Acadia (ACAD) Up on FDA Briefing Document for Nuplazid sNDA

Shares of ACADIA Pharmaceuticals Inc. ACAD gained 15.5% on Wednesday after the FDA issued briefing documents related to the resubmitted sNDA for Nuplazid (pimavanserin) for treating hallucinations and delusions associated with Alzheimer's disease psychosis (“ADP”).

The regulatory body issued the briefing documents ahead of its Advisory Committee meeting, which is scheduled to review the resubmitted supplemental new drug application (sNDA) for pimavanserin on Jun 17, 2022.

Per the FDA briefing document, the agency decided that the study was designed with features that could allow the latter to be considered an adequate and well-controlled one, suitable for regulatory decision making. Investors are upbeat about the likely positive outcome of the meeting. This might have been a catalyst for the stock price to go up.

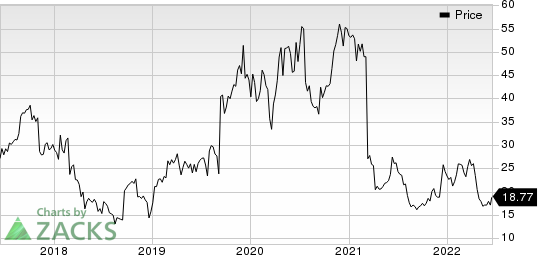

Shares of Acadia have lost 19.6% so far this year compared with the industry’s decrease of 28.8%.

Image Source: Zacks Investment Research

In March 2022, Acadia received the action date from the FDA related to its resubmitted sNDA for pimavanserin to treat hallucinations and delusions associated with ADP.

The regulatory body has set a target action date of Aug 4, 2022.

During the first quarter of 2022, Acadia resubmitted the sNDA to the FDA for pimavanserin for the treatment of hallucinations and delusions associated with ADP.

The resubmitted sNDA was based on positive data from two placebo-controlled studies — the pivotal phase III HARMONY study and the -019 study. Both studies have prospectively met their primary endpoints.

The FDA had issued a complete response letter to the sNDA for Nuplazid in April 2021.

The CRL indicated that the FDA had completed its review of the application and had decided that it could not be approved in its then-present form as it lacked statistical significance in some of the subgroups of dementia. Moreover, there was an insufficient number of patients with certain less common dementia subtypes, which was considered as a lack of substantial evidence of effectiveness to support approval. The CRL also stated that the phase II Alzheimer’s disease psychosis study, a supportive study in the sNDA filing, was inadequate and not well controlled.

Nuplazid is currently approved in the United States for the treatment of hallucinations and delusions associated with Parkinson’s disease psychosis.

Nuplazid generated sales worth $115.5 million in the first quarter of 2022, reflecting an increase of 8% year-over-year. A potential label expansion is likely to boost sales of the drug in the days ahead. However, if the FDA again declines to approve the sNDA for pimavanserinfor treating hallucinations and delusions associated with ADP, it will be a major setback for the company.

ACADIA Pharmaceuticals Inc. Price

ACADIA Pharmaceuticals Inc. price | ACADIA Pharmaceuticals Inc. Quote

Zacks Rank & Stocks to Consider

Acadia currently carries a Zacks Rank #3 (Hold). Better-ranked stocks in the biotech sector are Leap Therapeutics, Inc. LPTX, Galapagos NV GLPG and Precision BioSciences, Inc. DTIL, all carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Leap Therapeutics’ loss per share has narrowed 11.1% for 2022 and 5.9% for 2023 in the past 60 days.

Earnings of Leap Therapeutics have surpassed estimates in three of the trailing four quarters and missed the same on the other occasion. LPTX delivered an earnings surprise of 1.92%, on average.

Galapagos’ loss per share estimates narrowed 32.5% for 2022 and 31.1% for 2023 in the past 60 days.

Earnings of Galapagos have surpassed estimates in each of the trailing three quarters. GLPG delivered an earnings surprise of 40.80%, on average.

Precision BioSciences’ loss per share estimates narrowed 21.7% for 2022 and 31.4% for 2023 in the past 60 days.

Earnings of Precision BioSciences have surpassed estimates in each of the trailing four quarters. DTIL delivered an earnings surprise of 76.15%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

To read this article on Zacks.com click here.

Zacks Investment Research