6 Large-Cap Stocks Beating the Market

- By Tiziano Frateschi

According to the GuruFocus All-in-One Screener, the following stocks have outperformed the Standard & Poor's 500 Index over the past 12 months.

Microsoft Corp. (MSFT) has a market cap of $946.66 billion. It has outperformed the S&P 500 by 26.48% over the past 12 months.

Shares are trading with a price-earnings ratio of 27.45. According to the discounted cash flow calculator, the stock is overpriced by 157% at $123.8. The price is currently 31.73% above its 52-week low and 5.78% below its 52-week high.

The company, which provides software, hardware and services, has a profitability and growth rating of 9 out of 10. The return on equity of 40.15% and return on assets of 13.60% are outperforming 85% of companies in the Software - Infrastructure industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 1.80 is below the industry median of 5.23.

PRIMECAP Management (Trades, Portfolio) is the company's largest guru shareholder with 0.49% of outstanding shares, followed by Dodge & Cox with 0.41% and Ken Fisher (Trades, Portfolio) with 0.26%.

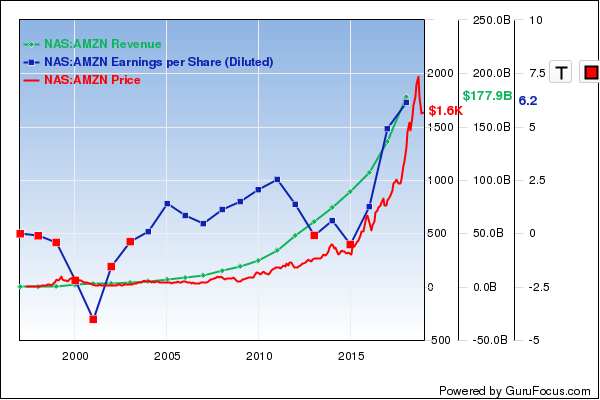

With a market cap of $878.44 billion, Amazon.com Inc. (AMZN) has outperformed the S&P 500 by 9.38% over the past year.

Shares are trading with a price-earnings ratio of 71.55. According to the DCF calculator, the stock is overpriced by 594% at $1,778.86 per share. The price is currently 35.90% above its 52-week low and 13.38% below its 52-week high.

The e-commerce giant has a profitability and growth rating of 8 out of 10. The return on equity of 30.39% and return on assets of 8.06% are outperforming 64% of companies in the Specialty Retail industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.65 is below the industry median of 0.99.

The company's largest guru shareholder is Fisher with 1.36% of outstanding shares, followed by Frank Sands (Trades, Portfolio) with 0.27% and Spiros Segalas (Trades, Portfolio) with 0.21%.

Visa Inc. (NYSE:V) has a market cap of $363.67 billion. It has outperformed the S&P 500 by 22.92% over the past 12 months.

Shares are trading with a price-earnings ratio of 33.41. According to the DCF calculator, the stock is overpriced by 17% at $161.33. The price is currently 32.81% above its 52-week low and 2.58% below its 52-week high.

The credit card company has a profitability and growth rating of 9 out of 10. The return on equity of 31.92% and return on assets of 15.99% are outperforming 85% of companies in the Credit Services industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.69 is below the industry median of 8.43.

The company's largest guru shareholder is Fisher with 0.85% of outstanding shares, followed by Sands with 0.73% and Warren Buffett (Trades, Portfolio) with 0.48%.

With a market cap of $346.80 billion, Johnson & Johnson (JNJ) has outperformed the S&P 500 by 9.83% over the past year.

Shares are trading with a price-earnings ratio of 24.17. According to the DCF calculator, the stock is overpriced by 125% at $130.6 per share. The price is currently 10.56% above its 52-week low and 11.97% below its 52-week high.

The health care company, which makes everything from medical devices and pharmaceutical products to personal care items like baby powder, has a profitability and growth rating of 7 out of 10. The return on equity of 23.72% and return on assets of 9.52% are underperforming 60% of companies in the Drug Manufacturers - Major industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.52 is below the industry median of 2.03.

Fisher is the company's largest guru shareholder with 0.43% of outstanding shares, followed by Barrow, Hanley, Mewhinney & Strauss with 0.24% and Yacktman Asset Management (Trades, Portfolio) with 0.18%.

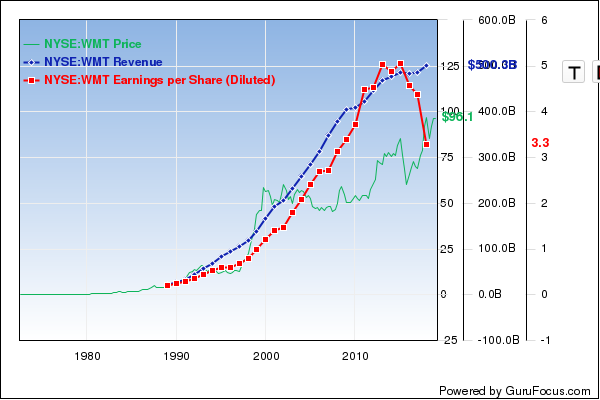

Walmart Inc. (WMT) has outperformed the S&P 500 by 21.58% over the past 12 months. The company has a market cap of $290.69 billion.

Shares are trading with a price-earnings ratio of 35.07. According to the DCF calculator, the stock is undervalued with a 227.93% of margin of safety at $101.43 per share. As of Monday, the price was 23.99% above its 52-week low and 4.49% below its 52-week high.

The retailer has a profitability and growth rating of 6 out of 10. The return on equity of 11.65% and return on assets of 3.84% are outperforming 59% of companies in the Discount Stores industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.16 is below the industry median of 0.55.

The company's largest guru shareholder is Bill Gates (Trades, Portfolio)' foundation trust with 0.40% of outstanding shares, followed by Fisher with 0.36%, Pioneer Investments (Trades, Portfolio) with 0.11%, the T Rowe Price Equity Income Fund (Trades, Portfolio) with 0.07%, Richard Pzena (Trades, Portfolio) with 0.06% and Jim Simons (Trades, Portfolio)' Renaissance Technologies with 0.06%.

Procter & Gamble Co. (PG) has a market cap of $260.87 billion. It has outperformed the S&P 500 by 42.12% over the past year.

Shares are trading with a price-earnings ratio of 24.76. According to the DCF calculator, the stock is overpriced by 130% at $103.43 per share. The price is currently 41.36% above its 52-week low and 5.31% below its 52-week high.

The consumer products manufacturer has a profitability and growth rating of 5 out of 10. The return on equity of 20.09% and return on assets of 9.09% are outperforming 78% of companies in the Household and Personal Products industry. Its financial strength is rated 6 out of 10. The cash-debt ratio of 0.33 is below the industry median of 0.49.

The company's largest guru shareholder is Yacktman Asset Management with 0.44% of outstanding shares, followed by Pioneer Investments with 0.23% and the Yacktman Fund (Trades, Portfolio) with 0.23%.

Disclosure: I do not own any of the stocks mentioned.

Read more here:

6 High-Yield Stocks

Insiders Roundup: GoPro, SolarWinds

Diamond Hill Buys Walt Disney, General Motors

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here .

This article first appeared on GuruFocus.