2022 Was a Year of Hard-Earned Lessons for Streamers – Here Are the 5 Biggest Ones | Charts

After a tough year for streamers in 2022, the industry as a whole is faced with two major questions as they look to improve their strategies in the new year.

First, just how much has the streaming industry’s bubble burst? And second, can major media companies looking to stem their streaming divisions’ losses find a path forward after the boom in subscriber growth from COVID lockdowns has fizzled out?

“The enthusiasm for streaming among consumers is still there, but I think the assumption that all these platforms are going to continue to grow and add subscribers every quarter is gone,” Hub Entertainment Research founder Jon Giegengack told TheWrap. “I’m not entirely sure why people thought it would go on forever, but we’ve reached the point where that’s not guaranteed.”

Here’s a roundup of the major lessons the industry learned over the past year and how they can use those lessons in 2023 to help them rebound from recent subscriber losses and stock price declines.

Also Read:

How the Streamers’ Movie Catalogs Stack Up, According to Demand | Charts

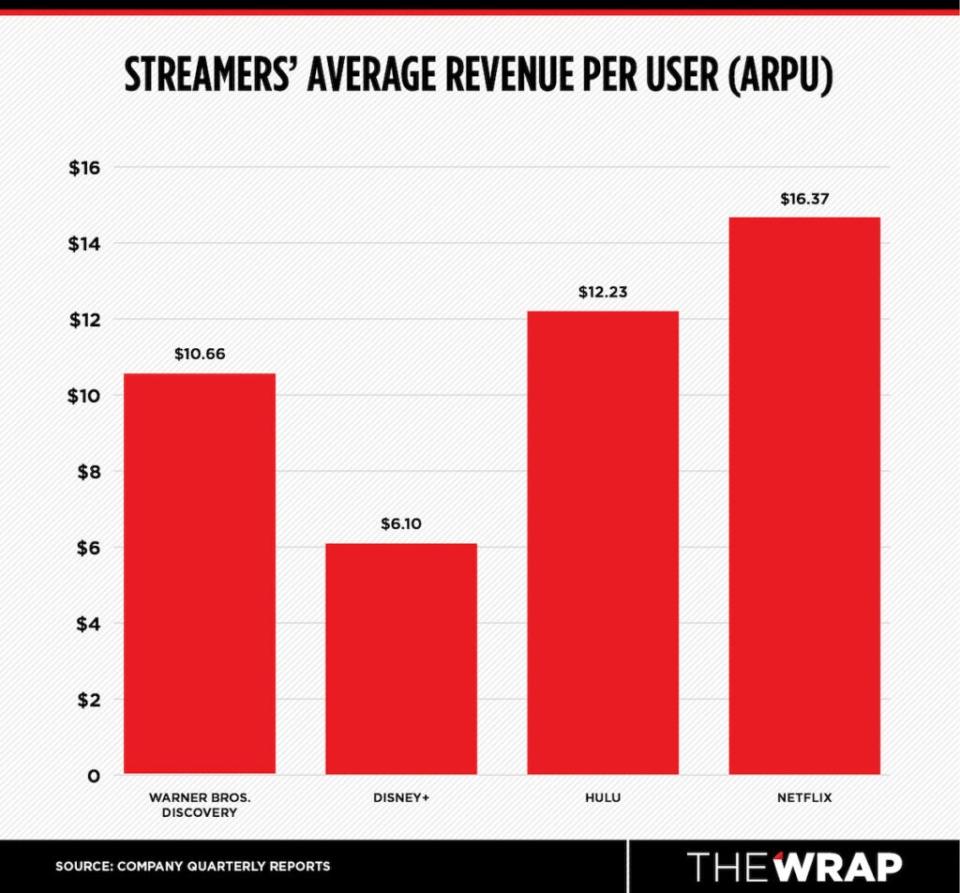

1. The metric for success has shifted from subscriber growth to profitability and revenue per user

This year, “everyone realized that the boom times for streaming were over and that profitability should be a much bigger focus than it has been,” Morning Consult entertainment and media analyst Kevin Tran told TheWrap.

In April, a seismic shift occurred when Netflix reported its first subscriber loss in over a decade. During its quarterly shareholder call at the time, the company said it would shift its focus from its subscriber count to revenue growth.

For the first time ever, the company also revealed it would enter uncharted territory and attempt to monetize account sharing. It also said it would roll out a cheaper ad-supported tier — a move that has since been followed by Disney+, which (along with other players like Paramount+) is looking to bring their streaming business to profitability.

“Ultimately, companies need to generate cash so that they can pay the bills and not go bankrupt,” David Offenberg, an associate professor of finance at Loyola Marymount University, previously told TheWrap. “I think the focus will be on ARPU [average revenue per user] for the rest of eternity at this point. We’re done with focusing on subscribers. And if you’re not at scale yet, your chances of getting there are pretty slim.”

As of now, Netflix is perched ahead of the competition, being the sole streamer that has — despite incurring losses and declines in its stock — successfully maneuvered the market and reached profitability. “We have a whole bunch of companies that have to figure out how to make the economics of streaming work, and only one has so far, and that’s Netflix,” Offenberg said.

Netflix has also led the pack on average revenue per user, racking up $16.37 in the U.S. and Canada, followed by Hulu’s ARPU of $12.23 and Warner Bros. Discovery’s domestic ARPU of $10.66 rounding out the top three. Disney+ has lagged behind its rivals with a domestic ARPU of just $6.10 domestically.

Also Read:

‘The Recruit’ Joins Netflix’s Domination of Most-Streamed Series Rankings | Charts

2. Consumers don’t have an endless budget for streamers

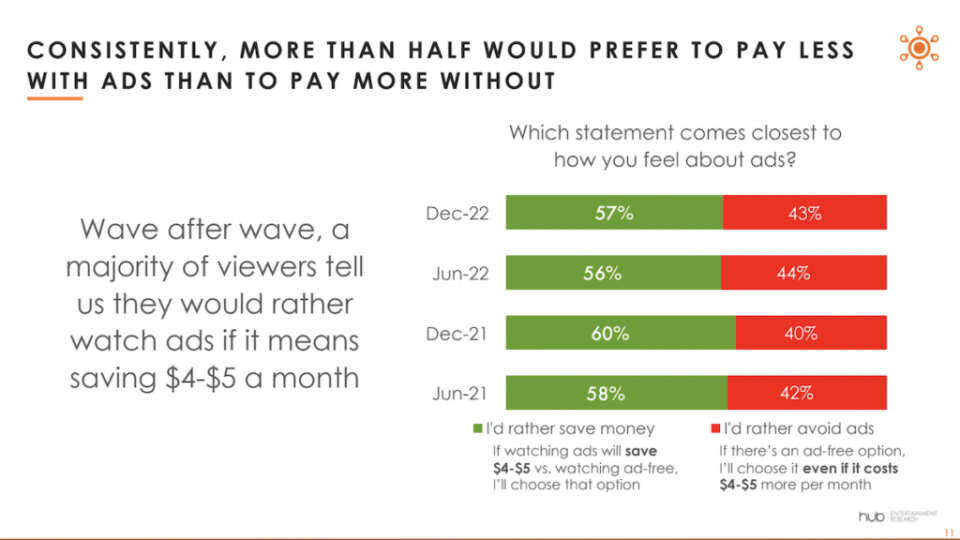

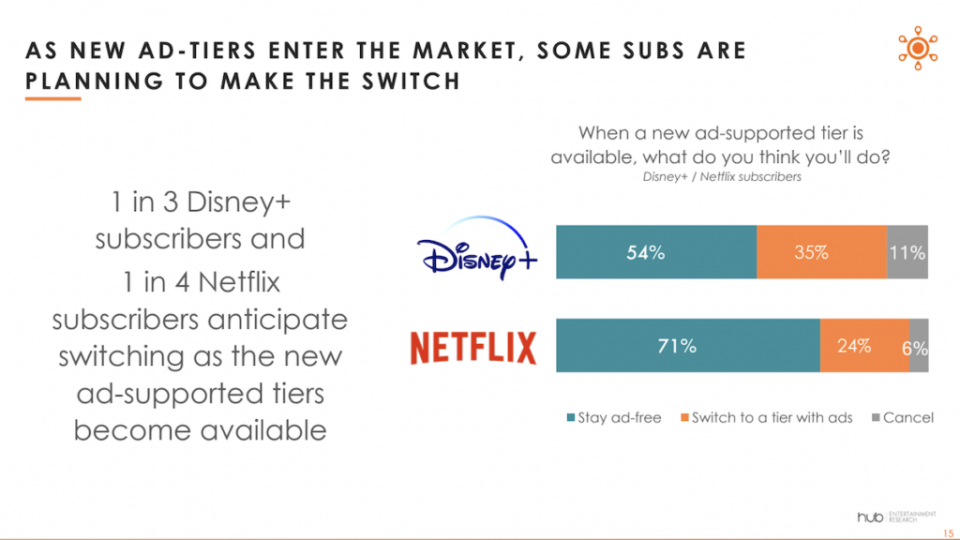

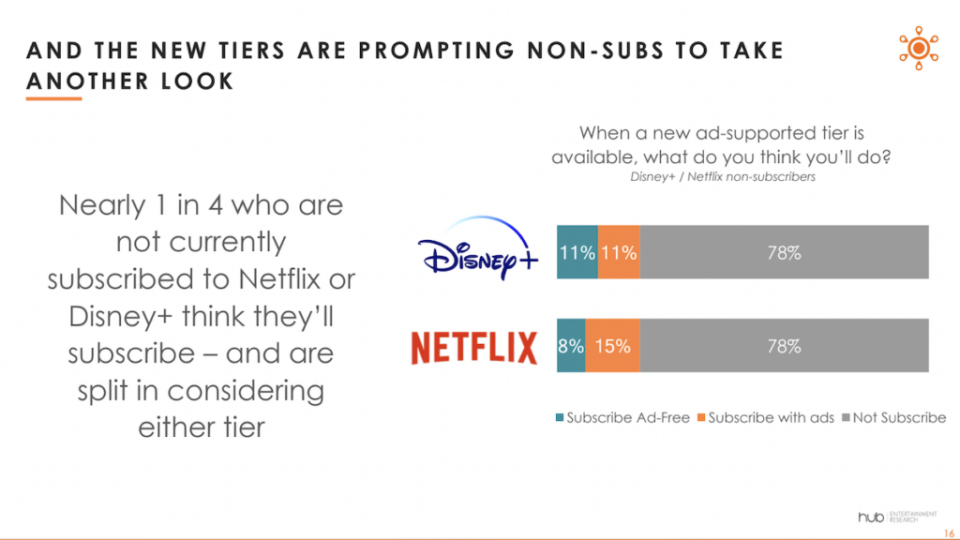

As inflation has taken a bite out of consumers’ earnings in 2022, streamers have learned that giving consumers a variety of pricing options is essential to tapping into new subscribers (or keeping existing ones). In the past few months, Disney+ and Netflix introduced ad-supported tiers in an effort to attract cash-strapped consumers at a lower price point.

More than half (57%) of 3,000 TV consumers surveyed by Hub Entertainment Research said that they would choose an ad-supported streaming subscription if it saved them $4 to $5 a month on streaming content.

Thanks to the new AVOD [advertising-based video on demand] tiers, some consumers who haven’t subscribed to Disney+ and Netflix at all are now considering taking another look, according to the November survey. According to the survey, 11% of respondents have considered signing up for Disney+ with ads, while 15% have considered subscribing to Netflix’s Basic with Ads tier. Meanwhile, one in three Disney+ subscribers and one in four Netflix subscribers surveyed have anticipated switching to the new ad-supported tiers.

“There’s a downside if you force people who don’t want to watch ads no matter what to watch them and there’s also a downside if you force people who would rather pay less and watch ads to pay more and watch ad-free because in both those cases, somebody’s having to compromise,” Giegengack said. “But by offering people these ad tiers, everybody’s watching the way they want to watch.”

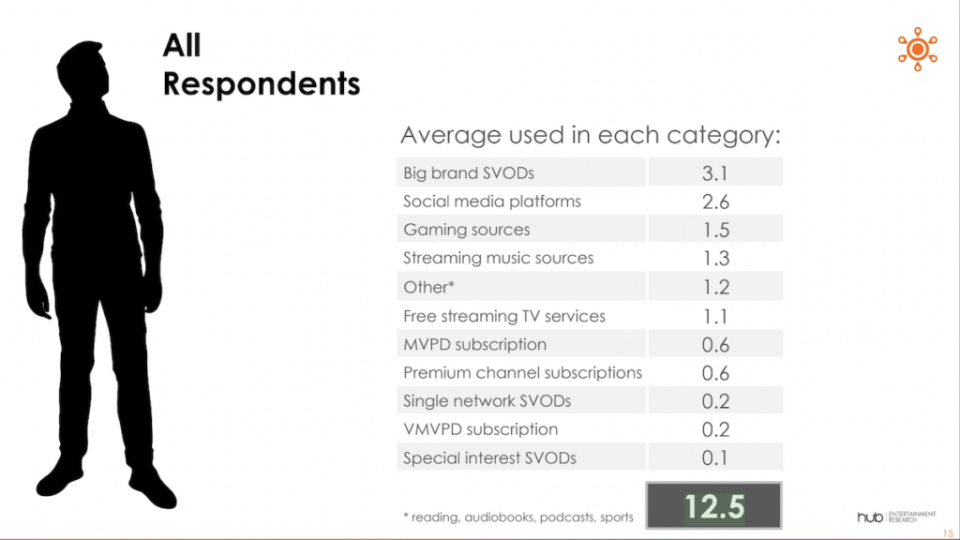

Additionally, many streamers are increasingly leveraging bundled services. The average household has 12.5 different entertainment sources that they consume, according to an October 2022 Hub Entertainment survey of 3,000 TV consumers. These sources include streaming TV, social media, gaming, music, sports, podcasts, audiobooks and reading.

“There’s a lot of mental bandwidth required to sort of manage all of those relationships with companies and all those subscriptions and there’s tremendous appetite for companies that can just simplify that whole process,” he continued. “So I think that that companies that are able to build these super bundles will have an advantage and you’re gonna see them lean in on that a lot more in 2023.”

Notable examples of super bundles include Amazon Prime, which offers benefits like access to Prime Video content and free delivery on Amazon purchases, and Apple One, which includes AppleTV+, iCloud storage, Apple News, Apple Music, Apple Arcade and AppleFitness+.

3. Streaming services can no longer afford to have an endless library of shows and movies

As profitability and ARPU take center stage moving forward, streamers have learned that they will need to be more mindful about their content spend and what that investment is going towards.

In 2022, content spending on streaming has ranged from as little as $3 billion at Peacock to $17 billion at Netflix. (Disney and Warner Bros. Discovery spent in the tens of billions on content in 2022 — but not all of that went towards programming strictly for their streaming services).

“The types of nine-figure deals that were previously awarded to people like Ryan Murphy and Shonda Rhimes are a thing of the past,” Tran said, referring to Netflix’s big producer deals. “Streamers need to make better use of the intellectual property they already own while also keeping in mind moving forward that sheer quantity of content is now far from a compelling differentiation factor.”

Also Read:

How Seasonal Demand for Christmas Movies Builds and Then Quickly Falls | Charts

One way that streamers can get more bang for their buck with existing content is by licensing it out. A recent example of this is HBO Max, which announced it would pull shows like “Westworld,” “Love Life,” “Minx” and “The Nevers” and license some of them to third-party free, ad-supported streaming television (FAST) services.

“If a title isn’t attracting many viewers for a streamer, the residual costs associated with hosting that title may not be worth paying,” Tran explained. “Holding on to a certain title would mean forgoing licensing revenue that could eclipse the value that title is generating for a media company on its current video streaming platform. It’s also important to consider how a competing streaming platform may expose a title or franchise to a bigger audience than the original home would have been able to attract.”

On the flip side, Tran previously warned TheWrap that pulling content could make showrunners and actors “more hesitant to work with a company that they view as too eager to axe pricey or declining shows from their streaming platforms” and potentially anger fans of those shows.

Also Read:

The 25 Best New Movies to Stream in December 2022

4. The binge model is no longer the best model to keep viewers engaged and reduce churn

In addition to being mindful about content spend, streamers have learned that the binge model may not be the best strategy to keep viewers engaged and reduce churn. Even Netflix, which originated and still swears piety to the binge model, has released big titles like “Stranger Things” and “Harry & Meghan” in parts, and the experiment seems to be successful — the upcoming fourth season of the hit series “You” is being released in two batches one month apart.

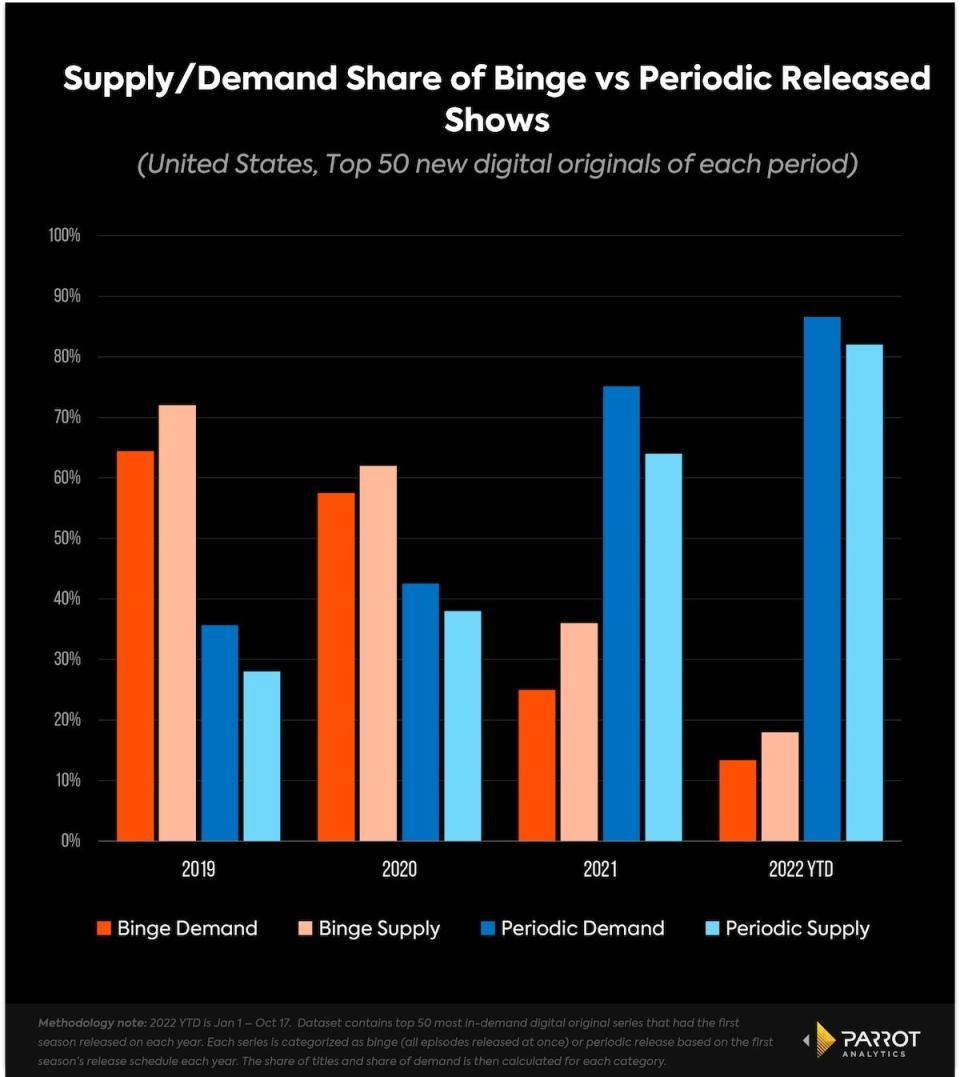

Over the last few years, the number of binge-released titles among the 50 most successful streaming releases has been falling — along with its demand share. In 2019, 72% of the top 50 shows released that year had a binge release, and they were responsible for 64.4% of the total demand for the top 50 new titles, according to Parrot Analytics‘ data, which takes into account consumer research, streaming, downloads and social media, among other engagement.

These shares have dropped to 62% of the number of shows and 57.5% of the demand in 2020. 2021 marked a turning point when more shows in the top 50 had a periodic release than a binge release that year for the first time in many years.

As of November 2022, only nine of the top 50 new streaming originals were binge-released, according to Parrot Analytics. Although most of the shows were Netflix originals, two Prime Video productions — “Reacher” and “The Terminal List” — also made the top 50 ranking. Binge-released shows made up only 13.8% of the demand share for the top 50 new releases.

Just 14% of U.S. consumers surveyed by Morning Consult in March said they try to watch an entire series in one day, while 34% said they like to watch two or three episodes each day (The survey included responses from 2,211 adults in the U.S. and 14 other countries.)

In the third quarter of 2022, premium SVOD subscription cancellations across Netflix, Hulu, AppleTV+, Disney+, Discovery+, HBO Max, Paramount+, Peacock, Showtime and Starz grew to 32 million, according to Antenna. The figure represents a “significant expansion” from 28 million cancellations in the previous quarter and 25.2 million cancellations in the same quarter a year ago. Antenna estimates that Netflix’s average monthly churn was 3.5% in the third quarter, up from 3.4% in the second quarter and 2% in 2021.

“If people can binge watch a whole show and then drop their subscription until the next season comes out, that’s a pretty tough calculation if you have to come up with a brand new, super expensive show to reengage them every time,” Giegengack said. “If you parse those shows out and the episodes come out once a week, or maybe starting with two like they do on Paramount+ to get people hooked, and then parse them out further apart after that, each piece of content that you’re investing with can keep people engaged for a longer period of time.”

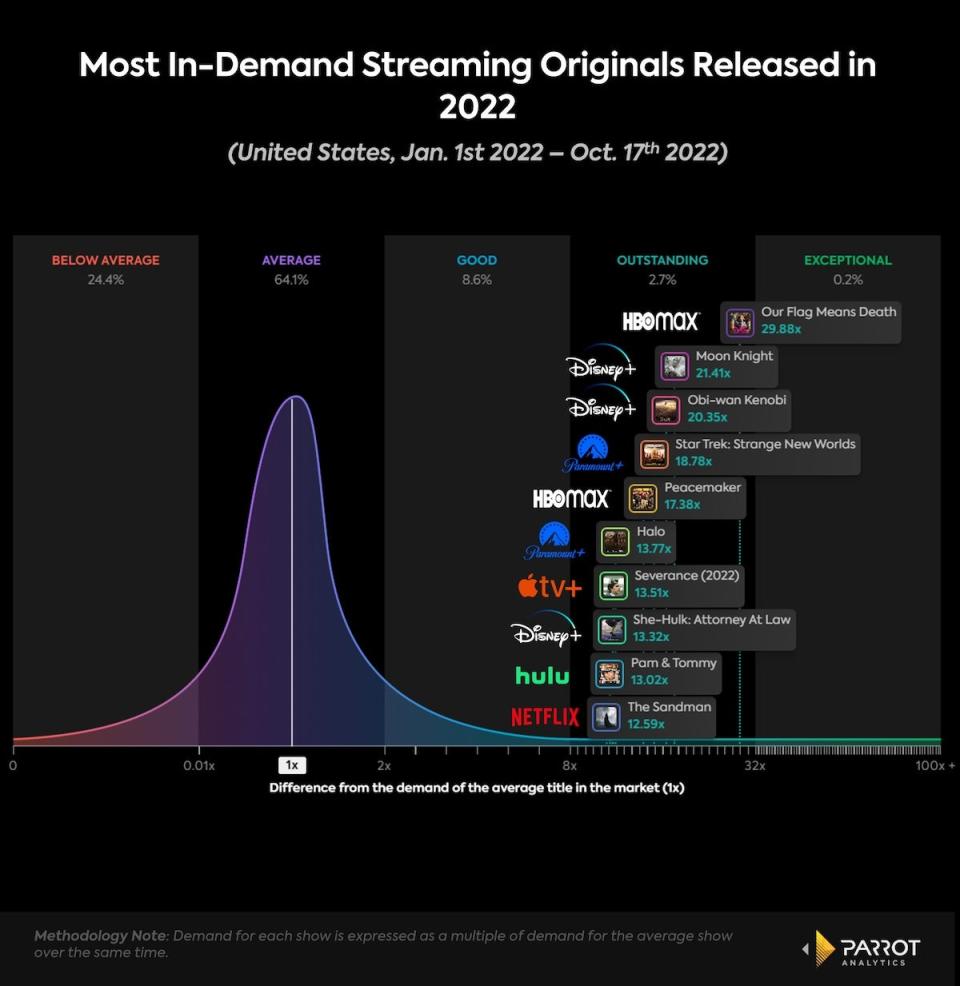

5. There’s a new urgency around franchises (and growing them)

A major trend fueling churn in streaming is subscription cycling, where viewers “sign up for a service with the clear intent to cancel within 30 days after consuming the content they came in for,” Samba TV CEO Ashwin Navin told TheWrap.

“Two-thirds of adults plan to cycle in 2023, making retention a big challenge for streamers to focus on,” he noted.

During TheWrap’s annual business conference TheGrill, held in October this year, Samba TV senior vice president Dallas Lawrence shared a poll of 2,000 adults, which found that more than 40% of Millennial and Gen Z streaming viewers have canceled a streaming service immediately after watching a single series they were interested in and subscribed to another service in the past six months. Additionally, approximately 75% of those surveyed said they are likely to cycle subscriptions in the next six months. The reasoning behind that isn’t even monetary, the study found: 55% of respondents said there was only one title on a given streamer that they were interested in viewing.

Also Read:

Will HBO Max’s Content Cuts Help or Hurt Warner Bros. Discovery in 2023?

For Lionsgate Television Group vice chairman Sandra Stern, reducing churn is all about luring in audiences with popular TV franchises even from decades past. The pull of preexisting and appealing IP is a strong one: “A reliable way to retain subscribers is to keep them connected to things that they know and love,” she said during TheWrap’s virtual Power Women Summit this month. “I think for streamers particularly that is a really major objective.”

Streamers that have leveraged popular franchises for TV content in recent years include Disney+ with regular output of new Marvel Studios shows like “WandaVision” and “Loki” and new “Star Wars” shows like “The Mandalorian” and “Andor,” Netflix with “The Witcher” and “Wednesday,” and Paramount+ with “Yellowstone” spinoffs (as the original series streams on Peacock under a pre-existing licensing agreement). Peacock has already been leveraging NBCUniversal’s IPs with its own “Real Housewives” and “Below Deck” reality spinoffs. It will expand further in 2023 with a “John Wick” universe spinoff.

Also Read:

HBO Max’s Latest Show Cuts Are Making a Dent Without ‘House of the Dragon’ for Cover | Charts