 billion, with current liabilities of $8.3 billion. The company has total debt of $29.3 billion, but just $1.5 billion of this is due within the next year.

The company paid interest expense of $310 million in the most recent quarter, which results in a weighted average interest rate of 2.9%.

Altria's balance sheet has it positioned to withstand any challenges from debt obligations in the near term. Free cash flow in the most recent quarter was more than enough to cover dividend and interest expense payments. Cash on the balance sheet also provides the company a solid buffer in case free cash flow were to decline. Due to this, I believe that debt obligations won't be a headwind to future dividend growth.

Valuation

According to analysts surveyed by Yahoo Finance, Altria is expected to earn $4.37 per share in 2020. Shares of the company trade for $41.50 as of today, giving the stock a forward price-earnings ratio of 9.5. Altria has traded with an average price-earnings ratio of 16.7 over the last 10 years.

I've stated before that Altria likely deserves to trade with a lower multiple given that tobacco use remains in decline in the U.S. Other factors, such as the company's write downs of its investment in JUUL, also have played in my target valuation. But even trading with a price-earnings ratio of 11 to 13 would result in a strong gain from the current price.

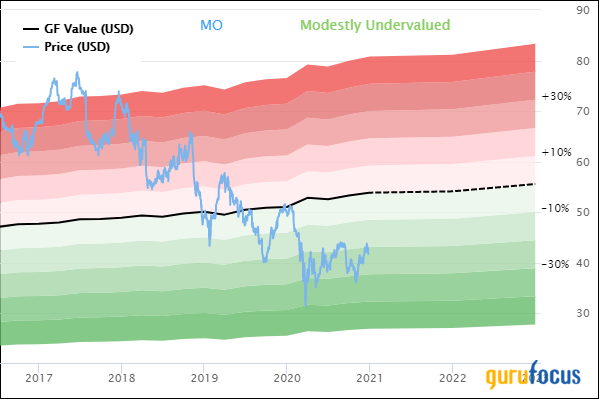

GuruFocus also seems to agree that the stock is undervalued:

Altria has a GF Value of $53.84, which would give the stock a price-to-GF Value ratio of 0.77. This earns Altria a rating of modestly undervalued from GuruFocus. Shares would need to increase 29.7% to trade with its GF Value. At this level, the dividend yield would be 6.4%, making total possible returns more than 36%.

Final thoughts

Altria has one of the longest dividend growth streaks in the market, one that has been recession tested many times over. The payout ratios are higher than I would like, but are actually an improvement over the recent trends.

The company does operate in a declining business, but has made investments in other areas to help offset this. Though some of those investments haven't paid off as of yet, Altria is at least making attempts to find other avenues of growth. In the meantime, the company does remain very profitable thanks to a high operating margin. Altria's balance sheet is also solid and its debt doesn't appear to be too cumbersome either.

Lastly, Altria trades well off of its long-term average multiple. Even expanding to a multiple that is a discount to its average would create an immense return from the current share price. Investors who don't mind what the company does for a living could see at least a 36% return on their investment, by my estimate. Investors buying today would receive a generous dividend while waiting for the multiple to expand. This seems like an excellent risk/reward proposition. As such, I continue to rate shares of Altria as a buy.

Author disclosure: the author has no position in any stock mentioned in this article.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.