AbbVie's (ABBV) Skyrizi Gets Nod for Psoriatic Arthritis in EU

AbbVie, Inc. ABBV announced that the European Commission (EC) approved its drug Skyrizi (risankizumab) for a second indication, which is active psoriatic arthritis.

The EC approval is for subcutaneous injection of Skyrizi — alone or combined with methotrexate (MTX) to treat adult patients with active psoriatic arthritis who had earlier shown an inadequate response or were intolerant to one or more disease-modifying antirheumatic drugs (DMARDs).

Sykrizi is an interleukin-23 (IL-23) inhibitor that selectively blocks IL-23, a cytokine, which is involved in inflammatory processes, including psoriasis.

The approval was expected as last month, the European Medicines Agency's (EMA) Committee for Medicinal Products for Human Use (CHMP) recommended the approval of Skyrizi for adults with active psoriatic arthritis.

The approval of Skyrizi for active psoriatic arthritis was based on data from the two phase III studies, namely KEEPsAKE-1 and KEEPsAKE-2. While the KEEPsAKE-1 study evaluated the drug in patients with an inadequate response or intolerance to at least one DMARD, the KEEPsAKE-2 study evaluated the drug in patients with a history of inadequate response or intolerance to the biologic therapy and/or DMARDs.

Both studies achieved their primary endpoint of ACR20 response at week 24 and multiple secondary endpoints, including improvements in physical function as measured by the Health Assessment Questionnaire Disability Index (HAQ-DI), and minimal disease activity (MDA) at week 24 with statistical significance over placebo.

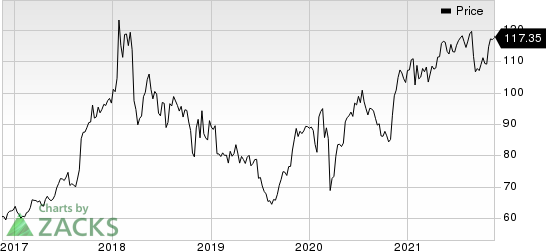

In the year so far, Abbvie’s stock price has increased 9.5% compared with the industry’s 16.1% rise.

Image Source: Zacks Investment Research

We remind investors that Skyrizi is already approved in Europe and the United States for moderate-to-severe plaque psoriasis. A supplemental new drug application seeking approval for Skyrizi to treat active psoriatic arthritis is currently under review by the FDA.

AbbVie is developing Skyrizi in collaboration with Boehringer Ingelheim, with Abbvie leading the global development and commercialization of the drug.

Psoriatic arthritis is a systemic inflammatory disease that impacts the skin and joints, resulting in pain, fatigue, stiffness in the joints and psoriatic lesions. The indication affects approximately 30% of psoriasis patients.

Apart from the above indications, AbbVie is currently evaluating Skyrizi in a phase III study for Ulcerative colitis. In September this year, the company submitted a supplemental new drug application to the FDA, seeking the label expansion of Skyrizi for moderate-to-severe Crohn’s disease in patients aged 16 years and above.

Skyrizi and AbbVie’s other new drug Rinvoq demonstrated differentiated clinical profiles compared to the company’s blockbuster drug Humira. Thus, both are gradually lowering AbbVie’s dependence on Humira. With many new indications coming in the next couple of years, sales of these two drugs could be higher and show potential to replace Humira, biosimilars of which are eroding AbbVie’s yearly international sales. Both drugs are expected to be launched in the United States in 2023.

Skyrizi already generated sales worth $2.04 billion from the beginning of 2021 through the September-quarter end.

AbbVie Inc. Price

AbbVie Inc. price | AbbVie Inc. Quote

Zacks Rank & Stocks to Consider

AbbVie currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector are GlaxoSmithKline GSK, Precision BioSciences DTIL and Synlogic SYBX. While Precision BioSciences sports a Zacks Rank #1 (Strong Buy), both GlaxoSmithKline and Synlogic carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Precision BioSciences’ loss per share estimates for 2021 have narrowed from $1.17 to $0.79 in the past 30 days. The same for 2022 has narrowed from $2.39 to $2.04 in the past 30 days. Shares of Precision BioSciences have rallied 16.9% in the year so far.

Precision BioSciences’ earnings beat estimates in all the last four quarters, delivering a surprise of 76.9%, on average.

GlaxoSmithKline’s earnings estimates per share for 2021 have increased from $2.82 to $3.04 in the past 30 days. The same for 2022 has increased from $3.08 to $3.26 in the past 30 days. Shares of Glaxo have risen 15.7% in the year so far.

Earnings of GlaxoSmithKline beat estimates in three of the last four quarters and missed expectations on one occasion, delivering a surprise of 15.3%, on average.

Synlogic’s loss per share estimates for 2021 have narrowed from $1.22 to $1.18 in the past 30 days. The same for 2022 has narrowed from $1.19 to $1.07 in the past 30 days. Shares of Synlogic have gained 23.2% in the year so far.

The bottom line of Synlogic beat estimates in three of the last four quarters and met expectations once, delivering a surprise of 3.41%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

GlaxoSmithKline plc (GSK) : Free Stock Analysis Report

AbbVie Inc. (ABBV) : Free Stock Analysis Report

Synlogic, Inc. (SYBX) : Free Stock Analysis Report

Precision BioSciences, Inc. (DTIL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research