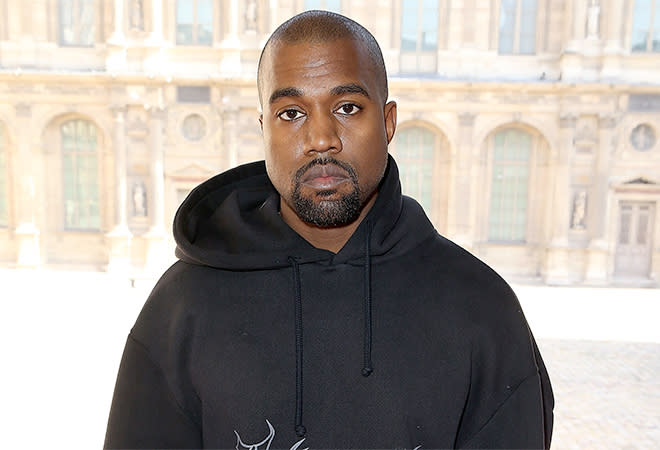

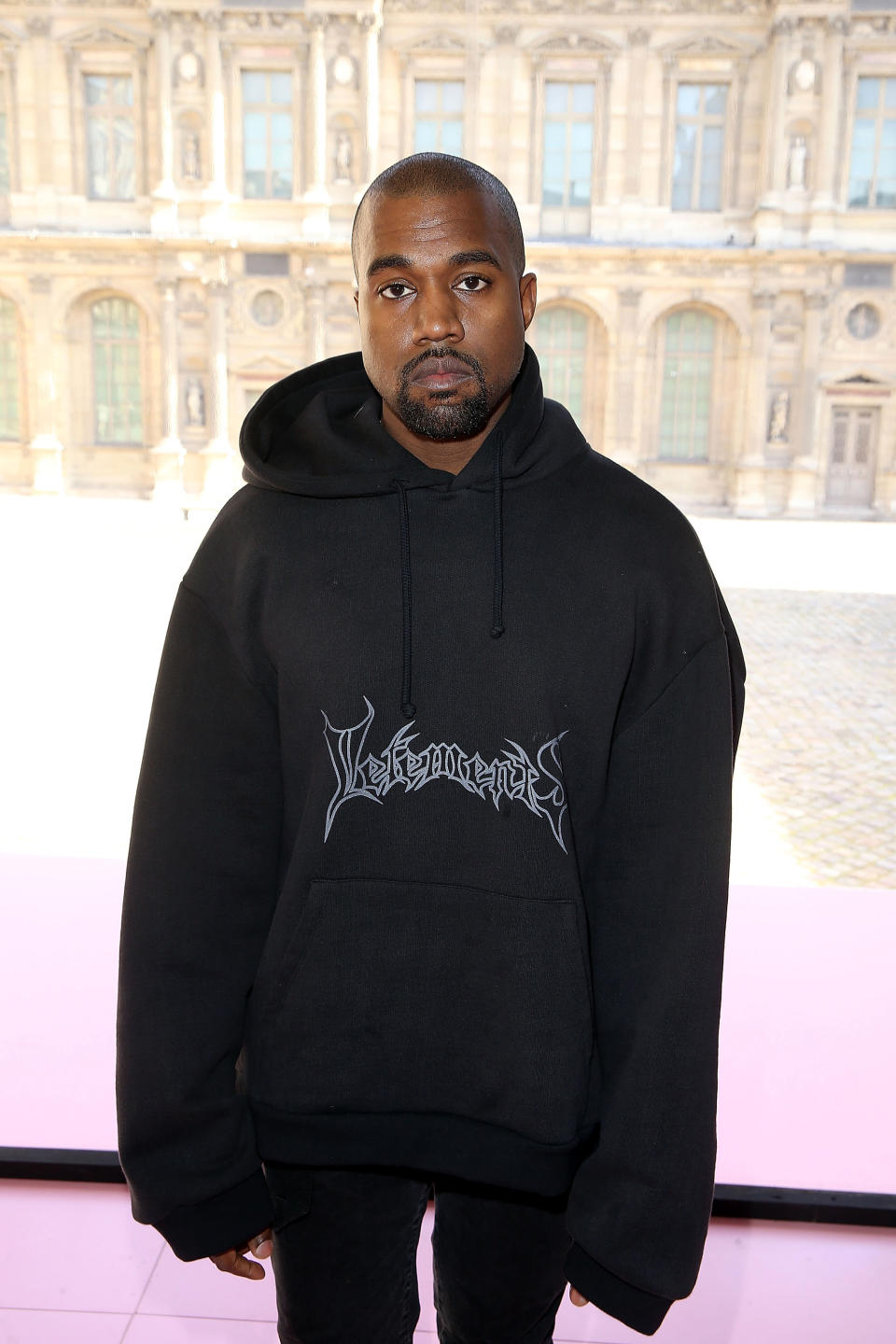

Kanye West Hit with Countersuit by Tour Insurance Company After Filing $10 Million Lawsuit Earlier This Month

Following Kanye West’s $10 million lawsuit against several insurers of his Saint Pablo tour, syndicates of insurance company Lloyd’s of London are hitting back with a countersuit claiming they’re not liable.

Earlier this month, West, 40, filed his suit claiming that several insurers are stalling on paying out a “multi-million dollar claim” stemming from the canceled concerts. According to court documents filed at the time, West claims that the insurers have made him go to great lengths to prove his mental breakdown was legitimate. (Last November, the rapper was hospitalized for exhaustion after cancelling his Saint Pablo tour.)

But, the insurers are in disagreement, according to the countersuit.

“Underwriters’ investigation indicates substantial irregularities in Mr. West’s medical history,” the documents state. “Furthermore the insured’s failure to cooperate in Underwriters’ investigation is contrary to the duties of cooperation VGT agreed to as a condition precedent to any obligation of Underwriters to pay any claim arising under the Policies.”

The papers continued: “Throughout Underwriters’ investigation, VGT and its legal, medical and other agents and representatives have delayed, hindered, stalled and or refused to provide information both relevant and necessary for Underwriters to complete their investigation of the claim.”

“Underwriters are informed and believe, and thereon these same persons have willfully concealed and or misrepresented relevant facts in an effort to thwart Underwriters’ investigation,” the suit added.

Although the insurance companies are choosing not to reveal what they found during their investigation “in order to protect the privacy of Mr. West from public disclosure of details of his private life,” they are seeking declaratory relief that they “have no duty to indemnify” West’s company, Very Good Touring, Inc.

The insurers claim that “the insuring clause allegedly has not been triggered and the tender is expressly excluded by” conditions and exclusions in the policy.