3 Medical Product Stocks Set to Beat on Earnings This Season

The quarterly performance of the Medical Product companies belonging to the broader Medical sector has witnessed improvement on a year-over-year basis so far. Accelerated base business growth during the January-March quarter was reflected in the results of the majority of the stocks, courtesy of the waning of the COVID-19 impact despite the emergence of new virus variants.

However, the quarterly performance of the majority of the companies witnessed a decline on a sequential basis. A number of MedTech players encountered severe staffing shortages and supply-chain hazards in the January-March quarter, thanks to the emergence of the new COVID variants.

However, companies belonging to Medical Products industry have adapted well to changing consumer preferences and are experiencing a sustained uptrend in their stock price.

In the second half of the January-March quarter, industry players saw a strong rebound in base sales volumes with the companies reaching their pre-pandemic legacy business level on the back of a substantial reduction in COVID-led fatality throughout the United States and other developed markets. Gradual lifting of restrictions and people getting back to pre-pandemic normalcy have led to a noticeable rebound in non-COVID and elective legacy businesses of the companies.

In fact, Abbott ABT and Intuitive Surgical ISRG are a few companies that have registered strong recovery rate in base-business performance.

According to the latest Earnings Preview, this sector’s first-quarter earnings are expected to improve 16.3% on 14.8% revenue growth.

Here we talk about three stocks, Canopy Growth Corporation CGC, Haemonetics Corporation HAE and Alcon Inc. ALC that are expected to beat earnings estimates in the ongoing reporting cycle.

Stocks Likely to Outshine Earnings Estimates

Given the high degree of diversity in the Medical Products industry, finding the right stocks with the potential to beat estimates might be quite a daunting task.

However, our proprietary Zacks methodology, makes this fairly simple.

We are focusing on stocks that have the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold). You can see the complete list of today’s Zacks #1 Rank stocks here.

Our research shows that for stocks with this combination, chances of a positive earnings surprise are as high as 70%.

Earnings ESP provides the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Here we present three stocks that are expected to beat earnings estimates in this reporting cycle.

Canopy Growth Corporation: Canopy Growth’s BioSteel and Storz & Bickel ("S&B") businesses generated record revenues during the third quarter of fiscal 2022 on the back of expanded distribution of BioSteel and new products launches for S&B. This trend is likely to have continued in the fiscal fourth quarter as well. Also, solid growth in consumer products revenue is likely to have favored the company’s performance in the to-be-reported quarter.

Canopy Growth’s Earnings ESP of +36.62% and a Zacks Rank #2 raise the possibility of an earnings surprise in the to-be-reported quarter.

CGC is expected to release results for the fiscal fourth quarter on Jun 7.

Canopy Growth Corporation Price and EPS Surprise

Canopy Growth Corporation price-eps-surprise | Canopy Growth Corporation Quote

Haemonetics Corporation: Haemonetics’ plasma collections saw improvement in the third quarter of fiscal 2022, while its Hospital business delivered double-digit growth in the same period. This momentum is likely to have continued in the fourth quarter of fiscal 2022, thereby favoring the company’s performance.

HAE is scheduled to release results for the fiscal fourth quarter on May 10.

Haemonetics has an Earnings ESP of +0.84% and a Zacks Rank #3.

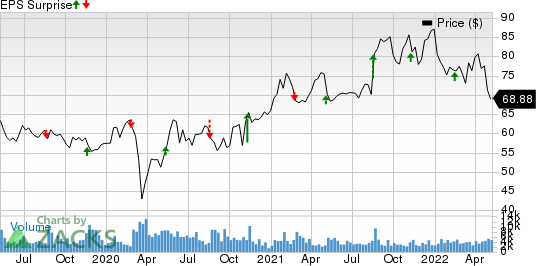

Haemonetics Corporation Price and EPS Surprise

Haemonetics Corporation price-eps-surprise | Haemonetics Corporation Quote

Alcon: Alcon’s net sales are expected to have witnessed strong gains in the first quarter on growth across all sales categories in Surgical and Vision Care, which was driven primarily by growing demand for new products, solid commercial execution and strong market recovery in the United States. Alcon continues to see strong demand for PRECISION1 and PRECISION1 for Astigmatism, which are the company’s newest contact lenses for the mainstream market.

Alcon is scheduled to release results for the first quarter of 2022 on May 10.

It has an Earnings ESP of +10.04% and a Zacks Rank #3.

Alcon Price and EPS Surprise

Alcon price-eps-surprise | Alcon Quote

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abbott Laboratories (ABT) : Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Haemonetics Corporation (HAE) : Free Stock Analysis Report

Alcon (ALC) : Free Stock Analysis Report

Canopy Growth Corporation (CGC) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research