Adidas sneakers 'just jumped over Jumpman'

Adidas is on a jaw-dropping hot streak in the American sneaker market. Its latest milestone: leapfrogging Nike-owned Jordan Brand in U.S. footwear market share.

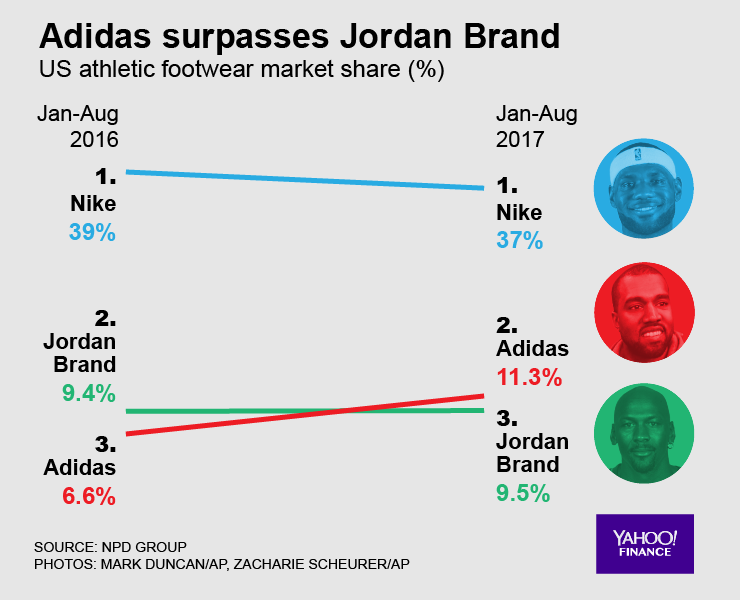

The German sportswear giant has for years been No. 3 behind Nike and Jordan Brand. But it is enjoying a comeback, stealing share from Nike. In the past year, while Nike’s sneaker share dipped slightly and Jordan Brand was flat, Adidas’s share has nearly doubled. It’s why Yahoo Finance named Adidas our 2016 sports business of the year.

According to new numbers from NPD Group, Adidas had an average monthly market share (by dollars) of 11.3% from January to August of this year, putting it atop Jordan Brand, which had 9.5%. Nike remains top dog with 37%.

“I’m amazed at the speed of Adidas’s ascent,” says NPD Group’s Matt Powell.

So, how did Adidas do it?

Adidas embraced fashion trend

The entire sports apparel industry is in an extended trend toward casual sportswear, or fashion —clothes that can be worn for sports, but also for everyday wear. (Perhaps you’ve heard the common term for this trend: athleisure.)

Adidas naturally benefits from that trend, since it has always been known for streetwear. But it has also leaned into sportswear even more in the past few years, whereas Under Armour is all about performance apparel (ice cold right now) and Nike “failed to respond” to the trend,” Powell says. (Stock performance of the three companies in 2017 reflects all this.)

The biggest reason Adidas is flying in America is because of its products: “Boost” running sneakers that people wear for everyday fashion; “Originals” including the classic Stan Smiths and Superstars; and NMD (“nomad” with no vowels), a casual sneaker that has been hot since its release in 2015. “UltraBoost is the greatest example of it,” Adidas U.S. CEO Mark King told Yahoo Finance. “It was going to be the ultimate running shoe, which it is, and now it’s the ultimate fashion shoe. These products can play both, and that’s not easy to do.”

Basketball sneakers in decline

Jordan Brand is named after Michael Jordan, the basketball legend. It has been the most successful signature sneaker line ever. But in 2017, performance basketball sneakers, as a category, have fallen 22% in sales.

And Nike “missed the shift away from basketball,” Powell says.

no end in sight for the continued declines at Nike. US market all about Adidas right now

— Matt Powell (@NPDMattPowell) May 8, 2017

Fewer kids are purchasing new basketball sneakers each season because they aren’t wearing them as everyday fashion. Instead, they’re wearing sneakers like Adidas Boost.

That change has been especially debilitating to Under Armour, which has an expensive endorsement deal with NBA star Stephen Curry, and, facing declining sales in key categories, recently said, “We’re pivoting.”

Kanye West?

And then there’s the influence — or not — of Kanye West.

Adidas partnered with the rapper in 2014 on a “Yeezy” line of sneakers and apparel, and then extended him in 2016 to an unusual long-term deal that includes Yeezy brick-and-mortar stores.

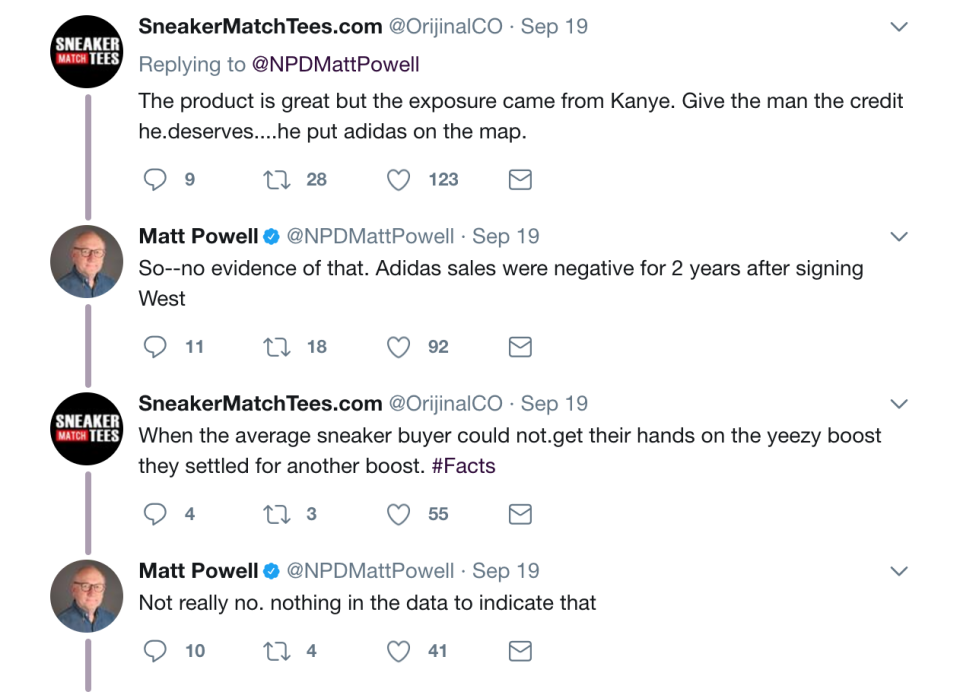

Many sneaker collectors insist that West is to thank for the Adidas comeback in America. They make the case that even though sales of the Yeezy sneakers are tiny since Adidas puts them out in limited release, West’s connection to the brand has had a spillover effect, leading people to buy other Boost shoes when they can’t obtain the Yeezy shoes.

Powell disagrees: he says West has had zero impact on Adidas sales in America of late. And has become famous among sneakerheads on Twitter for his uncompromising refusal to credit West with any effect.

When Powell tweeted this week that Adidas had surpassed Jordan Brand — a tweet that went viral, with 16,000 retweets and climbing — the majority of the replies were people mentioning West. Powell responded to almost all of them, shutting them down.

The truth is likely somewhere in the middle: West can’t be given sole credit for the Adidas comeback in America, or even a lion’s share of credit, but it’s hard to believe he’s had no impact whatsoever.

The “Kanye Effect” remains one of the hottest debates in the sneaker world. And whether you believe in West’s impact or not, suddenly a line in West’s 2015 single “Facts” has basically happened: “Yeezy, Yeezy, Yeezy just jumped over Jumpman.”

Keep in mind: market share fluctuates from month to month, and it’s a zero-sum game, where one brand’s rise means a dip for others; Powell warns that it’s not fair to compare share on a single month-to-month basis. In other words, Adidas could fall right back to No. 3 next month. But for now, in 2017 so far, Adidas is doing everything right.

—

Daniel Roberts is the sports business writer at Yahoo Finance. Follow him on Twitter at @readDanwrite.

Read more:

Adidas blows investors away with stellar 2017 outlook

3 big reasons Under Armour has cooled off

Adidas is Yahoo Finance sports business of the year for 2016

Adidas enters uncharted territory, going all in on Kanye West