2 Undervalued Nontraditional REITs Paying Market-Beating Yields

Investors tired of the market roller coaster might be interested in real estate investment trusts, or REITs, that provide a dividend yield superior to that of the S&P 500 Index.

While many investors are familiar with the most common types of REITs, such as those that specialize in malls or single-tenant properties, there are those trusts that have built impressive niche businesses that also provide market-beating levels of income.

By focusing more on dividends and less on the share price, the investor might find it easier to rest at night as their portfolio creates income regardless of what the market does each trading day.

Lets examine two REITs paying at least a 2% dividend yield that are also trading a discount to their intrinsic value.

American Tower

First up is American Tower Corp. (NYSE:AMT), which is not your traditional REIT as it operates in the niche industry of communications real estate. The trust is valued at $120 billion and generates annual revenue of $9.4 billion.

American Tower maintains a portfolio of more than 220,000 communication sites around the world, with a presence on nearly every continent. The trust is the largest independent operator of wireless telecom and broadcast towers.

The company is currently enjoying the transition to 5G, which should provide a significant tailwind to results as carriers have begun to turn the service on. With more towers needed to bring service to more people, American Tower is well positioned to benefit from 5G.

American Tower transitioned to a REIT in 2012 and growth has been impressive ever since. The last decade has seen revenue and funds from operations increase at a compound annual growth rate of 14% and 12.6%, according to Value Line.

Funds from operations are expected to reach $10.45 in 2022, according to analysts surveyed by Seeking Alpha, which would represent a nearly 11% improvement from the prior year.

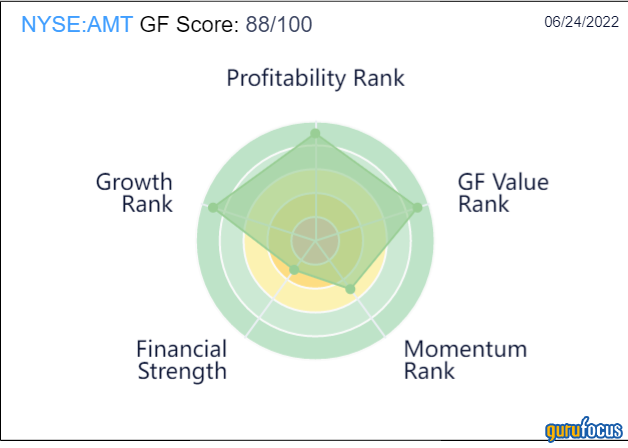

Taking financial strength, growth, momentum, profitability and valuation into account, American Tower currently holds an impressive GF Score of 88 out of 100.

The trust has increased its dividend for 11 years and with a CAGR of 21% for the last decade. Shares yield 2.2%, higher than the average yield of 1.6% for the S&P 500 Index.

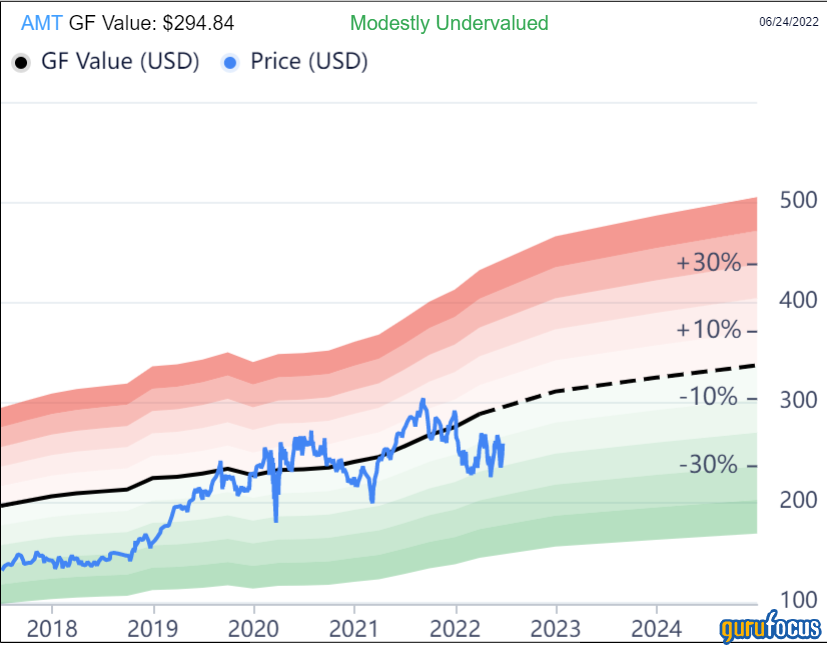

The GF Value chart shows American Tower trading at a sizeable discount to its intrinsic value.

With a current share price of $261.21 and a GF Value of $294.84, American Tower has a price-to-GF Value of 0.89. Reaching the GF Value would result in a nearly 13% return in the share price. Add in the stocks dividend and total returns could be in the mid-teens.

STAG Industrial

Next is STAG Industrial Inc. (NYSE:STAG), which owns and develops real estate property used for industrial purposes. The trust has a market capitalization approaching $6 billion and generated revenue of $562 million in 2021.

STAG Industrial stands out from the traditional REIT sector because of its focus on industrial properties. The trust is the only pure-play public entity in this industry. As a result, clients have limited options when it comes to renting a property, giving the company built-in advantages and causing its facilities to be in high demand.

The trust operates a highly diversified business model, helping to offset potential weakness in a single area. STAG Industrial has more than 550 facilities leased to tenants in approximately 45 industries spread out over 40 U.S. states.

STAG Industrial has wide appeal as it leases properties to companies with large annual revenues as well as those generating as little as $50 million per year. This keeps its potential client pool large, helping to reduce the length of time a property sits vacant.

The company has been quite successful since its initial public offering in 2011. Funds from operations have a CAGR of just under 6% over the last 10 years, but this masks the fact the companys share count has increased from 25 million shares in 2011 to 185 million shares today. Funds from operations are projected to grow 5.3% to $2.17 this year.

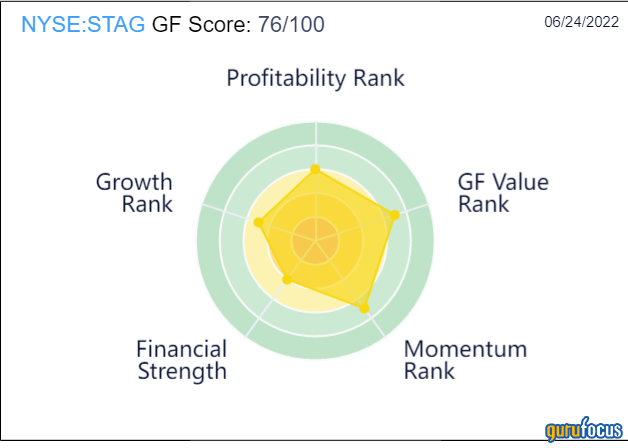

The trust receives a solid GF Score of 76 out of 100.

Another way that STAG Industrial differs from most other stocks is it pays a monthly dividend. The trusts dividend growth streak stands at 11 years. Shareholders have seen their dividends grow at a rate of 3.4% over the last decade. STAG Industrial currently yields 4.6%, nearly triple the income the S&P 500 Index averages.

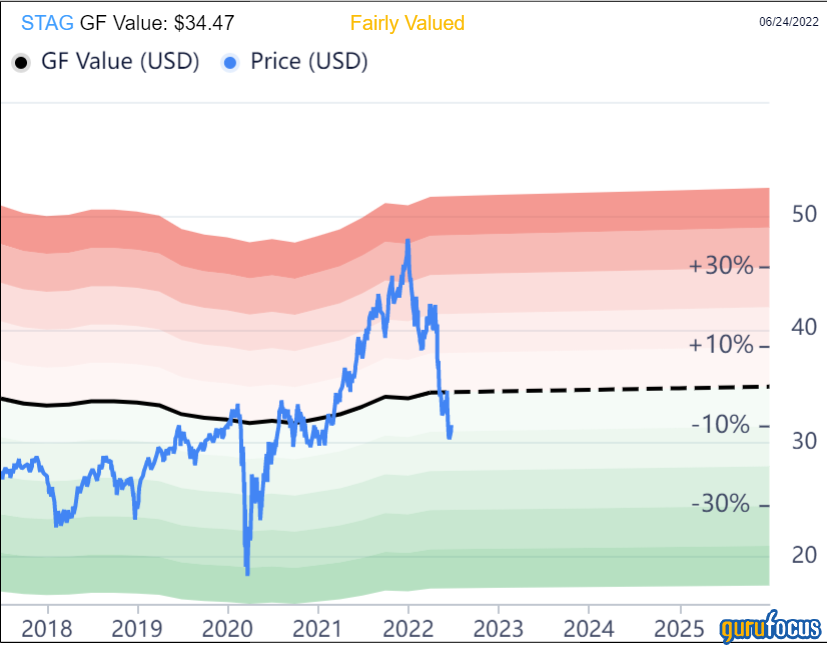

The GF Value shows there remains upside potential in the stock.

STAG Industrial has a current share price of $31.58 and a GF Value of $34.47, giving the stock a price-to-GF Value of 0.92. Shareholders could be looking at a 9.2% increase in share price were the stock to reach its GF Value. The dividend could push total returns into the low double-digit range.

Final thoughts

REITs are often a popular choice for investors looking for income as these stocks typically have high yields. Looking beyond the usual types of REITs reveals there are smaller industries home to high-quality names.

American Tower and STAG Industrial are leaders in their respective niche industries. Both trusts are blessed with sound business models with clear advantages over would-be competitors. Each name has rewarded shareholders for more than a decade with dividend raises and offer a market-beating yield.

They are also trading at a discount to their intrinsic value and total returns could potentially be in the low-to-mid-double-digit range. This suggests both could be a good investment option for those looking for growth and income from nontraditional REITs.

This article first appeared on GuruFocus.