AbbVie Is Undervalued and Offers a High Yield

- By Nathan Parsh

Buying shares of companies trading well above off their average valuation and dividend yield can mean adding a stock with significant growth potential.

One of my favorite low multiple, high-yield stocks remains AbbVie Inc. (NYSE:ABBV). The company's dividend track record and valuation show why this health care company should be consider by dividend growth and value investors alike.

Company background and historical performance

Spun off from parent company Abbott Laboratories (NYSE:ABBV) in 2013, AbbVie is one of the largest pharmaceutical companies in the world. The company's products address illnesses and diseases such as rheumatoid arthritis, HIV, blood cancers, Crohn's disease and neurological disorders. AbbVie completed its $63 billion acquisition of Allergan PLC in early May. The company has a market capitalization of almost $153 billion and generated $36 billion in revenue over the past year.

The purchase of Allergan helped drive revenue growth of more than 26% during the last quarter, while adjusted earnings per share improved 3.5%. The company easily topped Wall Street's expectations for the top and bottom line.

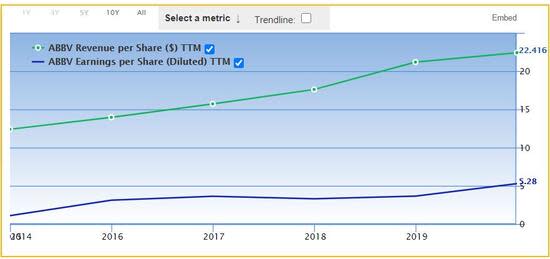

Demonstrating growth is something AbbVie has been quite successful at since becoming an independent company.

According to Value Line, revenues have increased with a compound annual growth rate of 8.5% from 2013 to 2019. Profit growth has been even better, with adjusted earnings per share growing at an annual rate of 16% and net profits rising at yearly clip of almost 15% over this same period of time.

It shouldn't come as a shock then that AbbVie scores so well on profitability.

The company scores very high according to the GuruFocus system, earning a 9 out of 10 for profitability. AbbVie outperformers its peers by a wide margin, especially on operating margins where it outranks nearly 95% of the approximately 1,000 companies in the drug manufacturers industry.

As I discussed previously, AbbVie is facing the loss of patent exclusivity for its top-selling drug Humira, but the company's pipeline should provide plenty of future revenue that will likely allow it to continue to remain highly profitable.

Dividend analysis

AbbVie last raised its dividend for the payment distributed this past Feb. 13. This increase raised the dividend by 10.3%.

AbbVie's dividend has increased with a CAGR of:

18.7% over the past three years.

16.2% over the last five years.

The most recent raise was lower than these averages, but was still in the double digits. The latest increase also marks eight consecutive years of dividend growth, 48 if you count the years the company was part of Abbott Laboratories.

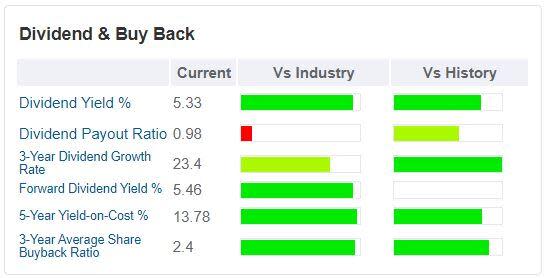

GuruFocus also thinks highly of AbbVie's dividend.

AbbVie's dividend receives high marks in almost every category from GuruFocus, including a dividend yield that is superior to more than 94% of peers.

The forward yield of 5.5% compares very favorably to the stock's average yield of 3.8% since 2013. Only once since 2013 has AbbVie averaged a yield above 3.8% for an entire year (2019), showing how out of the norm the current yield is.

One area of concern that some may point to is the company's earnings per share payout ratio.

Looking at the chart, it would appear that AbbVie's GAAP earnings per share payout ratio is elevated. On an adjusted basis, however, the payout ratio is very reasonable.

The last four declared dividends totaled $4.72. The company has produced adjusted earnings of $9.30 per share over this same period of time for a payout ratio of 51%, barely above the five-year average payout ratio of 47%.

Looking again at the above chart, you'll notice that AbbVie's free cash flow per share has outpaced earnings per share growth.

AbbVie has distributed $6.7 billion in dividends over the last year while generating free cash flow of $14.1 billion. This has resulted in a free cash flow payout ratio of 48%, which is identical to the average free cash flow payout ratio of 48% that the company has averaged since 2016.

AbbVie's dividend yield is one of the highest in its industry and looks very safe on an adjusted earnings per share and free cash flow basis. This should give investors comfort that the high yield isn't a mirage and is quite sustainable. Future growth may not compare to the three and five-year CAGRs, but low single-digit to double-digit growth is likely to occur given the company's low payout ratios and growth in free cash flow over the years.

Recession performance

AbbVie was not a standalone entity during the last recession, so we can't say for certain how it would perform, but its parent company was.

Listed below are the earnings per share results for Abbott Laboratories before, during and after the last recession:

2006 earnings per share: $2.52

2007 earnings per share: $2.84 (13% increase)

2008 earnings per share: $3.03 (7% increase)

2009 earnings per share: $3.72 (23% increase)

2010 earnings per share: $4.17 (12% increase)

2011 earnings per share: $4.66 (12% increase)

The Great Recession wasn't so much as a speedbump for AbbVie's parent company. In total, earnings per share increased by more than 30% from 2007 through 2009. While it is impossible to say for certain how AbbVie would perform on its own during a recession, we can take solace in Abbott Laboratories' performance during a difficult economic period in history.

Again, we don't know what dividend growth would have looked like for AbbVie during the last recession, but Abbott Laboratories' increases should provide some window into what it might look like during the next recession.

Listed below are the dividends paid out by Abbot Laboratories each year before, during and after the last recession:

2006 dividends: $1.18

2007 dividends: $1.30 (10% increase)

2008 dividends: $1.44 (11% increase)

2009 dividends: $1.60 (11% increase)

2010 dividends: $1.76 (10% increase)

2011 dividends: $1.88 (7% increase)

Abbott Laboratories consistently raised its dividends through the last recession. Not surprising given AbbVie's parent company has paid a dividend every quarter since 1924, which spans several bleak economic periods. With its DNA and its leadership position in the area of health care, it is highly probably that AbbVie will be able increase its dividend during the next economic hardship as well.

Debt

AbbVie has taken on quite a bit of debt over the last year or so, mostly on account of the Allergan acquisition. Total debt has jumped from $66.7 billion at the end of lats year to more than $87 billion at the end of the most recent quarter. The company has a total of $5.4 billion of this debt is due within the next year.

This has put a dent in the company's financial strength ratings according to GuruFocus.

AbbVie earns a mediocre score of 3 out of 10 according to GuruFocus, primarily due to its rankings against its own history. Cash-to-debt is especially much lower than usual.

As this debt is due in acquisitions to help grow, I am willing to give AbbVie a pass here as its free cash flow should be more than enough to pay interest expenses and its debt obligations.

Interest expenses totaled $2.2 billion over the last four quarters, but results in a weighted average interest rate of just 2.5% using the company's total debt.

As a reminder, AbbVie had more than $7 billion remaining in free cash flow over the last year after distributing dividends. The company is also sitting on more than $6 billion in cash and cash equivalents. This should provide plenty of capital to pay interest expenses, maturing debt and future dividend payments.

Valuation

Shares of AbbVie currently trade for around $86 a share today. According to Yahoo Finance, consensus estimates call for adjusted earnings of $10.44 per share for the year, giving shares a forward price-earnings ratio of just 8.2. The five-year average price-earnings ratio is 12.3, meaning the current valuation is approximately two-thirds of its historical average.

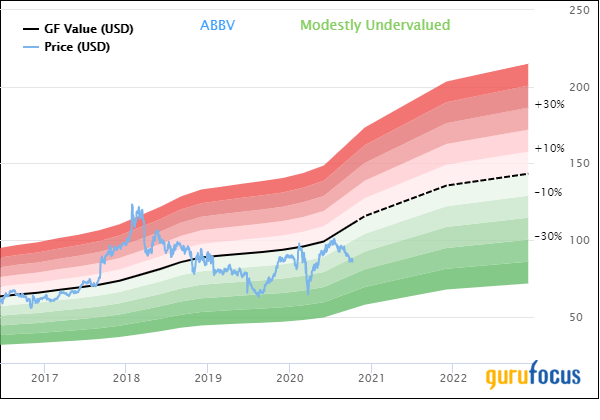

I continue to believe that AbbVie is undervalued, and the GF Value Line supports my thesis.

If you're not familiar with the GF Value Line, it represents the current intrinsic value of a stock based on a variety of factors, including price-earnings ratio, price-to-free cash flow, the company's past returns and future estimates of business performance.

Based on these factors, GuruFocus believes that AbbVie's GF Value is $99.07. This equates to a price-to-GF-Value of 0.87, which means a rating of modestly undervalued.

As I've stated on several occasions, I believe a target price-earnings ratio range of 12 to 14 is appropriate for AbbVie. The market continues to penalize the company for its loss of exclusivity for Humira, but the pipeline plus its acquisition of Allergan warrants a richer valuation in my opinion.

Applying the adjusted earnings per share estimate for 2020 to this valuation range results in a share price range of $125 to $146. This would mean a share price gain of at least 45%, not including the dividend.

Final thoughts

AbbVie has produced excellent top and bottom-line growth since being spun off from Abbott Laboratories. This has allowed the company to grow its dividend at a high rate. In addition, the debt balance, while hefty, seems manageable given cash on the balance sheet and the free cash flow that AbbVie generates. At the same time, the market continues to pay a single-digit multiple for the stock when the business appears to deserve a higher valuation. I maintain my buy rating on AbbVie due to its low valuation and high dividend yield.

Disclosure: The author has a long position in AbbVie and Abbott Laboratories.

Read more here:

PepsiCo: Beverages Are Back

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.