6 Ways Streaming Changed in 2023: From Cost Cuts to More Transparency

There’s no question that 2023 was a rollercoaster ride for the streaming industry.

The year came to represent a major pivot in the way both streaming and Hollywood operate. After years of claiming it would never include ads, Netflix saw the benefits from its ad-supported tier in 2023. Likewise, unexpected licensing crossovers became the norm after years of exclusivity. Some of those crossovers stayed in the family, such as CBS’ broadcast of the Paramount Network original “Yellowstone.” Others found rivals sharing content.

And in a move that will reverberate throughout the streaming landscape into 2024, Netflix made a bold step towards increased transparency by reporting unprecedented viewership numbers in December.

As of the major streamers’ latest financial quarters, Netflix continues to lead the pack with 247.15 million subscribers globally (up 7% from the end of 2022), followed by Disney+ with 150.2 million subscribers (down 8.5%), Warner Bros. Discovery with 95.1 million direct-to-consumer subscribers (down 1% ), Paramount Global with 64.3 million subscribers (down 16%), Hulu with 48.5 million subscribers (up 2.7%), Peacock with 30 million paid subscribers (up 50%) and ESPN+ with 26 million subscribers (up 30%).

Nearly all the major players in streaming operated their direct-to-consumer businesses at a loss during the year, prompting price hikes, password-sharing crackdowns, a push toward ad-supported tiers and the return of content licensing to generate additional revenue streams. The studios also tightened their belts with various cost cuts, from layoffs to content removals.

But the legacy studios expect that 2023 was the year when losses peaked, and are optimistic that streaming profits are likely to come in 2024 and 2025.

Here are the major ways streaming changed over the last 12 months.

Cost Cuts and Consolidation

In 2023, Disney and Warner Bros. Discovery tried to turn streaming profitable by squeezing out costs.

In February, Disney said it was embarking on a plan to cut $5.5 billion in costs, which included 7,000 layoffs, the removal of select streaming content (Disney+ originals like “Willow” and “The Mysterious Benedict Society” are now gone) and by lowering its production output. Last month, it boosted that cost-cutting target by another $2 billion. In total, Disney recorded $3.84 billion in restructuring and impairment charges in 2023, including $2.58 billion in content impairments and $357 million in severance costs.

Warner Bros. Discovery estimated it would incur up to $5.3 billion in total restructuring charges before taxes, including up to $3.5 billion in content impairment and development write-offs, and that “additional impairments above the revised estimates” could be incurred. The company revised that figure from a previous filing that anticipated up to $4.3 billion in restructuring charges, including up to $2.5 billion in write-offs from content and development. WBD also included $800 million to $1.1 billion in costs from severance, retention and relocation of personnel as well as $400 million to $700 million in facility consolidation and contract terminations.

In addition, several of the major media companies operating multiple streaming services have combined their platforms together. WBD’s Max rebrand, which launched in May, merged the libraries of HBO Max and Discovery+, while Paramount+ integrated Showtime into its platform in a revamped subscription tier dubbed Paramount+ with Showtime. Disney also launched a beta version of its combined app offering of Hulu and Disney+ this month, which officially rolls out in March 2024.

Ad-Supported Streaming and a Password-Sharing Crackdown

After Netflix posted two quarters of subscriber declines in 2022, the company’s leadership changed its tune about ad-supported streaming. It also embarked on a password-sharing crackdown targeting an estimated 100 million households, including 30 million in the United States and Canada.

As of its 1-year anniversary on Nov. 1, Netflix’s ad tier has surpassed 15 million monthly active users. The company’s password-sharing crackdown has rolled out in every region Netflix operates in as of the end of its third quarter of 2023, which led to an increase in overall subscribers. The ad tier of Disney+ reached a total of 5.2 million subscribers as of the end of the Disney’s fourth quarter of 2023; it plans to roll out its own password sharing crackdown in 2024.

Elsewhere, free ad-supported streaming television (FAST) platforms like Tubi, The Roku Channel, Pluto TV and Amazon Freevee saw a boost in popularity and awareness in 2023. According to a survey of 2,000 U.S. TV Time users by Whip Media released in November, the platforms collectively saw a 43% average increase since 2021. Nearly half of the survey’s respondents said they watched FAST channels at least a “few times” per month.

London-based research firm Ampere Analysis has previously predicted that the ad tiers from Netflix, Disney and others could generate over $10 billion in revenue domestically by 2027. On Dec. 20, it also forecasted that the streaming industry could reach a consistent profit within the next 18 months, primarily driven by advertising and cost-cutting efforts.

Content Licensing

In a January 2022 interview with The New York Times, Disney CEO Bob Iger compared the idea of licensing the studio’s content to Netflix as “selling nuclear weapons technology to a third world country.” But now, the House of Mouse and other legacy studios like Warner Bros. Discovery have started doing just that as they look to generate additional streams of revenue following pressure from Wall Street to turn their streaming businesses profitable.

The move has offered the benefit of exposing shows to new audiences and even generated a viewership bump on their original platforms, as seen firsthand with Max shows licensed to Netflix like “Ballers” and “Insecure.” Then there’s the “Suits” phenomenon, which made the best case yet that Netflix is the most valuable real estate in the streaming realm.

Iger recently revealed that Disney and Netflix are in conversations about “some opportunities” during the company’s fourth-quarter earnings call. But he emphasized that Disney has no plans to license content from its core brands such as Pixar, Marvel and Star Wars.

“I don’t see why— just to basically chase bucks — we should do that when they are really, really important building blocks to the current and future of our streaming business,” Iger said.

Some version of those conversations came to a head in December. An insider familiar with negotiations told TheWrap that Netflix is in talks to secure the streaming rights to 19 library titles from Disney that were non-branded series on a non-exclusive basis. These included “Lost,” “White Collar” and ESPN’s “30 for 30.”

This is, of course, circular as Netflix and Disney previously had a robust licensing deal before the launch of Disney+, after which Disney made its titles exclusive to its own streaming platform.

In December, Netflix also licensed feature film titles in the DC Cinematic Universe from Warner Bros. as the latter studio’s “Aquaman” sequel hit theaters.

Bundling

In addition to consolidating their own platforms, many of the major streamers have started discussing joining forces with their competitors in an effort to offer more value to consumers.

During an investor conference in May, WBD CEO David Zaslav said that he’d be open to including Max in a bundle with other streaming competitors — what he dubbed a “super bundle” — in order to create a better experience for consumers.

“Whether we do it this year or in three years, I think eventually something like that will happen. If we don’t do it to ourselves, I think it’ll be done to us,” he said.

Fast forward seven months later and Verizon is now offering Max in a bundle with Netflix, while Paramount+ and Apple TV+ are reportedly in talks to combine forces through a discounted bundle offering.

Even linear TV is getting in on the streaming game as pay TV operators bleed subscribers at an alarming rate. After an 11-day blackout for millions of Spectrum customers in September, its parent company Charter Communications struck a carriage deal with Disney that will bundle the studio’s streaming apps in Charter’s linear TV packages — a move that many in the industry see as a blueprint for future carriage negotiations.

Under the pact, ad-supported Disney+ Basic will be available to Spectrum TV Select package customers in the coming months. Additionally, ESPN+ will be provided to Spectrum TV Select Plus subscribers as will the sports network’s flagship direct-to-consumer service when it launches, likely in 2025.

But as a result of the new deal that greatly benefits Disney’s streaming service, Charter is allowed to drop from Spectrum TV video packages smaller Disney-owned channels like Baby TV, Disney Junior, Disney XD, Freeform, FXM, FXX, Nat Geo Wild and Nat Geo Mundo.

Streamflation

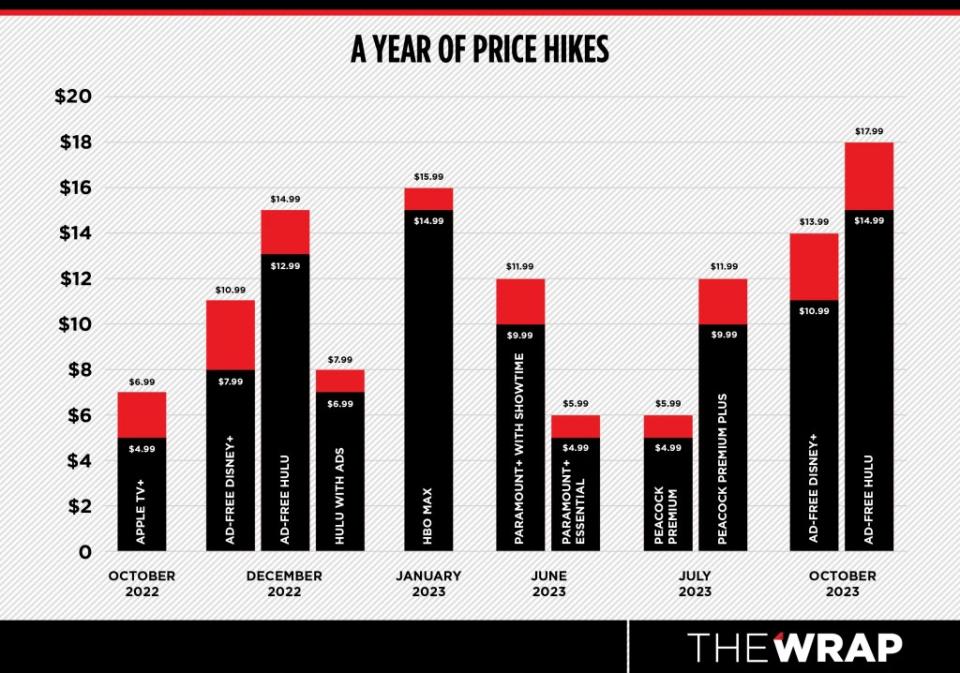

Many of the changes in 2023 came with price hikes — or as some people have called it, streamflation. Between October 2022 and 2023, Apple TV+, Disney+, Hulu, Max, Paramount+ and Peacock all raised their prices — some multiple times.

To help drive subscribers to the ad tier, Netflix phased out its $9.99 per month ad-free basic tier in the U.S. and U.K., Italy and Canada and said it would make the same change in Germany, Spain, Japan, Mexico, Australia and Brazil. It also hiked prices on its Basic and Premium subscription tiers in the U.S., U.K. and France.

While price increases are not expected to stop anytime soon, consumers have been making their voices heard, warning they are hitting a breaking point and will consider canceling for a cheaper alternative. A TransUnion survey of 3,000 adults conducted between Sept. 27 and Oct. 9 found that nearly four out of 10 (39%) consumers canceled streaming services in the past six months, with more than half doing so because of price increases.

Streaming Viewership Transparency

After six months of a historic double strike by the Writers Guild of America and SAG-AFTRA, Netflix took a first step in streaming viewership transparency by releasing a new semi-annual report that tallies over 18,000 titles that were watched for over 50,000 hours — 99% of all viewing on Netflix — over the period from January to June of 2023.

According to the report, “The Night Agent” Season 1 led the pack with a reported 812.1 million hours viewed. It was followed by the drama “Ginny and Georgia” Season 2 (665.1 million hours viewed), the Korean thriller “The Glory” (622.8 million hours viewed), the widely watched Adams Family saga “Wednesday” (507.7 million hours viewed) and the Shonda Rhimes romance “Queen Charlotte: A Bridgerton Story” (503 million hours viewed).

But the report went deeper, offering a closer look at how licensed titles performed on the streamer. “Suits,” “The Walking Dead,” “Breaking Bad” and “Grey’s Anatomy” all notched over 500 million hours viewed in the first half of 2023.

Moving forward, the streamer pledged to release the viewing report twice a year. Netflix emphasized that this report only reflected the most-viewed series during this six-month period and not the most-watched titles of all time. The most accurate scale for the most watched Netflix originals remains the streamer’s most popular lists, which measures hours viewed and total views during a title’s first 91 days on Netflix. (Total views constitutes hours viewed divided total runtime per season.)

“Over time, we’ve been getting increasingly more and more transparent about what people are watching on Netflix,” co-CEO Ted Sarandos told media on a call introducing the report. “When we started streaming 16 years ago, it was a pretty exotic proposition. There were no other streamers to compare to us and comparing live TV or live-plus-seven to Netflix on demand was like comparing apples to oranges. But as we’ve grown, streaming has become more mainstream in the U.S. — it makes up more TV time than cable or broadcast.”

The unprecedented increase in transparency comes in the wake of negotiations between the WGA and the AMPTP during the 2023 writers’ strike. The WGA’s deal with the studios requires that they provide the guild with confidential viewership data on their shows based on hours viewed. The guild can then share an aggregated form of the data with its members.

Starting in 2024, streaming titles with budgets of more than $30 million that are viewed by 20% or more of the service’s domestic subscribers in the first 90 days of release get a bonus equal to 50% of the fixed domestic and foreign residual, according to the new contract with the WGA. For example, projects written under the new agreement on the largest streaming platforms would receive a bonus of $9,031 for a half-hour episode, $16,415 for a single-hour episode, or $40,500 for a streaming feature.

For globally available services, streaming residuals will be based on the streaming platform’s number of foreign subscribers. That will amount to a 76% increase (including a 2.5% base increase) to the foreign residual for the services with the largest global subscriber bases over three years. The formula is the same as the foreign residual structure negotiated by the Directors Guild of America this past summer. When combined with the foreign residual improvements, this should result in a three-year residual of $216,000 for projects on the largest streaming platforms. That would represent a 49% increase from the $144,993 under the 2020 mutual bargaining agreement.

SAG-AFTRA members also agreed to the same performance-based model, in which they will receive a bonus equivalent of 100% of their fixed residual, as opposed to the WGA’s 50%. However, a portion of the bonus will be sent to a SAG-AFTRA-controlled fund to be shared with all actors who work on streaming shows. The guild agreed in principle with the studios that 25% of the bonus will go to the fund, but that percentage, along with how the fund’s money is disseminated, will be fully determined by a board of trustees that have yet to be selected and will consist of both SAG-AFTRA officials and studio representatives.

The post 6 Ways Streaming Changed in 2023: From Cost Cuts to More Transparency appeared first on TheWrap.